It is clear that once dominance of the US Dollar and the system which sustains it is removed, consequences for the United States could be catastrophic. The question is NOT about IF US Dollar will survive as world's reserve currency--this is not even up for a debate--it is WHEN and HOW the departure will happen. Reminiscence of the FutureAbout US Dollar and Sanctions, Yet Again.Andrei Martyanov

Read More »Michael Hudson — Super-Imperialism at the Pentagon

Sputnik International interviews Michael Hudson. Audio and transcript.Michael Hudson — On Finance, Real Estate And The Powers Of NeoliberalismSuper-Imperialism at the PentagonMichael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking University

Read More »Michael Hudson — On Finance, Real Estate And The Powers Of Neoliberalism Trump’s Brilliant Strategy to Dismember U.S. Dollar Hegemony

The end of America’s unchallenged global economic dominance has arrived sooner than expected, thanks to the very same Neocons who gave the world the Iraq, Syria and the dirty wars in Latin America. Just as the Vietnam War drove the United States off gold by 1971, its sponsorship and funding of violent regime change wars against Venezuela and Syria – and threatening other countries with sanctions if they do not join this crusade – is now driving European and other nations to create their...

Read More »Paul Antonopoulos — Turkey to Ditch U.S Dollar in Trade, Urges Europe to Follow Suit

Turkish President Recep Tayyip Erdogan said on Saturday that his country is ready to trade with partner nations using national currencies. “We are preparing to carry out trade in national currencies with China, Russia, Iran, and Ukraine, which account for the bulk of bilateral trade. If European countries want to get rid of the pressure of the dollar, we are ready to create a similar system with them,” said the Turkish leader during a meeting in the Turkish city of Rize. Fort RussTurkey to...

Read More »Alex Christoforou — De-dollarization and the rise of Bitcoin. Is there a connection between the two?

Is Bitcoin a Reaction to US Dollar Hegemony? Like Mike has been saying for some time. The DuranDe-dollarization and the rise of Bitcoin. Is there a connection between the two? Alex ChristoforouSee alsoThe iron fist of the US. As the launch of new ‘petro’ cryptocurrency draws near, a US government agency declared that this newcomer to the digital financial market may represent a violation of sanctions imposed against Venezuela, its issuer. Sputnik InternationalUS Treasury Warns About...

Read More »Alastair Crooke — Behind Korea, Iran & Russia Tensions: The Lurking Financial War

While out of paradigm with MMT, the conventional thinking underlying the scenario that Crooke depicts reflects a widespread view that is shared by most political leaders who are responsible for shaping the world through their decisions. This thinking lies at the basis not only of global finance but also geopolitics and geostrategy. So, it is important to understand it because it is shaping emerging events of great consequence. Financial warfare can easily turn into military warfare, and...

Read More »Russia Feed — New Russian Yuan-backed bond poses threat to US dollar hegemony

The two BRICS powers Russia and China are moving towards dethroning the greenback as global reserve currency. The Global South is moving away from the US dollar to the Chinese yuan owing to US politicization of global finance. Russia FeedNew Russian Yuan-backed bond poses threat to US dollar hegemony

Read More »Martin Armstrong — Will China take over US as the top Superpower

Stories about the imminent replacement of the USD as the global reserve currency abound. In some circles it is the consensus reality. Martin Armstrong sets a questioner straight. China is on the rise and it will become the financial capital of the world after 2032. However, it has a long way to go. China can price every commodity in yuan and demand all trade deals are in yuan. That still will not displace the dollar. The center core issue behind the dollar ironically in the US National...

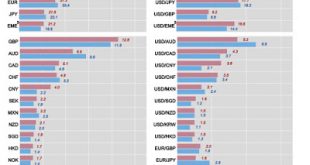

Read More »Foreign Exchange Trading and the Dollar

The new Bank for International Settlements (BIS) Triennial Central Bank Survey was published last month. The Foreign exchange turnover is down for the first time since they started in 1996. As the press release says: "Trading in FX markets averaged $5.1 trillion per day in April 2016. This is down from $5.4 trillion in April 2013." The figure below shows the main results. Not surprisingly the dollar remained the key vehicle currency, being on one side of around 88% of all trades, while...

Read More » Heterodox

Heterodox