In a speech in London the other day, Peter Praet discussed the ECB's unconventional policy measures. I was there, and I have to say that he deviated considerably - and rather entertainingly - from the version of the speech on the ECB website. But his core message was still the same: "Rates are expected to remain at their present levels for an extended period of time, and well past the horizon of our net asset purchases. So, no interest rate hikes for a long time to come.But that's not what...

Read More »Prebisch and Central Banking

You can read here the Power Point of our presentation at History of Economics Society conference on Prebisch and Central Banking and his role as a Money Doctor in the 1940s after he left the Central Bank of Argentina.

Read More »Birth of a bank

I have been following with some amusement the death and resurrection of the Bitfinex exchange. Bitfinex was forced to suspend trading after losing nearly 120,000 BTC in a hacking on 2nd August. But instead of going into liquidation, as we might expect, it reinvented itself - as a bank.Bitfinex had been doing bank-like things ever since its creation in 2012. It accepted deposits from some of its customers, and lent out those deposits to other customers - with the depositors' permission,...

Read More »Kicking Away the Ladder, Too: Inside Central Banks

Last January the Association for Evolutionary Economics (AFEE) sessions at the Allied Social Sciences Association (ASSA) meetings revolved around the theme of "Inside Institutions," meaning that within institutions there are many actors with different sets of interests, so one must look under the hood, so to speak, of the institution itself to understand its actions. My paper followed my previous discussion of the historical evolution of central banks, and a brief discussion within the...

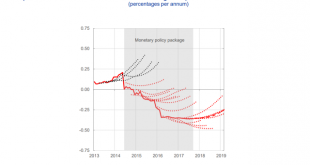

Read More »Negative rates and bank profitability

Banks are complaining. "Negative interest rates hurt our margins," they moan. Here's Commerzbank, for example, in its recent results announcement (my emphasis): Mittelstandsbank attained a solid result in a challenging market environment. The operating profit declined in the 2015 financial year to EUR 1,062 million (2014: EUR 1,224 million), yet remains at a high level. The fourth quarter accounted for EUR 212 million (Q4 2014: EUR 251 million). The full year revenues before loan loss...

Read More »The Slough of Despond

I'm bored.Bored with this crisis. Bored with endless calls for bank reforms. Bored with never-ending stories of inadequate bank resolution and legal battles which benefit no-one but lawyers. Bored with ineffectual monetary policy and fiscal gridlock. Bored with seeing the same things proposed over and over again, even things we know don't work and will never happen.Today, Mike Konczal wrote a piece on why restoring Glass-Steagall wouldn't solve anything. He's right, of course. But it is now...

Read More »The Fed’s IOER policy is not “paying banks not to lend”

Mainstream media get this wrong all the time. The latest to go down the "paying banks not to lend" rabbit hole is Binyamin Appelbaum in the New York Times. Because he didn't understand how IOER works, he didn't understand the Fed's strategy, and wrote a post that gets it quite seriously wrong. So I've written a Forbes post attempting to set things straight. Here's a taster: The FOMC has decided not to raise interest rates – for now. But it’s still widely expected that rate rises will come...

Read More »The real purpose of central banks

One of the things that has emerged from the PQE debate is a suggestion that it is time to consider ending the Bank of England's inflation-targeting mandate. Unfortunately this got mixed up with calls for ending the operational independence of the Bank of England (Richard Murphy), or abolishing central banks (Bill Mitchell, stated in response to a question at Reframing the Progressive Agenda).What we might call the "twin peaks" approach to macroeconomic policy-setting has been adopted the...

Read More »Correction or Crisis?

After almost seven years of relative calm and stability, a stock market crash is finally upon us. This is a very predictable crash stemming from a very widely known cause. Hundreds of analysts including myself — following the trail illuminated by Michael Pettis — have for a long time been banging on about a Chinese slowdown gathering an uncontrollable momentum, sending China into a panic, and infecting global markets. What’s less clear yet is whether this is a correction or a crisis. My...

Read More » Heterodox

Heterodox