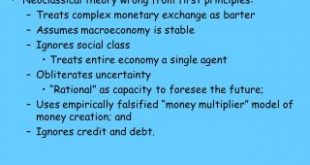

DSGE models — unparalleled and spectacular failures The unsellability of DSGE models — private-sector firms do not pay lots of money to use DSGE models — is one strong argument against DSGE. But it is not the most damning critique of it. To me the most damning critiques that can be levelled against DSGE models are the following two: DSGE models are unable to explain involuntary unemployment In the basic DSGE models the labour market is always cleared –...

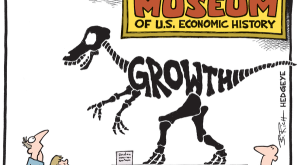

Read More »Krugman’s misapplication of neoclassical growth models

Krugman’s misapplication of neoclassical growth models The fallacies loanable funds theory commits might be explainable by the misapplication of some ideas and concepts of neoclassical growth models … to the sphere of money and finance … The Ramsey and Solow models are models of real investment only. Financial markets, financial assets and financial saving do not play any role in those models. There is only one good which, for simplicity, will be called...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. A big thanks to all the folks who’ve donated to IPA’s anti-poverty work before the year end (you can also donate through Dean Karlan’s Facebook fundraiser through tomorrow, credit to his brave daughter on that one.) Thirteen prominent economists offer their favorite econ papers of the year, but the paper making a splash this week is from Melissa Dell and Pablo Querubin, comparing two approaches to combatting insurgency during...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. A big thanks to all the folks who’ve donated to IPA’s anti-poverty work before the year end (you can also donate through Dean Karlan’s Facebook fundraiser through tomorrow, credit to his brave daughter on that one.) Thirteen prominent economists offer their favorite econ papers of the year, but the paper making a splash this week is from Melissa Dell and Pablo Querubin, comparing two approaches to combatting insurgency during...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. A big thanks to all the folks who’ve donated to IPA’s anti-poverty work before the year end (you can also donate through Dean Karlan’s Facebook fundraiser through tomorrow, credit to his brave daughter on that one.) Thirteen prominent economists offer their favorite econ papers of the year, but the paper making a splash this week is from Melissa Dell and Pablo Querubin, comparing two approaches to combatting insurgency...

Read More »Demystifying Trickle Down

[embedded content] Advertisements

Read More »The causes of secular stagnation and the loanable funds theory

The causes of secular stagnation and the loanable funds theory What are the causes of secular stagnation? What are the solutions to revive growth and get the U.S. economy out of the doldrums? … One headline conclusion stands out: the secular stagnation is caused by a heavy overdose of savings … All these savings end up as deposits, or ‘loanable funds’ (LF), in commercial banks … The glut in savings supply is so large that banks cannot get rid of all the...

Read More »Is it time to ditch the natural rate hypothesis?

Is it time to ditch the natural rate hypothesis? Fifty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy, and (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation. The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the ideas that...

Read More »Trumpian trickle down

Trump and the GOP delivering a huge gift to US corporations and shareholders. The only trickle down to workers going on is probably best described in analogy to the above picture … Advertisements

Read More »If only Trump had read Abba Lerner!

If only Trump had read Abba Lerner! The first financial responsibility of the government (since nobody else can undertake that responsibility) is to keep the total rate of spending in the country on goods and services neither greater nor less than that rate which at the current prices would buy all the goods that it is possible to produce. If total spending is allowed to go above this there will be inflation, and if it is allowed to go below this there will...

Read More » Heterodox

Heterodox