Dani Rodrik a heterodox economist? You must be joking! I discussed long ago what it means to be heterodox in economics. Bob Kuttner, who I once saw giving a talk at the New School (in the 1990s), a very sharp journalist that knows quite a bit about economics, sings the praises of Dani Rodrik as an heterodox economist … Rodrik is, or was a few years ago at least, in what Colander, Holt and Rosser refer to as the cutting edge of the profession … which is to...

Read More »The ‘deductivist blindness’ of modern economics

The ‘deductivist blindness’ of modern economics Scientific progress … is frequently the result of observation that something does work, which runs far ahead of any understanding of why it works. Not within the economics profession. There, deductive reasoning based on logical inference from a specific set of a priori deductions is “exactly the right way to do things”. What is absurd is not the use of the deductive method but the claim to exclusivity made for...

Read More »Macroeconomic blindspots

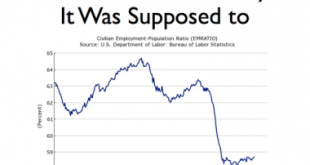

There was an unusual degree of consensus among economists about what would happen if Britain voted for Brexit in the referendum on June 23 last year. The language used by the International Monetary Fund was typical: It expressed fears of an “abrupt reaction,” adding that this “may have already begun” … What happened instead was that Britain enjoyed the best growth of any major advanced economy in 2016 … Andy Haldane compared the pitfalls of economic prediction to the single...

Read More »Why governments should run deficits

Why governments should run deficits Lynn Parramore: Do you think there are lessons in what has happened in the Eurozone for students of economics and the way the subject is taught? Mario Seccareccia: Yes, indeed. Ever since the establishment of the modern nation-state in the late eighteenth and nineteenth centuries, the creation of the euro was perhaps the first significant experiment in modern times in which there was an attempt to separate money from the...

Read More »The Swedish model is dying

The Swedish model is dying The 2017 OECD Economic Survey of Sweden — presented today in Stockholm by OECD Secretary-General Angel Gurría and Sweden’s Minister of Finance Magdalena Andersson — points out that income inequality in Sweden has been rising since the 1990s. I would say that what we see happen in Sweden is deeply disturbing. The rising inequality is outrageous – not the least since it has to a large extent to do with income and wealth...

Read More »Why not make macroeconomics a science?

Why not make macroeconomics a science? The trouble is, too many theorists — especially in the mainstream of the discipline — have drifted far from the real world. Their ambition has been to build mathematically elegant and internally consistent models of the economy, even if that requires wholly unrealistic assumptions. Granted, just as maps have to simplify complex terrain, theoretical models must ignore aspects of reality to be any use. But there’s a line...

Read More »Uncertainty and the pretty, polite techniques of economics

Uncertainty and the pretty, polite techniques of economics All these pretty, polite techniques, made for a well-panelled Board Room and a nicely regulated market, are liable to collapse. At all times the vague panic fears and equally vague and unreasoned hopes are not really lulled, and lie but a little way below the surface. Perhaps the reader feels that this general, philosophical disquisition on the behavior of mankind is somewhat remote from the...

Read More »Why economists don’t know what every baby knows about scientific methods

Why economists don’t know what every baby knows about scientific methods Limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we “export” them to our “target systems”, we have to be able to show that they do not only hold under ceteris paribus conditions and a...

Read More »RBC models — nonsense on stilts

RBC models — nonsense on stilts They try to explain business cycles solely as problems of information, such as asymmetries and imperfections in the information agents have. Those assumptions are just as arbitrary as the institutional rigidities and inertia they find objectionable in other theories of business fluctuations … I try to point out how incapable the new equilibrium business cycles models are of explaining the most obvious observed facts of...

Read More »Krugman and Stiglitz — nothing but neoliberal alibis

Krugman and Stiglitz — nothing but neoliberal alibis Mirowski’s concern to disabuse his readers of the notion that the wing of neoliberal doctrine disseminated by neoclassical economists could ever be reformed produces some of the best sections of the book. His portrait of an economics profession in haggard disarray in the aftermath of the crisis is both comic and tragic … Incoherence notwithstanding, however, little in the discipline has changed in the...

Read More » Heterodox

Heterodox