Why the realism of assumptions do matter Few economists think about methodology, but the methodological foundation of neoclassical economics is Milton Friedman’s (1953) version of ‘positivism.’ Positivism asserts two important theses. First, neither the extent to which the assumption set of a theory incorporates all the core elements of the phenomenon under investigation, nor the institutional or behavioral or empirical realism of the assumptions adopted...

Read More »Sticky wages is not the problem!

Sticky wages is not the problem! The stickiness of wages seems to be one of the key stylized facts of economics. For some reason, the idea that sticky wages may be the key to explaining business-cycle downturns in which output and employment — not just prices and nominal incomes — fall is now widely supposed to have been a, if not the, major theoretical contribution of Keynes in the General Theory. The association between sticky wages and Keynes is a rather...

Read More »Higher — not lower — wages could be the answer

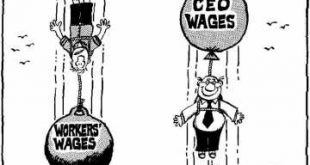

Higher — not lower — wages could be the answer The general view of most policymakers and analysts is that if firms, in aggregate, increase workers’ wages before there has been an increase in national productivity, the result will simply be a damaging burst of economy-wide inflation as too much money chases too few goods and services. This is the kind of description of the way the world works that one can find from economic authorities such as the Bank of...

Read More »Fixing the Euro’s Original Sins: The Monetary – Fiscal Architecture and Monetary Policy Conduct

The euro zone (EZ) was created in January 1999. Its weak economic performance is significantly due to the euro’s neoliberal monetary architecture and the design of monetary policy. Those features undermine national political sovereignty and consign the EZ to severe economic under-performance, which in turn fosters political demands for exit from the euro. Escaping this [...]

Read More »Wage cuts — the ultimate atomistic fallacy

Wage cuts — the ultimate atomistic fallacy The world has been slow to realize that we are living this year in the shadow of one of the greatest economic catastrophes of modern history. But now that the man in the street has become aware of what is happening, he, not knowing the why and wherefore, is as full to-day of what may prove excessive fears as, previously, when the trouble was first coming on, he was lacking in what would have been a reasonable...

Read More »Wren-Lewis and austerity dodging

Wren-Lewis and austerity dodging In the ongoing austerity debate, Brad DeLong told Simon Wren-Lewis the other day to stop dodging and instead squarely face the fact that most mainstream economists who were heard in the public sphere were not against austerity, but rather split, with, if anything, louder and larger voices on the pro-austerity side. But Wren-Lewis still thinks neither people outside economics, nor economists, know how representative of the...

Read More »Lowering wages is not the solution

Lowering wages is not the solution In connection with being awarded The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel a couple of years ago, Thomas Sargent, in an interview with Swedish Television, declared that workers ought to be prepared for having low unemployment compensations in order to get the right incentives to search for jobs. This old mercantilist idea has very little support in research, since it has turned out to be...

Read More »Verdoorn’s law

In the standard mainstream economic analysis a demand expansion may very well raise measured productivity in the short run. But in the long run, expansionary demand policy measures cannot lead to sustained higher productivity and output levels. In some non-standard heterodox analyses, however, labour productivity growth is often described as a function of output growth. The rate of technical progress varies directly with the rate of growth according to Verdoorn’s law. Growth...

Read More »The limits of formal models

The limits of formal models The practical limits of formal models become especially apparent when attempting to integrate diverse information sources. Neither statistics nor medical science begins to capture the uncertainty attendant in this process, and in fact both encourage pernicious overconfidence by failing to make adequate allowance for unmodeled uncertainty sources. Instead of emphasizing the uncertainties attending field research, statistics and...

Read More »Master class

[embedded content] Elzbieta Towarnicka — with a totally unbelievable and absolutely fabulous voice. This is as good as it gets in the world of music. Advertisements

Read More » Heterodox

Heterodox