Source AI is not what it is supposed to be. Inspired by my son, who attends higher education, I asked chat-GPT to write an article about the energy use of bitcoin in the style of my blog post series ´The real costs of making money´. Look here. Guess what: chat-GPT did not emulate my style but… has a better style. Sadly, however, you can´t rely on it for the facts (I am impressed by the speed, however, even when superficial googling yields better results, especially when non-english sources are used) Below a slightly edited version of this piece, pointing out some mistakes (In parentheses) **The Real Costs of Making Money: The Energy Use of Cryptocurrencies** We live in an age where technology and finance are increasingly intertwined. Cryptocurrencies, once a niche

Topics:

merijn knibbe considers the following as important: Bitcoin, blockchain, crypto, cryptocurrency, energy-use, Ethereum, footprint, outlaw-it, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

AI is not what it is supposed to be. Inspired by my son, who attends higher education, I asked chat-GPT to write an article about the energy use of bitcoin in the style of my blog post series ´The real costs of making money´. Look here. Guess what: chat-GPT did not emulate my style but… has a better style. Sadly, however, you can´t rely on it for the facts (I am impressed by the speed, however, even when superficial googling yields better results, especially when non-english sources are used)

Below a slightly edited version of this piece, pointing out some mistakes (In parentheses)

**The Real Costs of Making Money: The Energy Use of Cryptocurrencies**

We live in an age where technology and finance are increasingly intertwined. Cryptocurrencies, once a niche corner of the digital world, have evolved into a multi-trillion-dollar market, promising decentralization, freedom from traditional financial systems, and vast wealth creation. However, beneath the allure of digital assets like Bitcoin, Ethereum, and others lies a much darker, less glamorous truth: the enormous energy consumption that powers them.

As we increasingly shift to a greener, more sustainable future, the environmental impact of the technologies we use becomes harder to ignore. While cryptocurrencies promise freedom and autonomy, the reality is that their production, or “mining,” requires vast amounts of electricity, much of it from non-renewable sources. (If only we were shifting to a greener, more sustainable future…)

### The Mining Machine

Cryptocurrency mining is an energy-intensive process, but what exactly does that mean? Mining refers to the verification and validation of transactions on a blockchain network. This process involves solving complex mathematical problems (the problems are not complex but large and require insane amounts of computer power), which requires substantial computational power. Miners use specialized machines, often called “rigs,” to solve these problems and add new blocks to the blockchain. In return, miners receive cryptocurrency rewards, making it a competitive and lucrative business.

The process of mining Bitcoin, for example, requires miners to compete to solve (complex) cryptographic puzzles. These puzzles become progressively harder, and the miners are rewarded with newly minted Bitcoin and transaction fees for their efforts. However, this race comes at a significant cost. In the Bitcoin network, the most powerful mining rigs today can consume as much electricity as entire countries—sometimes more.

### The Numbers Don’t Lie

Let’s talk numbers. As of 2025, Bitcoin alone consumes more energy than countries like Argentina or the Netherlands. To put this into perspective, Bitcoin’s energy consumption is equivalent to that of the entire country of Finland. Ethereum, another major cryptocurrency, has taken steps toward reducing its energy footprint through its transition from Proof of Work (PoW) to Proof of Stake (PoS), which is expected to dramatically reduce its energy usage. But still, PoW systems like Bitcoin are responsible for an astonishing amount of global electricity consumption. (chat GPT mixes IP mining bitcoin and using bitcoin. Mining as well as using bitcoin require insane amounts of electricity)

To give you a concrete idea, Bitcoin’s energy consumption fluctuates, but estimates suggest it can consume between 80 to 150 terawatt-hours (TWh) annually. For comparison, that is more than the entire nation of Finland, or about 0.5% of the world’s total electricity consumption (Wrong, Bitcoing mining and use requires about twice the amount of energy as Finland, the mistake is due to only looking at the energy used for making transactions. Data: Statista)

### Where Does All This Power Come From?

The bulk of this energy comes from traditional, carbon-intensive sources, including coal and natural gas. Although some mining operations are located in regions with abundant renewable energy sources, such as hydroelectricity in parts of China and North America, much of the mining infrastructure is still heavily reliant on fossil fuels. In places where cheap, dirty energy is abundant, like regions rich in coal reserves, miners are drawn to set up shop for financial gain, perpetuating a cycle of environmental harm.

Even in areas with renewable energy, the sheer demand for electricity required by the cryptocurrency networks often leads to competition with local industries and residents for access to power. The environmental consequences of mining cannot be ignored, especially when many of the mining rigs run continuously, 24/7, year-round.

### The Carbon Footprint of Wealth

While many advocates of cryptocurrencies argue that they will eventually usher in a new economic era of decentralization, they rarely address the hidden costs. The carbon emissions associated with mining are staggering, and the industry is becoming a significant contributor to global climate change.

