I joined The Investor’s Podcast for a special Masterclass in Inflation. In this episode we covered the following topics: 00:00:00 – Intro 00:00:45 – What is inflation, and what is it not 00:05:51 – How much of inflation is due to base effects 00:09:53 – How can expected inflation drive inflation 00:14:21 – If the current inflation is temporary 00:21:37 – How is inflation reflected in the real estate prices 00:28:27 – Why do we have regional differences in inflation 00:36:40 – If...

Read More »The Scarcity of Money Myth

I’m here to ruin some long running narratives. I apologize in advance. Money is not scarce. It never has been and it never will be. More importantly, scarcity of money is not a strength.¹ It is a weakness. Sound weird? Yeah, I bet. Let me explain. Back in college I was kind of obsessed with commodities and commodity money. I’d been reading a lot of Austrian econ and all that stuff. But then I came across the endogenous money theories and I learned over time that money is not a physical...

Read More »Understanding Government Liabilities

I keep running into a strange issue in macroeconomic discussions – no one seems to agree on how we should account for government liabilities. For instance, Gold standard economists believe government issued cash is not a liability (even though the Federal Reserve specifically shows it as a liability on their balance sheet). MMT economists say government “debt” is an IOU, but not borrowed debt. They also, at times, refer to government debt as equity.¹ Other people think the government’s...

Read More »Why Stocks and Bonds are the Core of any Portfolio

“Stocks are overvalued and risky. Bonds yield nothing and expose you to interest rate risk. So you need to invest in alternative assets.” – Pretty Much Everyone I am a big advocate of a core and satellite approach to asset allocation. For instance, in my book I talked about the Total Portfolio approach. That is, everyone should own a diverse group of assets and consider how their Total Portfolio relates to what we typically think of as our “investment portfolio”. This might include real...

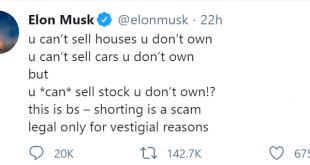

Read More »My View On: Short Selling

The recent craziness in Gamestop has resulted in a lot of hot takes on short selling. I have the hottest takes, of course, so let’s dive into this a bit deeper and put this debate to rest. Here’s a piping hot take from the richest man in the world: Wow. That kinda makes sense. But wait, does it really? No, Cullen, stop. Back up. Let’s explain how this works first. Just so we’re all on the same page. Short Selling Basics. This whole convo kinda reminds me of the buyback debates or the...

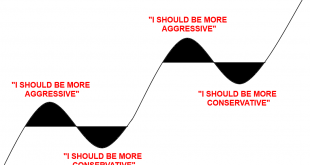

Read More »The Psychology of the Stock Market, in One Image

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful...

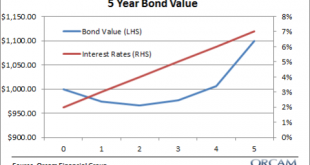

Read More »Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”

Share the post "Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”"If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as...

Read More »Understanding the Art of Doing Nothing

Share the post "Understanding the Art of Doing Nothing"Most of what we end up doing in our lives is determined not by what we decide to do, but by what we decide NOT to do. In the course of any given day we decide not to do millions of things. Eliminating all of these actions results in a direction that determines how we end up acting out our day. For instance, at lunch you might think you’re choosing to eat a baloney sandwich. But you didn’t really choose to eat the baloney sandwich. You...

Read More »Investing is not the Same as Gambling

Share the post "Investing is not the Same as Gambling" It’s the Monday following the second leg of the Triple Crown and a whole bunch of people lost money betting on the Preakness. Like the stock market, the allure of gambling is strong because many people think that having more money will solve most of their problems. And while there are some similarities between investing and gambling we should be clear that they are not nearly as similar as some people might believe. First, some...

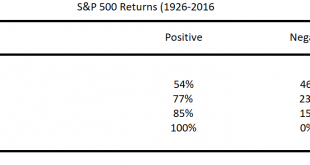

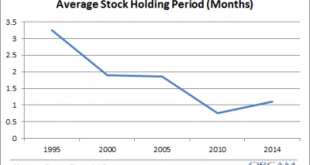

Read More »How to Avoid the Problem of Short-Termism

Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this...

Read More » Heterodox

Heterodox