Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this makes very little sense. This has become an increasingly problematic reality for the modern asset allocator as we are bombarded with investment options, the 24 hour financial news cycle and are regularly told that we’re stupid if we can’t “beat the market” (even though 80%+ of the pros consistently fail to beat the market also). The result has been a dramatic decline in the average holding period of stocks. In 1940 the average stock was held for 7 years, whereas today the average stock is held for 1 month! As I’ve noted before, I suspect all of this information and “news” is actually making us worse investors as it’s feeding on our behavioural biases.

Topics:

Cullen Roche considers the following as important: Essential Reading, How Things Work, Investing Basics, Investment Strategy, Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this makes very little sense.

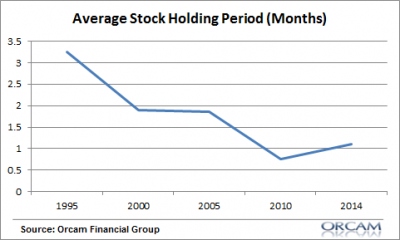

This has become an increasingly problematic reality for the modern asset allocator as we are bombarded with investment options, the 24 hour financial news cycle and are regularly told that we’re stupid if we can’t “beat the market” (even though 80%+ of the pros consistently fail to beat the market also). The result has been a dramatic decline in the average holding period of stocks. In 1940 the average stock was held for 7 years, whereas today the average stock is held for 1 month! As I’ve noted before, I suspect all of this information and “news” is actually making us worse investors as it’s feeding on our behavioural biases.

The arithmetic of global asset allocation clearly shows that more activity leads to higher taxes, higher fees and lower average returns, however, asset allocators are constantly falling victim to the myth that more activity leads to more control or better results. In fairness, this short-termism is understandable. No one likes to work for years earning their savings only to see it decline in value as the markets shift. So, how can we be better prepared to overcome the problem of short-termism? You just have to arm yourself with a bit of knowledge regarding the process of asset allocation.

As I noted in my new paper on portfolio construction, the allocation of savings is ultimately about asset and liability mismatch.¹ Cash lets us protect perfectly against permanent loss risk and maintain certainty over being able to meet our short-term liabilities, however, because it loses purchasing power it leaves us exposed to this risk in the long-term. Cash feels safe in the short-term, but in the long-term it is the riskiest asset because it is guaranteed to decline in value relative to inflation. We can extend the duration of our financial assets to better protect against the risk of purchasing power loss, however, this increases the odds of permanent loss risk (the risk of being forced to take a loss at an inopportune time) and not having the funds when you need them.

Thinking of your savings in terms of a specific duration can be extremely helpful for overcoming the problem of short-termism. For instance, we know that cash is essentially a zero duration asset that will lose purchasing power over the long-term. So, if you wanted to reduce your risk of purchasing power loss you could buy a bond aggregate fund which pays about 2% every year and has a duration of about 5.5 years. You might not beat the rate of inflation, but you’ll do better than cash. Of course, you need to be able to put the funds away for 5.5 years to ensure high odds that you’ll get your principal back at that time.

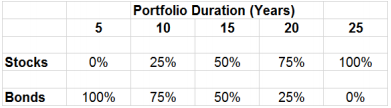

Of course, the stock market is what makes all of this tricky since the stock market doesn’t have a specific duration like a bond does. In the paper I used a rough heuristic technique calculating the break-even point on a range of stock market declines in an attempt to calculate the stock market’s sensitivity to price changes. I arrived at a duration of 25 years which I think is both quantitatively satisfactory and intuitively correct since the global stock market tends to have a very low probability of multi-decade bear markets.²

This puts things in a nice perspective for us because it allows us to allocate our assets in a way that properly contextualizes our asset and liability mismatch problem. For instance, we can now run a simple calculation using an aggregate bond index with duration of 5.5 years and the total stock market with duration of 25 years:

PD=(S*25) + (B*5.5)

Where PD = Portfolio Duration, S = % stock allocation & B = % bond allocation.

Here’s a basic cheat sheet for thinking about this across different time periods:

By quantifying the concept of time within our portfolios we’re able to become more comfortable with the way we allocate the assets. We’re able to increase the certainty in the way we balance that asset and liability mismatch. And importantly, what this exposes is a crucial reality – when we’re dealing with stocks and bonds we’re dealing with inherently medium-term and long-term instruments which means that this rat race of short-termism is completely inconsistent with the actual structure of these instruments. After all, you’d never judge the performance of a 2 year CD inside of a 1 month period, but that’s the equivalent of what someone is doing when they judge stock market performance based on a 1 year period.

By putting the concept of duration in the proper context you can improve the odds that you won’t fall victim to the problem of short-termism. And most importantly, by being armed with this knowledge going into the asset allocation process you’ll reduce the odds of falling victim to the many behavioural biases that plague modern asset allocators. As a result, you’ll reduce your fees, reduce your tax bill and increase your average performance. But most importantly, you’ll sleep better at night.

Sources:

¹ – Understanding Modern Portfolio Construction

² – This is clearly an imperfect, but sufficient approach for understanding duration in a diversified portfolio.

Did you have a comment or question about this post, finance, economics or your love life? Feel free to use the discussion forum here to continue the discussion.*

*We take no responsibility for bad relationship advice.