A few weeks ago, in a piece about Deutsche Bank's recent difficulties, I commented about its use of so-called "coco bonds" - contingent convertible bonds. I had over-simplified my description, and was promptly taken to task for doing so by @creditmacro on Twitter. He provided me with a detailed explanation of what coco bonds are and how they work. This piece draws heavily on his input. All of the quotations are from him unless otherwise stated. His full write-up can be found in Related Reading at the foot of this post. I'm also indebted to Martien Lubberink for pointing me to the capital structure diagram. In the aftermath of the financial crisis, regulators around the world recognised that banks were insufficiently capitalised. The proportion of equity (shareholders' funds) on the liability side of their balance sheets was distressingly low, which exposed their creditors - whose claims make up the rest of the bank's liabilities - to the risk of losses in the event of an asset price collapse such as happened in the autumn of 2008 after the fall of Lehman Brothers. Not only was common equity deficient, but the various forms of junior debt (preference shares and subordinated debt) that should have protected senior creditors including depositors proved inadequate to the task. Clearly, banks needed more, and better, capital.

Topics:

Frances Coppola considers the following as important: banks, Capital

This could be interesting, too:

Bill Haskell writes FDIC: Number of Problem Banks Increased in Q1 2024

Angry Bear writes The “Wayback Machine” and Rescuing Problem Banks

Angry Bear writes The Lie Banks Use To Protect Late-Fee Profits

Stavros Mavroudeas writes Destroy ‘creative ambiguity’ in order to change the world – Against Varoufakis’ conformist sci-fi

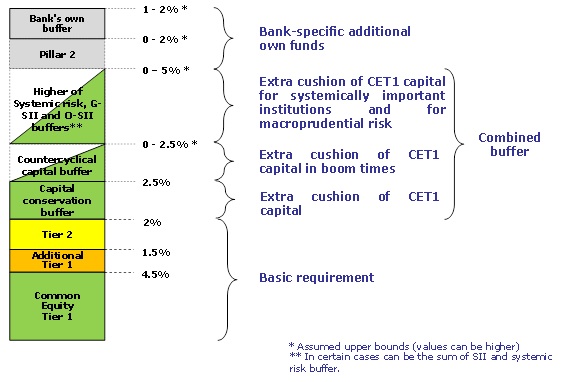

I'm also indebted to Martien Lubberink for pointing me to the capital structure diagram.

In the aftermath of the financial crisis, regulators around the world recognised that banks were insufficiently capitalised. The proportion of equity (shareholders' funds) on the liability side of their balance sheets was distressingly low, which exposed their creditors - whose claims make up the rest of the bank's liabilities - to the risk of losses in the event of an asset price collapse such as happened in the autumn of 2008 after the fall of Lehman Brothers. Not only was common equity deficient, but the various forms of junior debt (preference shares and subordinated debt) that should have protected senior creditors including depositors proved inadequate to the task. Clearly, banks needed more, and better, capital.

The Basel Committee on Banking Supervision issued a set of proposals (Basel III) that called on national authorities to improve the quantity and quality of bank capital. These were transposed into EU law via the Capital Requirements Directive IV (CRD IV) and Capital Requirement Regulation (CRR).

As a result of the European regulations, bank capital structures have become somewhat complex, as this graphic from the European Commission shows:

Note that this is a layered or "tiered" structure. CRD IV requires banks to have permanent capital of at least 8% of risk weighted assets (RWA): in the diagram, this is the bottom three tiers. Of these, common equity (CET1) is the largest, at a minimum of 4.5% of RWA, though most banks now have far higher levels, many in double digits. Above that is Additional Tier 1 capital (AT1), and Tier 2 - subordinated debt and preference shares, broadly speaking - forms the remainder of the permanent capital. The tiers above that are variable and discretionary capital buffers.

As its name implies, CET1 is made up of shareholders' funds (issued shares and retained earnings). But it is AT1 and Tier 2 that interest us. Some Coco bonds are Tier 2 instruments, but most are AT1, sitting above CET1 but below Tier 2 in the bank's capital structure. They are deeply subordinated, and are therefore risky investments. They are now so dominant in AT1 capital that they are usually known as AT1 in market trading.

AT1 bonds are hybrid instruments, with characteristics of both debt and equity. Officially, they are classed as debt, which means their coupon payments are tax deductible: they are thus a cheaper way of boosting capital ratios than rights issues. But they are designed to absorb losses ahead of senior and subordinated debt. There are four broad types of AT1 bond, all of which impose losses on investors when a bank's CET1 capital falls to a predetermined trigger level, though they do so in different ways:

- Equity convertible. Around 40% of the market

- Temporary write down/up: if capital falls below the trigger level the bonds' par level is reduced - for example from 100 down to 85 - until capital moves back above the trigger level. This is around 50% of the market. (Deutsche Bank's “cocos” are this type)

- Permanent write down: in the example above, the bonds' par value would be permanently reduced from 100 to 85. Around 5% of market

- Write-off. Around 5% of market

High-trigger bonds can suffer losses ahead of both lower-trigger AT1s and equity holders, This potentially undermines pari passu principles and cuts against normal capital structure hierarchy, in which equity holders take first loss....initially we had “low trigger” bonds (5.125% trigger) which were lower risk for investors, but we have moved towards “high trigger” structures becoming standard (~7% trigger). This part can add to the complexity of AT1 through the bank legal structures of Group and Holding Companies where in some cases AT1 bonds have dual triggers across the legal entities.

