Price stickiness is NOT the problem ‘New Keynesian’ macroeconomists have for years been arguing (e.g. here) about the importance of the New Classical Counter Revolution in economics. ‘Helping’ to change the way macroeconomics is done today — with rational expectations, Euler equations, intertemporal optimization and microfoundations — their main critique of New Classical macroeconomics is that it didn’t incorporate price stickiness into the Real Business...

Read More »Homecoming (personal)

After almost forty years in Lund, yours truly has returned to the town where he was born and bred — Malmö. Living on the top floor of this grandiose building — next to The Magistrate’s Park, and with The Opera and The Municipal Art Gallery just across the street — makes it easy to convince me returning was a good decision …

Read More »My philosophy of economics

My philosophy of economics A critique yours truly sometimes encounters is that as long as I cannot come up with some own alternative to the failing mainstream theory, I shouldn’t expect people to pay attention. This is however to totally and utterly misunderstand the role of philosophy and methodology of economics! As John Locke wrote in An Essay Concerning Human Understanding: The Commonwealth of Learning is not at this time without Master-Builders, whose...

Read More »New Classical macroeconomics — elegant fantasies

New Classical macroeconomics — elegant fantasies The crucial issue of macroeconomic theory today is the same as it was sixty years ago when John Maynard Keynes revolted against what he called the “classical” orthodoxy of his day. It is a shame that there are still “schools” of economic doctrine, but perhaps controversies are inevitable when the issues involve policy, politics, and ideology and elude decisive controlled experiments. As a lifelong Keynesian,...

Read More »The Nobel factor — the prize in economics that spearheaded the neoliberal revolution

The Nobel factor — the prize in economics that spearheaded the neoliberal revolution The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, usually — incorrectly — referred to as the Nobel Prize in Economics, is an award for outstanding contributions to the field of economics. The Prize in Economics was established and endowed by Sweden’s central bank Sveriges Riksbank in 1968 on the occasion of the bank’s 300th anniversary. The first...

Read More »Good advice to aspiring economists

Good advice to aspiring economists Submission to observed or experimental data is the golden rule which dominates any scientific discipline. Any theory whatever, if it is not verified by empirical evidence, has no scientific value and should be rejected. Maurice Allais Formalistic deductive “Glasperlenspiel” can be very impressive and seductive. But in the realm of science it ought to be considered of little or no value to simply make claims about the...

Read More »DSGE macroeconomics — overconfident story-telling

DSGE macroeconomics — overconfident story-telling We economists trudge relentlessly toward Asymptopia, where data are unlimited and estimates are consistent, where the laws of large numbers apply perfectly and where the full intricacies of the economy are completely revealed … Worst of all, when we feel pumped up with our progress, a tectonic shift can occur, like the Panic of 2008, making it seem as though our long journey has left us disappointingly close...

Read More »Solow on post-real Chicago economics

Solow on post-real Chicago economics As yours truly wrote last week, there has been much discussion going on in the economics academia on Paul Romer’s recent critique of ‘modern’ macroeconomics. But the rhetorical swindle that New Classical and ‘New Keynesian’ macroeconomics have tried to impose upon us with their microfounded calibrations and DSGE models, has not gone unnoticed until Paul Romer came along: I think that Professors Lucas and Sargent really...

Read More »Rethinking macroeconomic theory

Several mainstream economists still believe that ‘any interesting model must be a dynamic stochastic general equilibrium model. From this perspective, there is no other game in town. If you have an interesting and coherent story to tell, you can tell it in a DSGE model. If you cannot, your story is incoherent’ (V.V. Chair). Similarly, not very long ago, Blanchard (2014, p. 31) was affirming that the solution to previous mistakes was that ‘DSGE models should be expanded to...

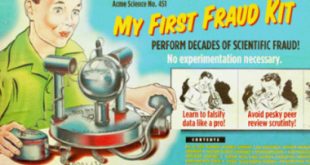

Read More »Post-real macroeconomics — science as fraud

Post-real macroeconomics — science as fraud There are many kinds of useless economics held in high regard within mainstream economics establishment today . Few — as Paul Romer recently has been arguing — are less deserved than the post-real macroeconomic theory – mostly connected with Nobel laureates Finn Kydland, Robert Lucas, Edward Prescott and Thomas Sargent – called calibration. In an interview by Seppo Honkapohja and Lee Evans (Macroeconomic...

Read More » Heterodox

Heterodox