Is having infinitely many models really a sign of progress in economics? In Dani Rodrik’s Economics Rules it is argud that ‘the multiplicity of models is economics’ strength,’ and that a science that has a different model for everything is non-problematic, since economic models are cases that come with explicit user’s guides — teaching notes on how to apply them. That’s because they are transparent about their critical assumptions and behavioral...

Read More »Nicholas Georgescu-Roegen

[embedded content] C’est vraiment incroyable que l’économie orthodoxe ait toujours négligé The Entropy Law and the Economic Process, un ouvrage fondamental et aussi important dans l’histoire de la pensée économique que General Theory de Keynes. Advertisements

Read More »Cutting wages is no panacea

Cutting wages is no panacea Falling wages might provide a short-term boost to corporate profits, but the reduced purchasing power of working people would soon cause people to buy less. That is disastrous in advanced capitalist countries, where consumer spending generally accounts for anywhere from 60 to 70 percent of gross domestic product … Falling wages were a reality during the Great Depression, but that didn’t help matters. By 1933 in the United States,...

Read More »Learning to think like an economist

Learning to think like an economist It takes some courage, maturity, and perception for the self-discovery that one is engaged in a fraudulent enterprise … Our teachers never talked about ideologies or the larger issues, and seemed content with discussing arcane mathematics — DELIBERATE deception involves knowing the truth and then using lies to hide it.This does not seem to be the modus operandi. Rather, after the initial discomfort of swallowing certain...

Read More »Mainstream ‘pluralism’

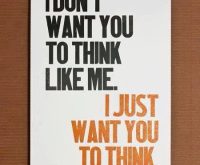

[h/t Unlearning Economics] The only economic analysis that mainstream economists accept is the one that takes place within the analytic-formalistic modeling strategy that makes up the core of mainstream economics. All models and theories that do not live up to the precepts of the mainstream methodological canon are pruned. You’re free to take your models — not using (mathematical) models at all is considered totally unthinkable — and apply them to whatever you want — as long...

Read More »Economics — an empty and inexact science

Economics — an empty and inexact science Of course economics involves cases where economists appear too reluctant to give up their favoured models. You can find similar stories in the hard sciences. There will be more such stories in economics because the inexact nature of economics makes it easier to discount any single piece of evidence. What I cannot understand is what leads someone … to argue against the use of evidence, and instead that “economics is...

Read More »Yes — there is something really wrong with macroeconomics

Yes — there is something really wrong with macroeconomics One way that macroeconomics stands out from other fields in economics is in how often it produces forecasts. The vast majority of empirical models in economics can be very successful at identifying causal relations or at fitting explaining behavior, but they are never used to provide unconditional forecasts, nor do people expect them to. Macroeconomists, instead, are asked to routinely produce...

Read More »Swedish economics establishment and pluralism in economics

Swedish economics establishment and pluralism in economics In the latest issue of Fronesis yours truly and a couple of other academics (e.g. Julie Nelson, Tony Lawson, and Phil Mirowski) made an effort at introducing its readers to heterodox economics and its critique of mainstream economics. Rather unsurprisingly this hasn’t pleased the Swedish economics establishment. On the mainstream economics blog Ekonomistas, professor Daniel Waldenström today rode...

Read More »Confusing statistics with research

Confusing statistics with research Coupled with downright incompetence in statistics, we often find the syndrome that I have come to call statisticism: the notion that computing is synonymous with doing research, the naïve faith that statistics is a complete or sufficient basis for scientific methodology, the superstition that statistical formulas exist for evaluating such things as the relative merits of different substantive theories or the “importance”...

Read More »‘Rigorous’ evidence — often worse than useless

‘Rigorous’ evidence — often worse than useless So far we have shown that for two prominent questions in the economics of education, experimental and non-experimental estimates appear to be in tension. Furthermore, experimental results across different contexts are often in tension with each other. The first tension presents policymakers with a trade-off between the internal validity of estimates from the “wrong” context, and the greater external validity of...

Read More » Heterodox

Heterodox