Michael Hudson — On Finance, Real Estate And The Powers Of NeoliberalismUp in Arms Michael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking University

Read More »The Delphic Oracle Was Their Davos: A Four-Part Interview With Michael Hudson: (Part 3)-John Siman interviews Michael Hudson

Michael Hudson — On Finance, Real Estate And The Powers Of NeoliberalismThe DNA of Western civilization is financially unstableMichael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking University

Read More »The Delphic Oracle Was Their Davos: A Four-Part Interview With Michael Hudson: Mixed Economies Today, Compared To Those Of Antiquity (Part 2) — John Siman interviews Michael Hudson

Mixed Economies and Monopoly Michael Hudson — On Finance, Real Estate And The Powers Of NeoliberalismThe Delphic Oracle Was Their Davos: A Four-Part Interview With Michael Hudson: Mixed Economies Today, Compared To Those Of Antiquity (Part 2)Michael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking...

Read More »The Delphic Oracle as their Davos

Your access to this site has been limited Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum global requests per minute for crawlers or humans. If you are a WordPress user with administrative privileges on this site please enter your email in the box below and click "Send". You will then receive an email that helps you regain access. Click here...

Read More »The Delphic Oracle Was Their Davos: A Four-Part Interview With Michael Hudson About His Forthcoming Book The Collapse of Antiquity (Part ¼) — John Siman interviews Michael Hudson

Naked CapitalismThe Delphic Oracle Was Their Davos: A Four-Part Interview With Michael Hudson About His Forthcoming Book The Collapse of Antiquity (Part ¼) John Siman interviews Michael Hudson

Read More »“What You Need To Know About The $22 Trillion National Debt”: The Alternative SHORT Interview

Steven Rattner’s opinion piece in the New York Times and Furman’s interview on National Public Radio are perfect examples of the ideas that MMT want to debunk. Deficits are not normal; deficits crowd out private investment; the public debt is a burden on our grandchildren; our ability to respond to societal problems is limited by the fact that the US government does not have enough money to confront them. Below is an alternative interview to the Furman’s interview that reviews these...

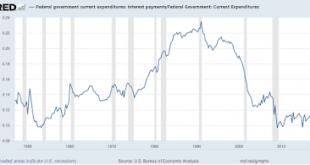

Read More »Financialization and the low burden of public debt

Financialization is a fuzzy concept. There are many definitions, and none is clear cut, at least to characterize the changes of the last 40 years or so, which is the period most authors associate with financialization. I'm not suggesting it's not a useful concept though.* In some sense, financialization refers to the last phase in the capitalist system (even if there are ways in which one might argue that capitalism was always financialized). At any rate, going to the point I wanted...

Read More »Mutual Aid vs Moral Hazard

Your access to this site has been limited Your access to this site has been limited Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum global requests per minute for crawlers or humans. If you are a WordPress user with administrative privileges on this site please enter your email in the box below and click "Send". You will then receive an email that helps you regain access. Click here...

Read More »Pence Vs. Xi at APEC — Trump decides to skip

Is accusing China of using debt as a weapon capitalist chutzpah on the part of Pence, when it's SOP under neoliberalism — "free markets, free trade, and free capital flows" — to put less powerful countries in debt to powerful countries to the degree that they need to go to the IMF for funding to meet debt obligations, the strings attached being giving up control of their institutional arrangements, fiscal policy and national sovereignty? I doubt Pence will fool anyone on this, but...

Read More »Brian Romanchuk — The Financial Instruments Associated With Crises

This article is a continuation of previous comments on financial crises, with two lines of discussion. The first is a bit of a primer, explaining why I and other commentators associate financial crises with a buildup of private debt. The second part discusses the main problem with associating crises with private debt buildups: growth in debt stocks is by itself not enough to trigger a crisis. The catch is a variant of the efficient markets hypothesis: if we could easily forecast crises, it...

Read More » Heterodox

Heterodox