In 2020, the Covid-19 crisis generated a long-awaited paradigm shift in European economic governance. An unprecedented policy response was provided, together with an entirely new approach to fiscal capacity. The dogma of keeping the EU budget around 1 per cent of the Gross National Income (GNI) and keeping it in balance every year evaporated within a few months. As we look forward to building the Europe of of the next ten years, it is clear that it is not enough to create a new model...

Read More »How to strengthen European solidarity?

In 2020, the Covid-19 crisis generated a long-awaited paradigm shift in European economic governance. An unprecedented policy response was provided, together with an entirely new approach to fiscal capacity. The dogma of keeping the EU budget around 1 per cent of the Gross National Income (GNI) and keeping it in balance every year evaporated within a few months.As we look forward to building the Europe of of the next ten years, it is clear that it is not enough to create a new model budget,...

Read More »Radically Transforming the EU Economy – and how to finance it

The following article appeared on Progressive Post, the website of the Foundation of Progressive European Studies (FEPS) Today’s capitalism cannot tackle climate breakdown and cannot prevent the loss of biodiversity. It considers work as a cost to be minimised, to the detriment of the economy and the social meaning of work. High rates of return on capital (interest) require ever-rising extraction of the earth’s finite assets and the felling of its biodiverse ecosystem. Nature is crowded out...

Read More »“The economic mechanism of Europe is jammed”

“The economic mechanism of Europe is jammed.” - J M Keynes [1] The Dutch finance minister Wopka Hoekstra is somewhat brazen. Like his German counterpart, he caused consternation across the Union by rejecting a ‘Coronabond’ – a scheme for raising finance for EU countries tackling the coronavirus crisis; a scheme that would have lowered the cost of debt for many countries. A conservative German economist, who had earlier rejected the concept of shared liability, predicted...

Read More »Things that could be done, once the lesson is learned

This is the second of two posts on the current crisis by Professor Massimo Amato, of Bocconi University, Milan. The first, “Lessons to be learnt”, was posted on PRIME on 31st March A new institutional architecture must be thought of. First of all for Europe. Europe has always thought of itself as an experiment and as a process. Now the time has come to experiment with new paths, in view of a new structure after the crisis. In these days, people speak more and more...

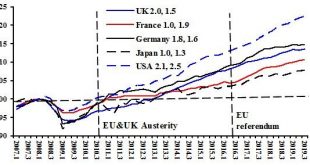

Read More »EU and UK economic prospects post-Brexit – the impact of investment

Analytical Considerations As Brexit is finalized we find considerable speculation about the likely consequences for the UK and EU economies after the end of January. Because this event has no clear precedent, much of the speculation derives from political predilections and opinion without an analytical anchor. Since private investment plays a major role in both growth and diversification of economies, beginning with the motivation to invest might provide that anchor. As...

Read More »The Great Brexit Wrench

The Progressive Economy Forum today launched its new report, “The Great Brexit Wrench”, on the economic and political implications of Brexit. The report is by PRIME’s co-director Jeremy Smith, and looks at the background to and implications of Brexit from many different angles. It argues that there is no form of Brexit which will have a positive...

Read More »The Minor Mystery of the Euro’s Trade Effect

The predilection for More Trade I do not consider an increase in inter-country trade a good thing in and of itself, though that view is common among economists and in the media. For most economists increased trade reflects a putative more efficient international allocation of resources derivative from competition on a global...

Read More »How to transform the EU – and build solidarity between its members

Image: Robert Triffin (1911-1993), influiential adviser on original European Payments Union. Via https://www.c2dh.uni.lu/ A new European Clearing Union would restore a common purpose to the European project and help defeat the rising ride of authoritarianism.This article is cross-posted from Open...

Read More »Economic Guidelines for a better European Union

Whether the UK finally leaves or remains a Member of the EU, progressives are generally united in viewing the existing Treaty and legislative rules on economic policy as dangerously dysfunctional. In their second joint paper on the theme, emeritus Professor John Weeks and PRIME co-director Jeremy Smith set out proposals for “Economic Guidelines...

Read More » Heterodox

Heterodox