By New Deal democrat Real wages and spending: I don’t think consumers will roll over that easily This is the second part of a post about “hard data” and consumer spending. (Dan here…First part here) Yesterday I noted that self-reported consumer spending, as measured by Gallup, has been running 10% or better YoY since the beginning of February, consistent with Amazon.com’s earnings growth, but in contrast to a small slump in retail sales as reported for the last two months. In fairness, real personal consumption expenditures have turned down slightly in the last several months: Since this measures spending, there is clearly a divergence between this measure and Gallup. Another contrary argument that the slump in consumer spending is real, is that the cause has been the decline in real wages since last July: But over the last 50 years, a downturn in real wages has frequently not meant recession. Consumers can cope by refinancing debt at lower rates (not available now), by cashing in appreciating assets, if they have them (e.g., stocks or housing equity), or saving less, before they cut back saving.

Topics:

Dan Crawford considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

by New Deal democrat

Real wages and spending: I don’t think consumers will roll over that easily

This is the second part of a post about “hard data” and consumer spending. (Dan here…First part here)

Yesterday I noted that self-reported consumer spending, as measured by Gallup, has been running 10% or better YoY since the beginning of February, consistent with Amazon.com’s earnings growth, but in contrast to a small slump in retail sales as reported for the last two months.

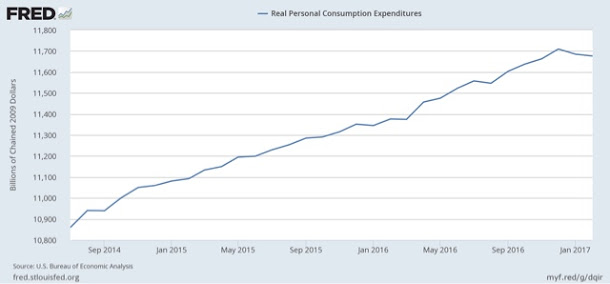

In fairness, real personal consumption expenditures have turned down slightly in the last several months:

Since this measures spending, there is clearly a divergence between this measure and Gallup.

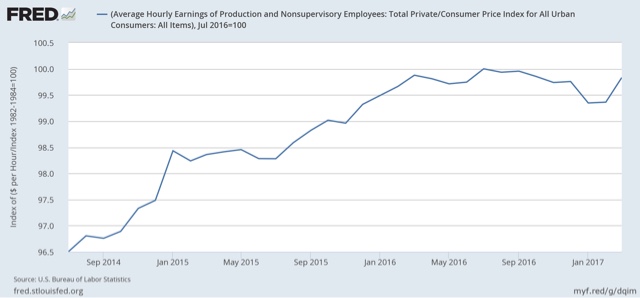

Another contrary argument that the slump in consumer spending is real, is that the cause has been the decline in real wages since last July:

But over the last 50 years, a downturn in real wages has frequently not meant recession. Consumers can cope by refinancing debt at lower rates (not available now), by cashing in appreciating assets, if they have them (e.g., stocks or housing equity), or saving less, before they cut back saving. While there was a slight downturn in the savings rate in 2016, it was less than half of that we saw in 1998 and 2004 (and similar downturns in earlier cycles not shown in the below graph):

In the past, consumers have not caved in without saving less first. It could always be different this time, but my suspicion is that we will see a much more substantial decline in the savings rate before we see a real, sustained downturn in spending.