It doesn't take a crystal ball to see where this is going. The conventional wisdom reinforced institutionally is that Venezuela is "bankrupt." Even though the bolivar is nominally pegged to the dollar, Venezuela is potentially a currency sovereign and has huge energy reserves. When the ruble was under attack, Russia floated the currency. Venezuela can make that choice, too. So the claim that Venezuela is "running out of money," or becoming "insolvent" is bogus.The obvious (neoliberal,...

Read More »TASS — Moody’s upgrades outlook on Russia’s sovereign rating to positive from stable

For what it's worth. Russia FeedMoody’s upgrades outlook on Russia’s sovereign rating to positive from stable TASS

Read More »Zero Hedge — China Downgrades US Credit Rating From A- To BBB+, Warns US Insolvency Would “Detonate Next Crisis”

In its latest reminder that China is a (for now) happy holder of some $1.2 trillion in US Treasurys, Chinese credit rating agency Dagong downgraded US sovereign ratings from A- to BBB+ overnight, citing "deficiencies in US political ecology" and tax cuts that "directly reduce the federal government's sources of debt repayment" weakening the base of the government's debt repayment. Oh, and just to make sure the message is heard loud and clear, the ratings, which are now level with those of...

Read More »The Latin American Crisis

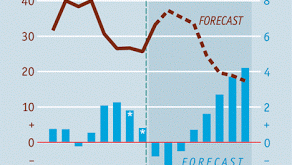

Downhill I have not written on the problems in the region for a while now (last stuff that is more comprehensive here in the talk at Keene, for example), in part, because the whole theme is a bit depressing (more recently the Honduras crisis, and the return of the right in Chile). As I have noted before, there is no doubt that the collapse of commodity prices has played a significant role in the downturn in the region, but it is also true that a lot of the problems are political in...

Read More »Zero Hedge — “Credit Negative For U.S. Government”: Moody’s Threatens Downgrade If Trump Tax Plan Is Passed

Moody's goes all proactive. As various institutions continue to publish very detailed estimates of how Trump's tax plan will impact the federal budget, which is somewhat amazing since income brackets haven't even been assigned yet, Moody's published a note today threatening to finally strip the U.S. of its AAA credit rating if the tax plan is ultimately passed as currently contemplated.... The deficit would be too big. Gotta cut some welfare.Zero Hedge"Credit Negative For U.S. Government":...

Read More »BBC News — UK’s credit rating downgraded by Moody’s

Moody's, one of the major ratings agencies, downgraded the UK to an Aa2 rating from Aa1. It said leaving the European Union was creating economic uncertainty at a time when the UK's debt reduction plans were already off course. Downing Street said the firm's Brexit assessments were "outdated". The other major agencies, Fitch and S&P, changed their ratings in 2016, with S&P cutting it two notches from AAA to AA, and Fitch lowering it from AA+ to AA. Moody's said the government...

Read More »Indian PM Modi — BRICS Should Topple Western Dominance in Credit-Rating Market

That would be the US credit rating agencies. Indian Prime Minister Narendra Modi has strongly called for expediting the process of establishing a transparent, non-western dominated, sovereign credit rating agency for developing economies, particularly those of the BRICS block.In his address at the plenary session of the BRICS summit, Indian Prime Minister Narendra Modi emphatically highlighted the need for countering western rating institutions by establishing a separate rating agency...

Read More »Moody’s upgrades Argentina credit rating status

Mainly because of their "expectation that Argentina will settle holdout creditor claims which will result in a lifting of court injunctions and clear the way for Argentina to access international capital markets." Fair enough, access to capital markets would lift the balance of payments constraint, even if the agreement is a complete surrender to the Vultures demands. But the most interesting argument for the improvement in the credit rating is that it results from "economic policy...

Read More »From BBB-razil to BB+razil or the meaning of investment grade

So Brazil (or here about Petrobras, the State oil company) lost its investment grade status with Standard & Poor's. You would think this is huge given the media attention in Brazil. If you read S&P's actual rationale for the downgrading (here) it is essentially about the fiscal situation. They say: "We now expect the general government deficit to rise to an average of 8% of GDP in 2015 and 2016 before declining to 5.9% in 2017, versus 6.1% in 2014. We do not expect a primary fiscal...

Read More » Heterodox

Heterodox