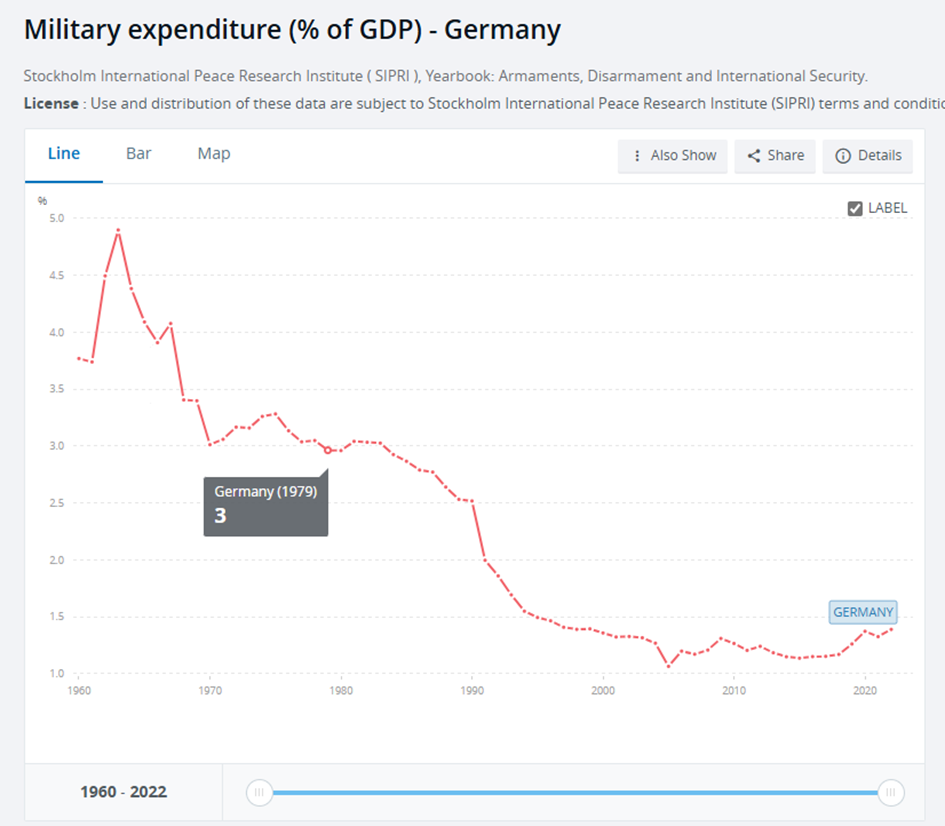

The end of the post-World War II ´Pax Americana, an almost eighty-year period of peace for European countries allied with the USA, will soon lead the EU to end the prohibition of monetary financing of governments by the European Central Bank (ECB). This might take the shape of the ECB providing credit to an entity purchasing Eurobonds, which will further increases military spending. At this moment, there is based on the Maastricht treaty of 1992 a strict prohibition of monetary financing by the ECB. This prohibition can be understood as part of the peace dividend (graph 1) reaped after the implosion of the USSR in 1991. It is related to post-1991 ideas about ´the end of history´ and the illusion that the Pax Americana would last forever. Graph 1. Source A prohibition of

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The end of the post-World War II ´Pax Americana, an almost eighty-year period of peace for European countries allied with the USA, will soon lead the EU to end the prohibition of monetary financing of governments by the European Central Bank (ECB). This might take the shape of the ECB providing credit to an entity purchasing Eurobonds, which will further increases military spending. At this moment, there is based on the Maastricht treaty of 1992 a strict prohibition of monetary financing by the ECB. This prohibition can be understood as part of the peace dividend (graph 1) reaped after the implosion of the USSR in 1991. It is related to post-1991 ideas about ´the end of history´ and the illusion that the Pax Americana would last forever.

Graph 1.

A prohibition of monetary financing of the government by a central bank is surprising. On the website of the Bank of England we can find the next quote:

The Bank of England began as a private bank that would act as a banker to the Government. It was primarily founded to fund the war effort against France. The King and Queen of the time, William and Mary, were two of the original stockholders. The original Royal Charter of 1694, granted by King William and Queen Mary, explained that the Bank was founded to ‘promote the public Good and Benefit of our People’.

Source, assessed 14 – 10 2024.

Once, the financing of governments, and, especially, wars was the very reason to establish a central bank! Historical aside, the idea of ´The public good´ was not entirely new at the time. But 16th and early 17th century treatises on public finances are still based on managing ´the estate of the prince´ instead of improving the ´public good´. Somewhat later, in England and explicit in the writings of William Petty, the ´common good´ (the English one, not the Irish one) became a central concept in economic writing. The Bank of England, with princely stockholders but a public mandate, seems to have been somewhat in between.

