A few weeks ago, in a piece about Deutsche Bank's recent difficulties, I commented about its use of so-called "coco bonds" - contingent convertible bonds. I had over-simplified my description, and was promptly taken to task for doing so by @creditmacro on Twitter. He provided me with a detailed explanation of what coco bonds are and how they work. This piece draws heavily on his input. All of the quotations are from him unless otherwise stated. His full write-up can be found in Related...

Read More »Marx’s Capital, Volume 1, Chapter 13: A Critical Summary

Chapter 13 of volume 1 of Capital is called “Co-operation” and it deals with the concept of cooperation of workers in production process and with historical aspects of the development of capitalist modes of production.Marx sees cooperation in capitalism as having three historical forms (1) simple co-operation, (2) manufacture, and (3) modern industry, but the earlier forms can persist within modern capitalism (Brewer 1984: 50).At the beginning of capitalist history, Marx sees changes in the...

Read More »Marx’s Capital, Volume 1, Chapter 11: A Critical Summary

Chapter 11 of volume 1 of Capital is called “The Rate and Mass of Surplus-Value” (Marx 1990: 417), and it deals with further aspects of surplus value.In essence, Marx makes a number of points in this chapter as follows: (1) the rate of surplus value is dependent on the duration of the working day and the value of labour-power;(2) the total mass of surplus value can be measured by s/v multiplied by the value of total variable capital, and capitalists wish to maximise the mass of...

Read More »Robert Wilbrandt’s Interpretation of Marx’s Law of Value in Volume 1 of Capital

The socialist German economist Robert Wilbrandt (1875–1954), the author of Karl Marx: versuch einer Würdigung (Leipzig, 1920), had an interesting interpretation of the “law of value” in volume 1 of Capital, as described by Alexander Gray: “Professor Wilbrandt, in his very sensitive appreciation of Karl Marx, offers us two points which are of some interest towards an appreciation of what Marx's admirers think that Marx really meant. The first is a rather naive admission that the first Volume...

Read More »What are the Useful Insights in Marx’s Capital?

It is not difficult to identity them: (1) the use of a proto-effective demand theory by Marx;(2) endogenous money theory;(3) Marx’s rejection of Say’s law;(4) the notion of a monetary production economy (also developed as a theory by Keynes); and(5) a conflict theory of the distribution of income, and the recognition that workers and capitalists have unequal power. However, the trouble is that none of these insights prove that Marx’s overall theory was right: far from it.There are many...

Read More »Germany’s Sparkassen: banking on capital exports

My latest post at Forbes takes a close look at Germany's much-praised Sparkassen and their odd relationship with other German banks. It's not quite as it seems.... The German Sparkassen (public savings banks) are widely praised for their stability and their service to German savers and small businesses. They survived the 2008 crisis largely unscathed; the few failures were handled within the network, and depositors were compensated from a fully-funded deposit insurance scheme, with no...

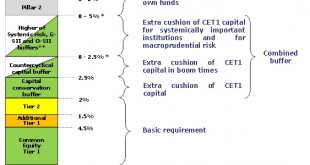

Read More »Capital, liquidity and the countercyclical buffer, in plain English

The FT reports that due to “modest but rising credit growth”, the Bank of England’s Financial Policy Committee (FPC) considered raising banks’ countercyclical capital buffer. According to the FT's Caroline Bingham: This measure requires lenders to build up capital in good times to draw down in more challenging times. And she goes on to say this: The prospect of yet more capital that banks must set aside would come on top of capital rules on a European and global basis that lenders must...

Read More »The Co-Op Bank: too high a mountain?

The Co-Op Bank has revealed its 2015 half-year results. And they are not pleasant reading. It has made a statutory loss before taxation of £204m, considerably worse than the £77m loss reported in the 2014 half-year accounts. And the Board advises that the bank will not return to profit for another couple of years.The background to this horrible report is the Bank of England's stress tests last autumn. I didn't bother to look at the results at the time, since it was always obvious that the...

Read More »Two Instances where Marx’s Theory of Value in Volume 3 Intrudes into Volume 1 of Capital

In fact, it happens in two obscure footnotes in Chapters 5 and 8 in volume 1 of Capital.The first comes in a footnote at the end of Chapter 5 in which Marx discusses the nature of capital. I give the relevant part of the main text with the footnote below: “The conversion of money into capital has to be explained on the basis of the laws that regulate the exchange of commodities, in such a way that the starting point is the exchange of equivalents.1”[Footnote] (1) “From the foregoing...

Read More »Marx’s Capital, Volume 1, Chapter 8: A Critical Summary

Chapter 8 of volume 1 of Capital is called “Constant Capital and Variable Capital” (Marx 1990: 307), and it discusses non-labour factors (constant capital) and living labour (variable capital).Marx divides capital as factors of production into two categories: (1) constant capital, and(2) variable capital (Marx 1990: 317). Constant capital is the means of production used in the production process whose values are merely transferred to the output product (Marx 1990: 307; Harvey 2010: 128).How...

Read More » Heterodox

Heterodox