History of Modern Monetary Theory [embedded content]

Read More »Chicago drivel — a sure way to get a ‘Nobel prize’ in economics

Chicago drivel — a sure way to get a ‘Nobel prize’ in economics In 2007 Thomas Sargent gave a graduation speech at University of California at Berkeley, giving the grads “a short list of valuable lessons that our beautiful subject teaches”: 1. Many things that are desirable are not feasible. 2. Individuals and communities face trade-offs. 3. Other people have more information about their abilities, their efforts, and their preferences than you do. 4. Everyone...

Read More »Why critique in economics is so important

Why critique in economics is so important Some of the economists who agree about the state of macro in private conversations will not say so in public. This is consistent with the explanation based on different prices. Yet some of them also discourage me from disagreeing openly, which calls for some other explanation. They may feel that they will pay a price too if they have to witness the unpleasant reaction that criticism of a revered leader provokes....

Read More »Economists’ infatuation with immense assumptions

Economists’ infatuation with immense assumptions Peter Dorman is one of those rare economists that it is always a pleasure to read. Here his critical eye is focussed on economists’ infatuation with homogeneity and averages: You may feel a gnawing discomfort with the way economists use statistical techniques. Ostensibly they focus on the difference between people, countries or whatever the units of observation happen to be, but they nevertheless seem to...

Read More »Lazy theorizing and useless macroeconomics

Lazy theorizing and useless macroeconomics In a new, extremely well-written, brave, and interesting article, Paul Romer goes to frontal attack on the theories that has put macroeconomics on a path of ‘intellectual regress’ for three decades now: Macroeconomists got comfortable with the idea that fluctuations in macroeconomic aggregates are caused by imaginary shocks, instead of actions that people take, after Kydland and Prescott (1982) launched the real...

Read More »Proper use of math

Proper use of math Balliol Croft, Cambridge 27. ii. 06 My dear Bowley, I have not been able to lay my hands on any notes as to Mathematico-economics that would be of any use to you: and I have very indistinct memories of what I used to think on the subject. I never read mathematics now: in fact I have forgotten even how to integrate a good many things. But I know I had a growing feeling in the later years of my work at the subject that a good mathematical...

Read More »Has economics — really — become more empirical?

Has economics — really — become more empirical? In Economics Rules (OUP 2015), Dani Rodrik maintains that ‘imaginative empirical methods’ — such as game theoretical applications, natural experiments, field experiments, lab experiments, RCTs — can help us to answer questions conerning the external validity of economic models. In Rodrik’s view they are more or less tests of ‘an underlying economic model’ and enable economists to make the right selection from...

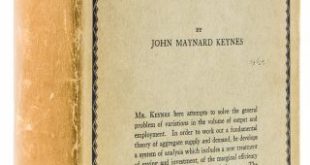

Read More »Dark age of macroeconomics

Dark age of macroeconomics In his 1936 “The General Theory of Employment, Interest and Money”, John Maynard Keynes already recognized that the idea that savings finance investments is wrong. Savings equal investment indeed, which is written as S=I. However, the way that this identity (roughly: definition in the form of an equation) holds is exactly the opposite … “Income is created by the value in excess of user cost which the producer obtains for the...

Read More »The Federal Reserve Must Rethink How it Tightens Monetary Policy

After more than 7 years of economic recovery, the Federal Reserve is positioning itself to tighten monetary policy by raising interest rates. In light of the wobbly reaction in financial markets, an important question that must be asked is whether raising interest rates is the right tool. It could well be that the world’s leading central [...]

Read More »But not as wrong as Paul Krugman …

But not as wrong as Paul Krugman … In his review of Mervyn King’s The End of Alchemy: Money, Banking, and the Future of the Global Economy Krugman writes: Is this argument right, analytically? I’d like to see King lay out a specific model for his claims, because I suspect that this is exactly the kind of situation in which words alone can create an illusion of logical coherence that dissipates when you try to do the math. Also, it’s unclear what this has to...

Read More » Heterodox

Heterodox