Take Bitcoin as an example. According to the Cambridge Centre for Alternative Finance, the carbon footprint of Bitcoin alone is estimated to be over 60 million tons of CO2 annually—comparable to the carbon emissions of entire countries like Greece or the Czech Republic. This is the hidden price of decentralized finance: an unrelenting demand for electricity and, consequently, an immense carbon footprint.

### Alternatives and Solutions

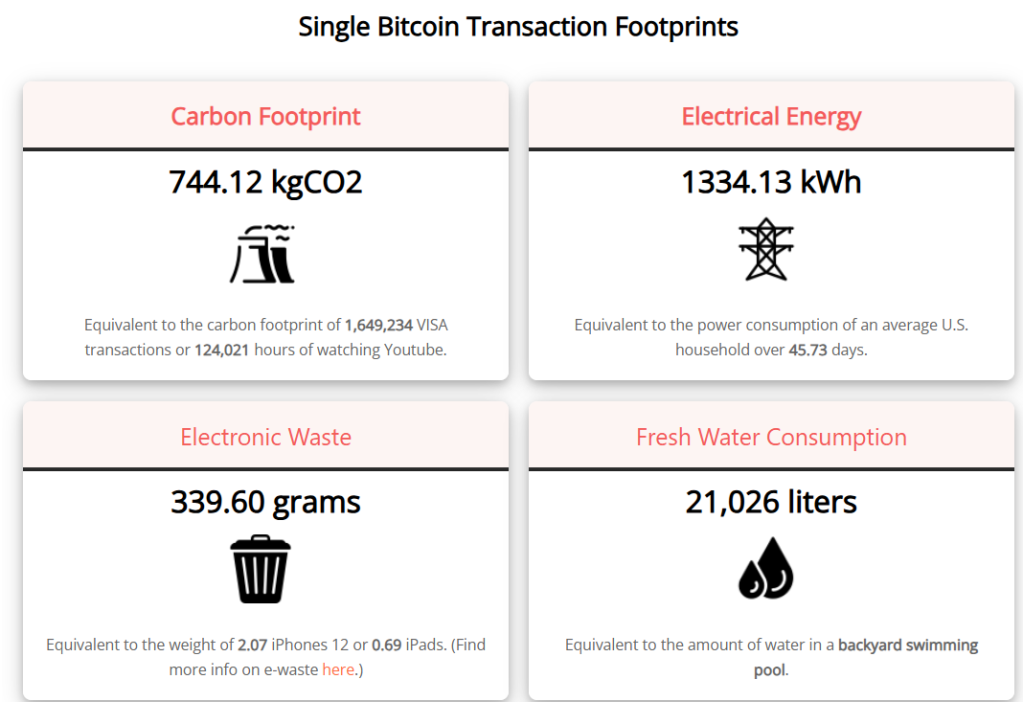

As with all technology, solutions to these issues are emerging. Ethereum’s switch to Proof of Stake has cut its energy usage by over 99%, and other cryptocurrencies are exploring ways to reduce their environmental impacts as well. Proof of Stake eliminates the need for energy-hungry mining rigs by instead using a system where validators are chosen to confirm transactions based on how much cryptocurrency they already hold. (I did not check it – but even a 99% reduction leaves a lot of energy use. One bitcoin transaction uses as much energy as 100.000 credit card transactions, a 99,999% reduction is needed)

The cryptocurrency industry is also looking to harness renewable energy for mining, although this is not yet widespread enough to make a significant impact. Some miners have even turned to innovative solutions, like using surplus renewable energy that would otherwise go to waste. The hope is that by creating mining operations that leverage clean energy sources, the environmental impact of the industry can be drastically reduced. (surplus renewable energy can be used to store heat for hothouse and whatever, it should not be used for ponzi like quasi currencies)

Another promising avenue is the use of carbon credits or blockchain-based carbon offsetting schemes, allowing miners to invest in renewable energy projects to offset their emissions (sigh…)

### The Hidden Cost of Financial Freedom

At the end of the day, cryptocurrencies may indeed be a game-changer in how we think about money, finance, and power. But it’s crucial to understand the cost that comes with that transformation. Decentralization and freedom from central banks have their place, but not at the expense of our planet’s health. The real cost of making money in the crypto world is not just about financial transactions—it’s about energy consumption, environmental degradation, and the irreversible damage we are doing to the environment. (I totally agree with this paragraph. However, the costs of transactions alone already make bitcoin unfit for use as a means of payment)

As we push forward into the future, we need to be mindful of the broader implications of the technologies we use to create wealth. It’s time for the crypto industry to take a hard look at its own energy consumption, and for us to consider whether the digital wealth we’re accumulating is worth the toll it takes on our world. (I totally disagree with this paragraph. Bitcoin and cryptocurrencies are useless, expensive and harmfull and have to be outlawed, by governments, asap)

Because the truth is: there’s no such thing as “free” money. Every transaction, every coin mined, and every block verified comes with a cost—a cost that might be too high to pay if we don’t start taking the environmental impact seriously. The question is: are we willing to pay it? (Not a question anymore)