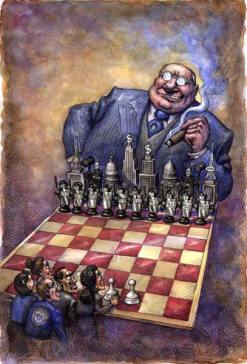

Recently, I came across an interview with Dick Bryan and Mike Rafferty for the JACOBIN magazine. The interview concerns their analysis of financialisation and it can be accessed in the following web-address: https://jacobinmag.com/2019/07/financialization-capitalism-with-derivatives-australia. The interview has the telling title ‘How Finance Exploits Us’. It is not coincidence that a book on financialisation by Costas Lapavitsas carries the same title (‘Profiting Without Producing: How Finance Exploits Us All’). This similarity is not accidental but denotes deeper common elements of the different theories of ‘financialisation’. In particular, as it will be shown below, this identical titling exhibits their common departure from the Marxist theory of labour exploitation in work

Topics:

Stavros Mavroudeas considers the following as important: Byan, derivatives, financialisation, Mavroudeas, Rafferty, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Recently, I came across an interview with Dick Bryan and Mike Rafferty for the JACOBIN magazine. The interview concerns their analysis of financialisation and it can be accessed in the following web-address: https://jacobinmag.com/2019/07/financialization-capitalism-with-derivatives-australia.

The interview has the telling title ‘How Finance Exploits Us’. It is not coincidence that a book on financialisation by Costas Lapavitsas carries the same title (‘Profiting Without Producing: How Finance Exploits Us All’). This similarity is not accidental but denotes deeper common elements of the different theories of ‘financialisation’. In particular, as it will be shown below, this identical titling exhibits their common departure from the Marxist theory of labour exploitation in work towards a theory of expropriation through usury in distribution. It also exhibits their common dissolution of the working class into an inter-class mass of financially expropriated persons. Unsurprisingly, this mass is dominated by the ‘middle-class’ (that is mainly the petty bourgeoisie).

What makes this interview interesting is that it reveals both the (non-dialectical) contradictions and the empirical errors not only of Bryan and Rafferty but of the ‘financialisationists’ in general.

Bryan et al. set out to (a) innovate Marxist economic analysis by focusing on finance and (b) propose a class politics on the basis of their analysis. They fail utterly in both.

Regarding their first point, they consider financialisation – and especially financial derivatives (which is supposed to be the differentiae specificae of their financialisation theory) – as a new era of capitalism. They argue that derivatives constitute a path-breaking innovation in the 21st century similar to that of the joint-stock company in the 19th century. There is a first inaccuracy here. Financial derivatives in capitalism are quite older. Even their recent proliferation and expansion dates back to the 1990s.

But the analytical problems of their approach are even greater than their empirical inaccuracies. They adopt (a) a Neoclassical understanding of profit (as reward for risk-taking) and (b) a Keynesian emphasis on liquidity. Both are alien to and incompatible with Marxism. But, moreover, they are erroneous as they misrepresented the actual working of the capitalist economy.

A neoclassical conception: Risk as a source of surplus-value

The gist of their analysis is that risk (embodied in and managed through derivatives) is a source of surplus-value. The following excerpt is characteristic:

‘We contend that risk-absorption is a contribution to capital’s surplus’.

It is well known that Neoclassicism justifies profit as the reward of (entrepreneurial) risk-taking. Marxism has offered a devastating critique of this fallacy.

A Keynesian loan: liquidity

Keynes and the Keynesian tradition founded The Liquidity Preference Theory. This maintains that the demand for money stems not from the need to borrow money but from the desire to remain liquid in the face of future risks. Needless to say, this perspective can be easily accommodated with the conception of risk as source of profits. For this reason, the Liquidity Preference Theory has been easily incorporated in the Hicksian synthesis of Keynesianism and Neoclassicism and also in subsequent neoliberal theories (with significant modifications).

Marxism has a totally different perspective from that. Capital (and not everybody as both Neoclassicals and Keynesians maintain) has a tendency to seek fluidity. This means its ability to move easily – particularly in monetary form – from one activity to the other. But this fluidity has a gear: capital wants to move easily from one activity to the other because it is seeking higher profit. And profit, for Marxism, comes from surplus-value (that is new wealth) creation. This constitutes a generic contradiction of capital. On the one hand, it wants to freely move from one surplus-value producing activity to the other in search of higher returns. On the other hand, it is obliged to tie down itself to the production of value (and surplus-value) in specific productive activities. The preference between fluidity and ‘productive bondage’ depends upon profitability. In any case, at least a significant part of capital has to be in production bondage in order for value to be produced. Of course, the more fluid forms of capital are basically the financial ones.

Bryan et al. attempt to marry risk and liquidity with Marxism is a total failure. Marxism explains risk and liquidity with reference to value and profit. Marxism has a production centered analysis whereas Bryan et al. adopt the circulation-centered perspective of Neoclassicism and Keynesianism. See, for example the following excerpt:

‘So capital has become liquid, but labor power stays illiquid’

Regarding the second task that Bryan et al. set to themselves – namely to offer a class politics for the ‘new era of financial capitalism’ – they fail even more utterly. First, they do not have a Marxist – let alone a coherent – theory of classes. The last sections of their interview are indicative. Ultimately they consider ‘classes’ as income categories. And they adopt the misleading Mainstream non-class term of ‘households’ as their analytical category. These are typical bourgeois conceptions. Needless to say, Marxism has a totally different theory of classes. Despite their denials (‘In Marxism there is an aversion to defining class in terms of income, but we’re not actually doing that’), this is what they are actually doing. The following excerpt is also characteristic:

‘this surplus-generating role reaches significantly into the “middle class.”