In Europe, World War I and World War II showed that the financing of wars, not exactly conducive to the ´common good´ of nations, was still a pivotal role of central banks. This kind of financing helps governments to win wars, even when financing governments and pushing economies towards overheating comes at a cost and has to be managed at the macro level (Keynes wrote the classic book about this). During the Pax Americana and especially after the Suez crisis, which cemented the USA’s Atlantic hegemony and dwarfed the geopolitical influence of individual European countries, war increasingly seemed a thing of the past, at least in Europe. New generations of economists were only dimly aware of the role of central banks during wars or even not at all. Around 1981, when I studied economics, my (Dutch) textbook still stated that central banks had multiple goals and functions: financial stability, bank of banks, price stability, an ´orderly payment system´, and the bank of the government. Even when the last function implied that the bank could provide short- and long-term credit to the government, the financing of wars was not explicitly mentioned. Around 1983 Dutch textbooks were replaced by USA ones, which increasingly restricted the role of central banks to maintaining price stability. This thinking emphasised that when a central bank would ´credibly´ promise to tank the economy in situations of a price shock, people would restrain from increasing prices, which would end reverberations of the price shock or would even prevent such a shock (while problems of financial stability, the payment system and the like would miraculously disappear).

In 1992, one year after the USSR’s implosion, the Maastricht treaty was signed, paving the way for a common European currency and a European central bank. Even when the treaty still defined multiple ´mandates´ for the central bank, soon maintaining a stable price level (operationalised using a limited definition of ´price stability´) took precedence. The bank’s main instrument became ´credibility´, in the case of the ECB operationalised as the strict prohibition of monetary financing of governments. This prohibition is a stark difference between the Eurozone and, for instance, Japan, India, the UK and the USA. This prohibition limits the financial leeway of European governments and the EU. In my opinion, the ban is, to an extent, a consequence of the combination of post-WWII USA dominance (requiring a Europe with limited monetary independence) and the 1991 breakup of the Soviet Union. It can be understood as part of the’ peace dividend’, just like the decline of European post-91 military spending. It was furthered by neoclassical macroeconomics, which misunderstood central banking but which was embraced by economists.

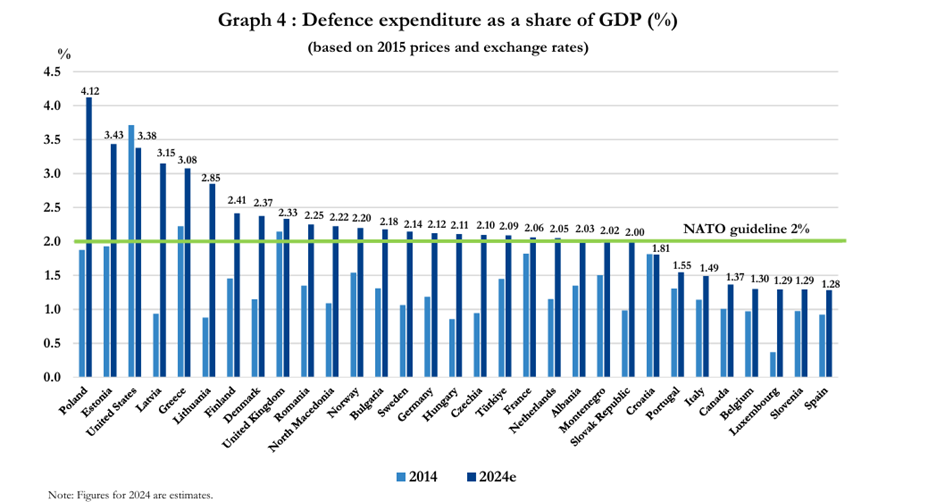

American dominance ended some years ago (in 2016, to be precise) when the Chinese economy surpassed the USA’s in size (PPP estimates). Soon, the Chinese economy will be twice the size of the USA’s. Already, the combined Asian economy (China, India, Bangla-Desh, Vietnam, Singapore, Taiwan, South Korea, the Philippines, Indonesia, and Japan) dwarfs the combined USA/EU/Russian economies in size and dynamism. Against this background, the war in Ukraine is a local, European war waged between countries in demographic, economic and geopolitical decline (not just Ukraine and Russia but other European countries, too). After the presidential elections in the USA, European countries will be pressed to abandon their dependency on the USA, leading them to increase military spending even more than they are already doing and, considering labour shortages, to reinstate the draft (if they haven´t already done so).

This will bring the possibility of financing government expenditure by a central bank to the fore. Eurobonds will come. In case of necessity, the ECB will buy them, even on the primary market.