[embedded content]

Read More »Economics at the edge

Economics at the edge The Fourth Nordic Post-Keynesian Conference will take place in Aalborg, Denmark, April 20-21 2017. More on the conference available here.

Read More »Krugman’s gadget interpretation of economics

Krugman’s gadget interpretation of economics Paul Krugman has often been criticized by people like yours truly for getting things pretty wrong on the economics of John Maynard Keynes. When Krugman has responded to the critique, by himself rather gratuitously portrayed as about “What Keynes Really Meant,” the overall conclusion is — “Krugman Doesn’t Care.” Responding to a post up here on Krugman not being a real Keynesian, Krugman writes: Surely we don’t...

Read More »Technically, “constant returns to scale” describes a…

Technically, “constant returns to scale” describes a production process where you get exactly twice as much stuff out if you put twice as much stuff in. Economists often argue that at least constant returns to scale should be achievable since, worst case scenario, you could just build a second identical factory next to the first one. As such, I want economic instructors to start using this as their example of constant returns to scale.

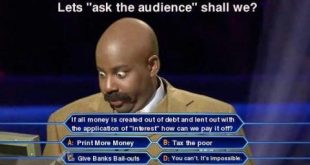

Read More »The reality of how money is created

The reality of how money is created Everything we know is not just wrong – it’s backwards. When banks make loans, they create money. This is because money is really just an IOU. The role of the central bank is to preside over a legal order that effectively grants banks the exclusive right to create IOUs of a certain kind, ones that the government will recognise as legal tender by its willingness to accept them in payment of taxes. There’s really no limit...

Read More »Personally, I won’t decide whether I am suspicious of the…

Personally, I won’t decide whether I am suspicious of the linear regression until someone tells me whether the slope is statistically significant. Also, if there are multiple explanatory variables that affect an outcome, a scatter plot that only looks at one of them at a time will generally looks like a mess even when all of the variables are individually important. In related news, this is a good opportunity to talk about the distinction between estimated effects (i.e. regression...

Read More »The real debt problem

The real debt problem One of the most effective ways of clearing up this most serious of all semantic confusions is to point out that private debt differs from national debt in being external. It is owed by one person to others. That is what makes it burdensome. Because it is interpersonal the proper analogy is not to national debt but to international debt…. But this does not hold for national debt which is owed by the nation to citizens of the same...

Read More »I laughed, not gonna lie.

[unable to retrieve full-text content]I laughed, not gonna lie.

Read More »Tired of the disposition effect yet? This one’s short, I…

Tired of the disposition effect yet? This one’s short, I promise- just shows how the incentives for tax-motivated selling of losing stocks change over the year and cloud the disposition effect test statistics. As usual, you can see the whole behavioral economics playlist here in case you want to catch up or need a review.

Read More »On The Increasingly Unfortunate Economics Of Peanut Allergies…

[unable to retrieve full-text content]On The Increasingly Unfortunate Economics Of Peanut Allergies…: Things get awkward when companies decide to maximize profit, if for no other reason than it highlights where policy makers have procrastinated on regulation in hopes that self-interested oganizations would just behave.

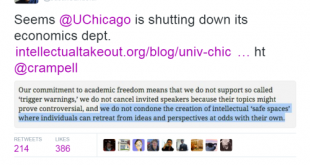

Read More » Heterodox

Heterodox