Moreover, despite their class rhetoric, they dissolve labour into capital as they argue that labour has become a form of capital, as the reproduction of labor has become in Financialisation a source of surplus-value transfer in the form of interest payments and the ‘financialization of daily life’. With this formulation, Bryan, Martin, and Rafferty suggest that there lies an exploitation that is not confined to unpaid labor-time but extends to usury. This exploitation does not concern only labour but primarily the ‘middle classes’. The following excerpt is telling:

‘We are offering an additional perspective on the surplus-producing class, by extending it into how class relations are transformed by capital. We have shown that this surplus-generating role reaches significantly into the “middle class.”

Characteristically, Bryan et al. in their empirical study on Australia discover that it is not the lowest-income people (i.e. a proxy for the working-class) that are subject this new capitalist exploitation mechanism through household absorption of risk but the middle-income people. Again, the following excerpt is telling:

‘We’re just saying if you are interested in the way in which household absorption of risk makes capital look profitable, and you look at where the risk is being absorbed, you find that it is not with the lowest-income people because by and large they’re excluded from finance because they can’t get loans.

Not every working-class person is on a low income but who we call a “working class” remains contentious, especially with the rise of fake independent contracting (like the gig economy). We are offering an additional perspective on the surplus-producing class, by extending it into how class relations are transformed by capital. We have shown that this surplus-generating role reaches significantly into the “middle class.”

So, in the end and despite their verbose ‘class politics’, value theory bruhaha and workerist declarations (‘capital ripping off labor by shifting risk in a distributional sense’), Bryan et al. end up by recognizing that it is the ‘middle class’ that is primarily exploited in this new era of financialized capitalism. Nice end for the new class warriors!!!

The political programme that they propose is totally idiotic. The ‘strategic non-payment of bills that have been securitized’ is a matter for financial pundits but not the central issue of workers’ trade unions. The refusal to repay rent has been a very old part of workers’ struggles and is nothing new. However, this idiotic political programme has a truly catastrophic consequence for the labour movement. It removes its primary focus from struggles in production and work and transposes it to inter-class distributional issues. Moreover, as Bryan et al. accept, these issues concern primarily the ‘middle class’. Thus, they essentially make the working-class the servant of middle-class’ demands. Nice advice to the trade unions Bryan et al. seek to guide!!!

The rest of the interview is full of minor errors.

See for example the idiotic declaration that ‘Given that households are where most wealth lies’. This is not sustainable even in Neoclassical terms.

Another blatant error concerns Bryan et al. understanding of the value of labour-power. The value of labor-power is not ‘basically subsistence’ as it encompasses also a social part. And of course, their argument that ‘subsistence is about household illiquidity’ is totally absurd.

The New Reformism of Financialisation

The errors of the Bryan et al. theory of financialisation are typical of the contemporary breed of the New Reformism of Financialisation. This New Reformism comes from many sides. Post-Keynesianism and its Marxisant fellow-travelers (Lapavitsas, Bryan etc.) is one stream. Another one comes from the Rosa Luxemburg Institute with M.Heinrich etc. D.Harvey is a specie-on-its-own who cherry peaks from all these with astonishing lightness and equally astonishing lack of economic coherence.

Rather unsurprisingly, the common themes of this New Reformism of Financialisation are the following.

First, they shift the analysis from the production-centered Marxian circuit of capital to a Mainstream circulationist perspective. Finance becomes the central locus of this circulationism.

Second, they deform the notion of capitalist exploitation by moving it from surplus labour extracted at the production sphere to exploitation in distribution. This move was also made in the past by Marxo-Keynesian (or rather vice versus) theories. However, this time there is a new element. Exploitation in distribution is conducted not only through economic mechanisms but, to a great extent, through political coercion. This is less evident within an economy as there usury is the mechanism of financial exploitation. However, as Bryan et al. argue in this interview, the state plays a crucial role in establishing this mechanism. This primary political mechanism is more evident in the fallacious theory of New Imperialism.

Third, they blur class analysis by dissolving the working class within the middle strata. In order to do this, they abandon the Marxist theory of classes. Thus, they end up by substituting the working class with an almost post-modern social slop (reminiscent of Negri’s ‘multitude’).

Fourth, they deny the existence of a Marxian theory of crisis (let alone one based on falling profitability) and argue that there can be many types of crisis (some of them even argue that each crisis is a special case). But practically, they see every modern crisis as a financial crisis; thus, agreeing with the Mainstreamers.

Fifth, in terms of politics they practically abandon socialism in favour of a vague anti-capitalism. Instead of the independent from the bourgeoisie political organization of the working class they favour inter-class populist programmes than express mainly the demands of the middle and petty bourgeoisie. There ultimate aim is not socialism but a reformed humane capitalism.

- For a broader critique of the Financialisation Hypothesis and its many currents see the links below: