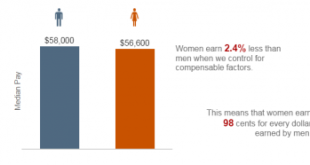

Why do women still earn less than men? Spending the morning going through Francine Blau’s and Lawrence Kahn’s JEL survey of modern research on the gender wage gap, yours truly was struck almost immediately how little that research really has accomplished in terms of explaining gender wage discrimination. With all the heavy regression and econometric alchemy used, wage discrimination is somehow more or less conjured away … Trying to reduce the risk of having...

Read More »Progressive capitalism? Is that even possible!?

Progressive capitalism? Is that even possible!? [embedded content]

Read More »The interest rate fallacy

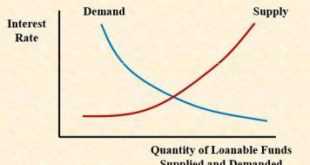

The interest rate fallacy While currency-issuing governments do not need to sell bonds, the fact that they do creates no competition for finite savings between public and private borrowers. First, government deficits stimulate growth and private savings as national income grows … Moreover, deficits place downward pressure on interest rates. Debt issuance serves to allow the central bank to maintain a positive target interest rate by providing investors...

Read More »Do government deficits necessarily cause inflation?

Do government deficits necessarily cause inflation? It may be objected that government expenditure financed by borrowing will cause inflation. To this it may be replied that the effective demand created by the government acts like any other increase in demand. If labour, plants, and foreign raw materials are in ample supply, the increase in demand is met by an increase in production. But if the point of full employment of resources is reached and effective...

Read More »On the use of logic and mathematics in economics

On the use of logic and mathematics in economics Logic, n. The art of thinking and reasoning in strict accordance with the limitations and incapacities of the human misunderstanding. The basic of logic is the syllogism, consisting of a major and a minor premise and a conclusion – thus: Major Premise: Sixty men can do a piece of work sixty times as quickly as one man. Minor Premise: One man can dig a post-hole in sixty seconds; Therefore- Conclusion: Sixty...

Read More »Banks are NOT intermediaries of loanable funds

Banks are NOT intermediaries of loanable funds The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credit, determined by supply and demand — as Bertil Ohlin put it — “in the same way as the price of eggs and strawberries on a village market.” In the traditional loanable funds theory — as presented in mainstream...

Read More »Krugman to Lietaer: “Never touch the money system”

Krugman to Lietaer: “Never touch the money system” [embedded content]Bernard Lietaer (1942-2019) was a former professor of international finance and president at the Central Bank of Belgium. One of our greatest monetary thinkers, and contrary to Krugman et consortes he dared to talk about — and question — our monetary system!

Read More »Austerity 101

[embedded content] We are not going to get out of the present economic doldrums as long as we continue to be obsessed with the insane idea that austerity is the universal medicine. When an economy is already hanging on the ropes, you can’t just cut government spendings.Cutting government expenditures reduces aggregate demand. Lower aggregate demand means lower tax revenues. Lower tax revenues mean increased deficits — and calls for even more austerity. And so on, and so on. To...

Read More »Keynes on Mitchell-Innes

Mr. Innes’s next point is that the idea, that “in modern days a money-saving device has been introduced called credit, and that, before this device was known, all purchases were paid for in cash, in other words in coins,” is simply a popular fallacy. The use of credit, he thinks, is far older than that of cash. The numerous instances, he adduces in support of this, from very remote times are certainly interesting … Mr. Innes’s development of this thesis is of unquestionable...

Read More »Paul Davidson and yours truly on Keynesian and Knightian uncertainty

Paul Davidson and yours truly on Keynesian and Knightian uncertainty A couple of years ago yours truly had an interesting discussion — on the Real-World Economics Review Blog — with Paul Davidson on ergodicity and the differences between Knight and Keynes re uncertainty. It all started with me commenting on Davidson’s article Is economics a science? Should economics be rigorous? : LPS: Davidson’s article is a nice piece – but ergodicity is a difficult...

Read More » Heterodox

Heterodox