One of my Patrons posed a very good question to me: in a nutshell, how would I respond to a politician who took my ideas and perverted them for political gain? Here’s Andre’s full query: Hi Steve, thank you, you’ve given me the gift of some of the most important ideas and explanations I’ve come across in my lifetime. I was wondering how you might respond to a politician who misreads your latest book, and then declares: 1. People will love me, because Steve Keen says I can become known as a master of managing my country’s economy by engineering a private debt boom 2. People will love me, because when private debt eventually falters, Steve Keen says I get to tell everyone they get more government spending on them, because public debt is justified to offset lack of accelerating private debt 3. Even if some people grumble about me enlarging the state, they’ll definitely love me when I tell them they’re all getting tons of free money in a debt Jubilee straight into their bank account and/or their debts partially repaid for them. 4. Best of all, after a few days of announcing everyone gets more public spending and free money in their bank account, the country’s private debt load will be reduced enough that we can start another private debt boom! a.

Topics:

Steve Keen considers the following as important: Debtwatch

This could be interesting, too:

Steve Keen writes Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

Steve Keen writes Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

Steve Keen writes Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

Steve Keen writes What To Be Able To Wear To The Casino? The Complete Dress Guide

One of my Patrons posed a very good question to me: in a nutshell, how would I respond to a politician who took my ideas and perverted them for political gain? Here’s Andre’s full query:

Hi Steve, thank you, you’ve given me the gift of some of the most important ideas and explanations I’ve come across in my lifetime.

I was wondering how you might respond to a politician who misreads your latest book, and then declares:

1. People will love me, because Steve Keen says I can become known as a master of managing my country’s economy by engineering a private debt boom

2. People will love me, because when private debt eventually falters, Steve Keen says I get to tell everyone they get more government spending on them, because public debt is justified to offset lack of accelerating private debt

3. Even if some people grumble about me enlarging the state, they’ll definitely love me when I tell them they’re all getting tons of free money in a debt Jubilee straight into their bank account and/or their debts partially repaid for them.

4. Best of all, after a few days of announcing everyone gets more public spending and free money in their bank account, the country’s private debt load will be reduced enough that we can start another private debt boom!

a. And this debt boom will make my country even more prosperous for even longer because no one will be afraid – after all they now know that the worst thing that can happen is that I have to announce to them again that they’ll be getting more free money in another debt jubilee!

b. Free money from speculating on assets in a private debt boom, followed by free government money for public services, followed by free money in a debt jubilee, over and over again until we’re the richest nation the Earth has ever known!

The short answer is that it’s already happened. The long answer is that I don’t believe that conscious policy will get us out of this crisis: instead we’ll get out of it the same way we got out of the last one (the Great Depression): as the accidental side-effect of responding to an existential crisis.

Now I’ll background both those answers.

The (Long) Short Answer: Kevin Rudd

I first realised that this crisis was inevitable as a consequence of checking the Australian private debt to GDP data in relation to a court case on predatory lending, in which the NSW Legal Aid Commission had asked to be an Expert Witness.

As I explain in Can we avoid another financial crisis?, while drafting my report (in late December 2005) I wrote the line “Australia’s private debt to GDP ratio has been rising exponentially”, and then realised that, as an Expert, I couldn’t just use hyperbole—that was the Barrister’s job! I’d have to research the data, and I’d need to replace “exponentially” with another expression. “Increasing sharply” perhaps.

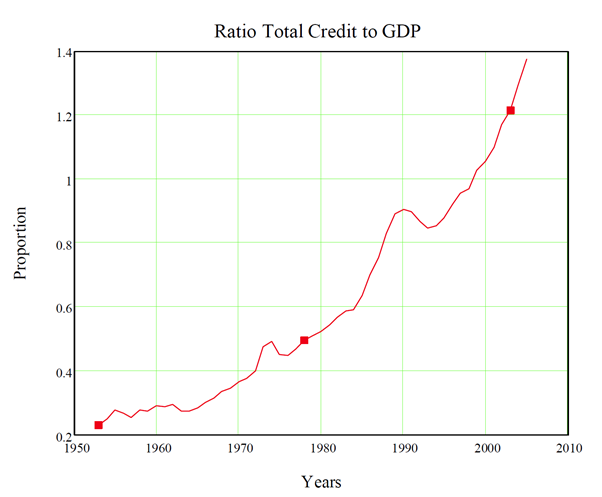

So I downloaded the private debt data from the Reserve Bank of Australia’s website, grabbed the nominal GDP data from the same place, wrote a few import and data processing routines in MathCad (my favourite mathematical and statistical program—I loathe spreadsheets) to match the monthly debt data to the quarterly GDP data, imported the data, graphed it, and instantly realised that calling the trend exponential wasn’t hyperbole: it was an accurate description of the trend. The chart shown in Figure 1 was ultimately a centrepiece of my Expert Witness report.

Figure 1: Australia’s exponential increase in its private debt to GDP ratio from 1952 till 2006.

Granted the data are non-stationary, but the obvious correlation of this with a simple exponential function was so strong as to be almost ridiculous. I used a nonlinear fitting function to find that the correlation coefficient of the actual debt to GDP data to a simple exponential function (with an initial value of 0.23 and a growth rate of 3.4% per year) was a staggering 0.978.

Having seen this data, there was no doubt in my mind that, when the rate of growth of private debt stopped, Australia was in for its biggest economic crisis since the Great Depression. The only question was whether this was just an Australian phenomenon, or a global one.

The only reasons the fit was less perfect were two super-exponential bubbles in the mid-1970s and 1980s—both of which I knew caused severe booms and busts at the time, since they occurred at significant points in my own life…

You can read the rest of this post on my Patreon page if you become a Patron: Click here to read the rest of this post.