Guest post by Tom Streithorst. Brexit already looks a disaster. Sterling has plunged to the lowest level in thirty years, the FTSE fell more than 12% at the open, global equities lost $2 trillion in value in less than a day, and gold, the traditional safe haven in times of turmoil, has shot up. Uncertainly reigns. Firms are less likely than ever to hire or invest. It is going to get worse. Who shall we blame? David Cameron is the obvious villain. He did not need to call this referendum....

Read More »Ending austerity policies to open a new time in Europe

The management of the economic crisis has had devastating consequences for our country, as well as for the eurozone as a whole. The fiscal austerity and wage reduction policies imposed over the last few years have unnecessarily prolonged the recession across the continent and generated deep social fractures by increasing economic and social inequalities.Fiscal austerity and wage reduction policies have led us to a lost decade. Across the Eurozone, we haven’t yet regained pre-crisis level of...

Read More »Bill Mitchell on the Euro, Austerity and MMT

Nice, short interviews.[embedded content][embedded content][embedded content][embedded content][embedded content]

Read More »Sisyphus,Tantalus and a prisoner’s dilemma

Should Greece leave the Euro? That was the title of the Oxford debate at the Prague Summit in which I had the pleasure of participating yesterday.But this is the wrong question. Unless there is a considerable shift in Eurozone politics, Greece WILL leave the Euro - eventually. The question is when, and how.To see this, we need to look at the motivations of all the players involved in the negotiations. The Greek negotiations resemble a "prisoner's dilemma", in which the best outcome for...

Read More »John Cochrane on economic growth

There are three kinds of lies, "lies, damned lies, and statistics," supposedly said Benjamin Disraeli. This applies to John Cochrane piece in the Wall Street Journal today. Cochrane says that: "Sclerotic growth is America’s overriding economic problem. From 1950 to 2000, the U.S. economy grew at an average rate of 3.5% annually. Since 2000, it has grown at half that rate—1.76%. Even in the years since the bottom of the great recession in 2009, which should have been a time of fast catch-up...

Read More »The Central Bank as sugar daddy

Complex technical stuff indeed Pascal Blanqué and Amin Rajan complain about unconventional monetary policy, low or negative rates and Quantitative Easing, which they mostly blame on Greenspan and the excessive reliance on the lender of last resort (LOLR) function of the central banks (even though this precedes Greenspan). They say: The US example shows all too clearly that the longer such unconventional policy remains in place, the harder it is to exit. Most likely, ultra-low rates will...

Read More »Moody’s upgrades Argentina credit rating status

Mainly because of their "expectation that Argentina will settle holdout creditor claims which will result in a lifting of court injunctions and clear the way for Argentina to access international capital markets." Fair enough, access to capital markets would lift the balance of payments constraint, even if the agreement is a complete surrender to the Vultures demands. But the most interesting argument for the improvement in the credit rating is that it results from "economic policy...

Read More »The Austerity Beatings of Greece Will Continue Until Its Morale Improves

By William K. Black April 17, 2016 Bloomington, MN The old joke, that conveys a critical truth, is the poster that says “The daily floggings will continue until morale improves around here.” The troika misses the irony in the poster, for it thinks that the answer to the eurozone nightmare problems caused by austerity is more austerity. The latest example is three IMF stories that ran contemporaneously. The IMF, again, lowered global growth forecasts. Two, the IMF is calling for...

Read More »Latin American corner: When will they ever learn?

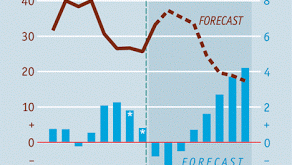

By Naked Keynes (Guest Blogger)The latest IMF World Economic Outlook (April 2016) projects stagnation in World Growth (3.1% and 3.2% in 2015 and 2016) both in advanced economies (4.0% and 4.1% in 2015 and 2016) and emerging market and developing economies (1.9% and 1.9% for 2015 and 2016). The prospects for 2017 are hardly any better with an estimate of 3.5% for global output and continuing stagnation of advanced economies. But things could get worse.The current outlook scenario depends on...

Read More »A plan to turn the Euro from zero to hero

Guest post by Ari Andricopoulos It is difficult to read the history of inter-war Europe and the US without feeling a deep sense of foreboding about the future of the Eurozone. What is the Eurozone if not a new gold standard, lacking even the flexibility to readjust the peg? For the war reparations demanded at Versailles, or the war debts owed by France and the UK to the US, we see the huge debts owed by the South of Europe to the North, particularly Germany. The growth model of the...

Read More » Heterodox

Heterodox