From Duncan Austin While Adam Smith’s Invisible Hand has many beneficial attributes, somewhere along the way the Invisible Hand was recast as the Infallible Hand, seeding today’s widespread faith that markets can solve large-scale social and ecological problems they are ill matched for. In the formidable shadow of the Infallible Hand, non-market solutions – policy, regulatory, cultural, behavioural – are often deemed ‘impractical’, so remain under-utilized. ‘Green growth’, ‘sustainable profit’ ‘shared value’ etc. are the solutions of the day. Yet, if a market system denies its external costs and consequences – as contemporary markets do in spades – then the Hand is not Infallible at all, but rather it is powerfully, ubiquitously, and possibly existentially very fallible indeed. Excess

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Duncan Austin

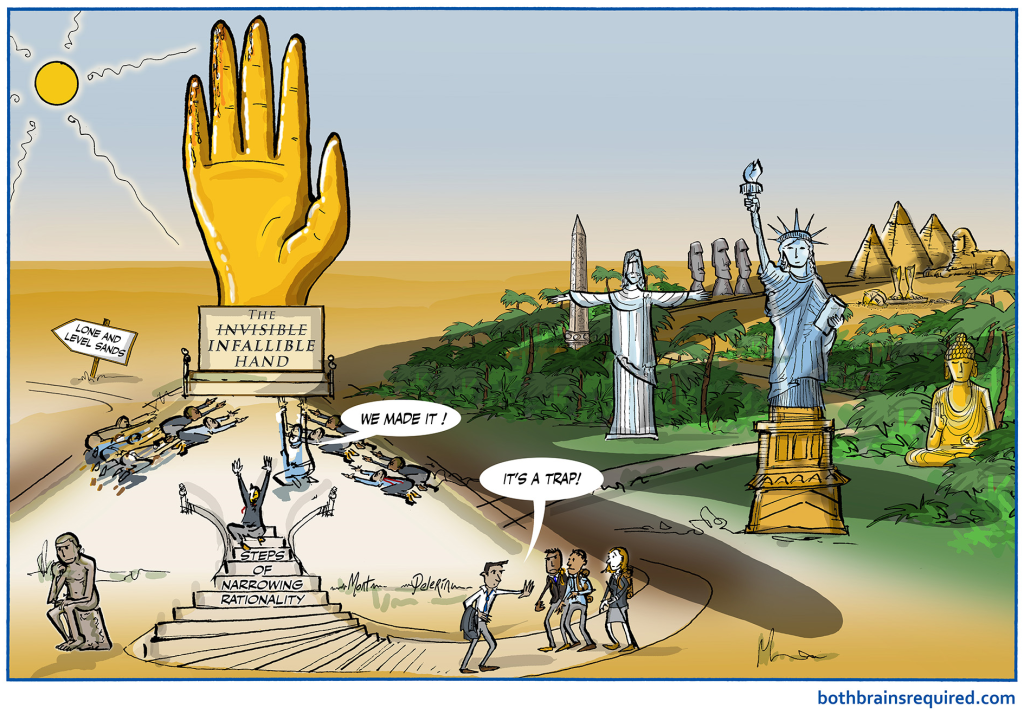

While Adam Smith’s Invisible Hand has many beneficial attributes, somewhere along the way the Invisible Hand was recast as the Infallible Hand, seeding today’s widespread faith that markets can solve large-scale social and ecological problems they are ill matched for.

In the formidable shadow of the Infallible Hand, non-market solutions – policy, regulatory, cultural, behavioural – are often deemed ‘impractical’, so remain under-utilized. ‘Green growth’, ‘sustainable profit’ ‘shared value’ etc. are the solutions of the day.

Yet, if a market system denies its external costs and consequences – as contemporary markets do in spades – then the Hand is not Infallible at all, but rather it is powerfully, ubiquitously, and possibly existentially very fallible indeed.

Excess faith in markets is starting to feel like a major wrong turn of human cognition – indeed, a trap that seems very difficult to reverse out of. The sustainability challenge increasingly has the character of whether we can collectively unlearn modern myths about the superiority of market outcomes before it is too late. For, if markets deny their external consequences and are not fully costed, they are not the most efficient and distributed means of allocating resources, as textbooks proclaim, so much as the most efficient and distributed method we have yet devised to extract and appropriate value.

Of course, governments and cultures are fallible too, so it is a question of matching problems to decision-making domains. Markets do valuable work in handling myriad diverse expressions of self-interest, but the inevitable social and ecological fallout of all that self-interested activity requires the constant re-directing and re-regulating of markets that only ‘meta-market’ (?) government and cultural influences can provide.

It’s a real pity that Smith offered the world a disembodied hand. Hands seem to work best when they are connected to arms and bodies. It may be more helpful to view the Fallible Hand as being dependent on the arm and body of government and culture, which, while they cannot rival the Hand’s dexterity, have the gross motor capabilities to direct and place the Hand where its dexterity can be most beneficial. It is almost as if gross motor and fine motor skills have evolved as useful complements that exemplify the layered, nested ‘wisdom of systems’.

For private sector actors sincere about developing a sustainable human culture, rather than double down on the latest greatest firm- or portfolio-level sustainability strategy, it may be more effective – more ‘sustainable’, even – to concede the limitations of trying to solve global ecological problems as a profit-bound private entity, and instead help re-invigorate the public sector’s capacity to internalize the substantial externalities that have become irrefutably known on our generation’s watch.