Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »UK – bottom of the international economic league table

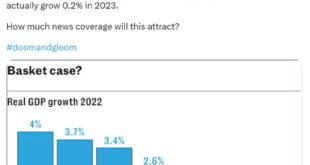

There are still a lot of arguments on Twitter as to whether the UK is doing ‘better’ or ‘worse’ in terms of GDP than, in particular, our EU neighbours, and the G7 in general. (Yes we know GDP is a wholly inadequate measure, but it’s still the common currency in our political debate, and we don’t want to leave the field to the false claims of others). Today, dear old Liam Halligan, now to be found wandering the arid deserts of GB News and the Daily Torygraph, has valiantly tried to lift...

Read More »UK – bottom of the international economic league table

Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »Is Modern Monetary Theory suited for the EMU?

In 2020, governments all over Europe and beyond enacted unprecedented fiscal stimulus to keep their economies afloat amidst the pandemic. By the end of the year, a country like France will have engaged or guaranteed at least EUR 300 billion, the equivalent of four years of income tax receipts. Institutions of the European Union (EU) also rightly stepped up to the challenge.Of particular importance has been the response of the European Central Bank (ECB) which launched several bond-purchasing...

Read More »Is Modern Monetary Theory suited for the EMU?

In 2020, governments all over Europe and beyond enacted unprecedented fiscal stimulus to keep their economies afloat amidst the pandemic. By the end of the year, a country like France will have engaged or guaranteed at least EUR 300 billion, the equivalent of four years of income tax receipts. Institutions of the European Union (EU) also rightly stepped up to the challenge. Of particular importance has been the response of the European Central Bank (ECB) which launched several...

Read More »Is Modern Monetary Theory suited for the EMU?

In 2020, governments all over Europe and beyond enacted unprecedented fiscal stimulus to keep their economies afloat amidst the pandemic. By the end of the year, a country like France will have engaged or guaranteed at least EUR 300 billion, the equivalent of four years of income tax receipts. Institutions of the European Union (EU) also rightly stepped up to the challenge.Of particular importance has been the response of the European Central Bank (ECB) which launched several bond-purchasing...

Read More »The GND and Europe’s next ten years: a plan for resolving the public debt crisis

The centrality of public debt to private capital marketsIn thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

Read More »The GND and Europe’s next ten years: a plan for resolving the public debt crisis

The centrality of public debt to private capital markets In thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

Read More »The GND and Europe’s next ten years: a plan for resolving the public debt crisis

The centrality of public debt to private capital marketsIn thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

Read More »How to strengthen European solidarity?

In 2020, the Covid-19 crisis generated a long-awaited paradigm shift in European economic governance. An unprecedented policy response was provided, together with an entirely new approach to fiscal capacity. The dogma of keeping the EU budget around 1 per cent of the Gross National Income (GNI) and keeping it in balance every year evaporated within a few months.As we look forward to building the Europe of of the next ten years, it is clear that it is not enough to create a new model budget,...

Read More » Heterodox

Heterodox