It's not just the par value of AT1 bonds that is variable. Coupon payments can be, too. To qualify as AT1, coco bonds must be issued as perpetual instruments with discretionary coupon payments - which means coupon payments can be cancelled at any time for any reason. AT1 bonds typically offer interest rates of 6-7%, which in today's low interest rate environment appear attractive compared to senior unsecured or subordinated bonds. But unlike traditional (Tier 2) subordinated debt, AT1 issuers can choose not to pay a coupon, and the investor has no recourse. This is why Deutsche Bank was at pains to reassure investors that it had sufficient payment margin to cover AT1 coupon payments for the next two years.

Perpetual they may be, but AT1 bonds are callable. Usually, therefore, the market prices them as if they will be called at the next call date. But there is uncertainty around this: when the market view of the probability of a call declines, as it is doing at the moment, duration and credit risk increases and the market price of the bonds falls. For market wonks, this is a more technical explanation:

This last threat is real. It's worth remembering that the only reason AT1 bonds exist at all is the demand of regulators for higher bank capital levels. They are, first and foremost, regulatory capital instruments. Regulators can, and do, dictate how banks should use them.Finally it’s worth touching on negative convexity which is prominent in AT1 markets right now. Negative convexity affects callable bonds and occurs when the market starts to price in the expectation that they will not be called at their next call date. If we take an AT1 with 5 year call and we think it’s no longer going to be called in 2021 and at best 2026, then we need to reprice the bond to take into account the added duration and risk. In most cases as interest rates fall the ability of the issuer to refinance the debt at a lower price and call the outstanding bond increases but.. you may ask.. we are seeing interest rates fall now, so why are AT1 showing signs of negative convexity? In this instance it’s the credit risk part of refinancing that is increasing at a faster pace and the worry that the current back end spread (the level that the coupon resets at post initial call date) will be lower than the refinancing cost of issuing a new bond - hence uneconomical to do so and may therefore be blocked by the regulator.

They are, however, attractive to investors looking for yield. They can also be profitable for traders, and as such highly liquid:

Consequently, the AT1 market is increasing in size. In July 2014, the European Securities Markets Association (ESMA) reported that total issuance was 60bn Euros and expected to grow fast. But as these bonds are generally rated well below investment grade, some of the largest institutional investors such as pension funds cannot invest in them, and those who can are liable to dump them at the drop of a hat:AT1s come in 750-1.5bn deal sizes, trade in minimum amounts of 200k and tend to come with call structures varying across 5, 7, 10 year parts of the curve. The bonds trade in cash price, unlike the bulk of credit markets which trade in spread, and tend to work on 50 cents bid offer. As such, AT1 are a lucrative product to trade across bid-offer and they quickly became a favourite among the Street trading desks willing to provide high levels of liquidity where 10 to 25 million bids or offers were the norm at peak times.

This tends to make the market price volatile. Stable capital, these are not. And this obviously poses something of a problem for banks using them to shore up their capital ratios.The bulk of AT1 market however is High Yield rated and as such attracts “tourist” money both from corporate Investment Grade funds and from High Yield funds. And this is one of the issues with the AT1 market... it’s an off benchmark asset class with a small dedicated buyer base. When times are good, AT1 is everyone’s best friend... when times are bad, index based investors drop their off benchmark overweights and return to benchmark weightings to avoid further underperformance.

But there is an even bigger problem. Because of their complexity, there is real concern that these instruments are easily mispriced. ESMA discussed the pricing problems back in July 2014:

Basically, don't dabble in these things unless you know what you're doing.To correctly value the instruments one needs to evaluate the probability of activating the trigger, the extent and probability of any losses upon trigger conversion (not only from write-downs but also from unfavourably timed conversion to equity) and (for AT1 CoCos) the likelihood of cancellation of coupons. These risks may be highly challenging to model. Though certain risk factors are transparent, e.g., trigger level, coupon frequency, leverage, credit spread of the issuer, and rating of instrument, if any, other factors are discretionary or difficult to estimate, e.g. individual regulatory requirements relating to the capital buffer, the issuers’ future capital position, issuers’ behaviour in relation to coupon payments on AT1 CoCos, and any risks of contagion. A comprehensive appreciation of the value of the instrument also needs to consider the underlying loss absorption mechanism and whether the CoCo is a perpetual note with discretionary coupons (AT1 CoCos) or has a stated maturity and fixed coupons (T2 CoCos). Importantly, as one descends down the capital structure to sub-investment grade where the majority of CoCos sit, the level of precision in estimating value when compared to more highly rated instruments, deteriorates. ESMA believes that this analysis can only take place within the skill and resource set of knowledgeble institutional investors.

And don't assume you will make any money from them, either. There doesn't as yet appear to be a satisfactory hedging strategy for them: credit default swaps don't cover AT1s, and hedging with equity is both expensive and of unclear effectiveness, especially for AT1s that don't convert to equity. With all the risks and uncertainties, 6-7% coupon doesn't look that great, really:

It is a matter of some concern that the European regulators - and the large European banks - seem to be placing so many of their eggs in the AT1 basket. It may simply be early days, and these instruments will become more stable as the market matures. But I suspect a large part of the problem is that no-one knows how they would behave in a crisis. And until this has been tested in reality, the AT1 Coco bonds will continue to be everyone's favourite football.In summary you’re looking at an average of 6-7% coupon at issuance for the lowest ranked debt in a bank’s capital structure with risks of failure to pay coupons, extended duration and principal being written down or wiped out completely.

Related reading:

Cocos & AT1s - what, who and where? Credit & Macro

Capital requirements - CRDIV/CRR - FAQs - European Commission

Potential risks associated with investing in contingent convertible instruments - ESMA