[unable to retrieve full-text content]Trump posted on his pseudo-twitter site: “I will make sure the U.S. is the Crypto Capital of the World.” He announced something he calls a US crypto strategic reserve. What, exactly, is a crypto reserve? Look, I get it. Money is whatever people use as a medium of exchange and a store of value. And […] The post Crypto capital of the world appeared first on Angry Bear.

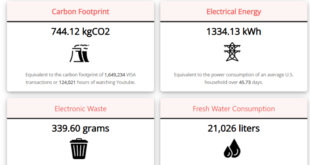

Read More »The incredible cost of Bitcoin.

Source AI is not what it is supposed to be. Inspired by my son, who attends higher education, I asked chat-GPT to write an article about the energy use of bitcoin in the style of my blog post series ´The real costs of making money´. Look here. Guess what: chat-GPT did not emulate my style but… has a better style. Sadly, however, you can´t rely on it for the facts (I am impressed by the speed, however, even when superficial googling yields better results, especially when non-english...

Read More »The fatal flaws of Celsius Network

Celsius Network was never a real business. It did not have a viable business model. Really, it was a momentum trading scheme that relied on the premise that crypto prices would always rise. And when they didn't, it resorted to fake valuations and market manipulation to escape insolvency. It was fraudulent from the start. This is the conclusion I've reached after studying the U.S. Examiner's final report (yes, I've read all 476 pages of it) and Celsius's audited reports and accounts up to...

Read More »Where has all the money gone?

The collapse of Terra in May sent shock waves round the crypto world, triggering domino-like collapses of crypto companies. One of those companies was the investment fund Three Arrows Capital. At the time, everyone thought 3AC was a conservatively-managed investment company that was simply the unfortunate victim of an unforeseen event. If anyone was to blame for 3AC's collapse, it was Do Kwon. How wrong they were. Since 3AC was ordered into liquidation by a British Virgin Islands court,...

Read More »Why Celsius Network’s depositors won’t get their money back

The crypto lender Celsius has filed for Chapter 11 bankruptcy. This should come as a surprise to absolutely no-one, though the grief and pain on Twitter and Reddit suggests that quite a few "Celsians" didn't want to believe what was staring them in the face. Celsius suspended withdrawals nearly a month ago. So far, every crypto lender that has suspended withdrawals has turned out to be insolvent. There was no reason to suppose that Celsius would be different. Celsius's bankruptcy filing...

Read More »Shipwrecked

Two days after I published my last post, the ship went down. Voyager Digital filed for Chapter 11 bankruptcy protection. The bankruptcy filing revealed the extent of its indebtedness. Tragically, most of its creditors are customers, some of whom hold claims worth millions of dollars. But its largest creditor is Alameda Research, to whom it owes $75m. This is the maximum that Voyager could draw down from Alameda's credit line in a 30-day period. So it appears that Alameda did not pull its...

Read More »The sinking of Voyager

Friday was quite a day. The crypto lender BlockFi provisionally agreed a bailout deal with FTX. The hedge fund Three Arrows Capital (3AC), already in compulsory liquidation in its home territory the British Virgin Islands, filed for Chapter 15 bankruptcy protection in the United States. And the crypto broker Voyager suspended trading and withdrawals. Voyager's press release revealed a massive hole in its balance sheet. Some 58% of its loan book consists of loans to 3AC:And its loan book is...

Read More »There’s no such thing as a safe stablecoin

Stablecoins aren't stable. So-called algorithmic stablecoins crash and burn when people behave in ways the algorithm didn't expect. And reserved stablecoins fall off their pegs - in either direction. A stablecoin that does not stay on its peg is unstable. Not one of the stablecoins currently in circulation lives up to its name. Don't believe me? Well, here's the evidence. Exhibit 1, USDT since the end of April:Exhibit 2, USDC over the same time period:(charts from Coinmarketcap)Both coins...

Read More »Crypto’s Weimar

A cryptocurrency has just re-enacted the Weimar hyperinflation.Yesterday, the price of the cryptocurrency TITAN crashed to zero, and its related stablecoin IRON fell off its USD peg, trading as low as 69 cents to the dollar. It was a sudden and dramatic collapse that left investors shocked and bewildered. Equally shocked and confused, the coins' issuer launched an immediate investigation: Iron Finance issued its post mortem a few hours later. This is the key paragraph:Later, at around 3pm...

Read More »Tether’s smoke and mirrors

Tether has issued what it calls a “breakdown of its reserves”. It actually consists of two pie charts. Here they are:Seriously, this is all Tether has seen fit to reveal. Furthermore, the pie charts only purport to show the breakdown of Tether’s reserves on the 31st March 2021. We do not know whether Tether’s reserves still have the same composition now. Nonetheless, the crypto world took these charts as an indication that Tether was, if not fully cash-backed, at least mostly. “76% of its...

Read More » Heterodox

Heterodox

-310x165.jpg)