This article first appeared on Substack.Last week the Biden team delivered their first press conference on the Democrat’s much-anticipated Climate Plan.The good news is that Climate Envoy, John Kerry and Advisor, Gina McCarthy are talking about the Climate Plan delivering “Good paying Union Jobs”.All hail to that ambition.The bad news is that this ain’t no Rooseveltian New Deal.Roosevelt confronted Wall St from the get go. His administration systematically drained the Street of power, and...

Read More »The case for an Ecological Interest Rate

Between the Anglo-American political horror shows of 2020 and the raging pandemic, something much less theatrical drifted centre stage to play a more than usually important role: interest rates. There is one obvious reason: like waiting to witness a rare celestial event there is a high likelihood that rates will do a shocking, unusual thing and go negative. But there is another important reason that hasn’t, to date, been part of mainstream economic commentary. With more focus than ever on a...

Read More »The case for an Ecological Interest Rate

Between the Anglo-American political horror shows of 2020 and the raging pandemic, something much less theatrical drifted centre stage to play a more than usually important role: interest rates. There is one obvious reason: like waiting to witness a rare celestial event there is a high likelihood that rates will do a shocking, unusual thing and go negative. But there is another important reason that hasn’t, to date, been part of mainstream economic commentary. With more focus than ever on a...

Read More »The case for an Ecological Interest Rate

Between the Anglo-American political horror shows of 2020 and the raging pandemic, something much less theatrical drifted centre stage to play a more than usually important role: interest rates. There is one obvious reason: like waiting to witness a rare celestial event there is a high likelihood that rates will do a shocking, unusual thing and go negative. But there is another important reason that hasn’t, to date, been part of mainstream economic commentary. With more focus than ever on a...

Read More »The Wealth of Corporations: Why Firms Have Zero Net Worth, and Why It Matters

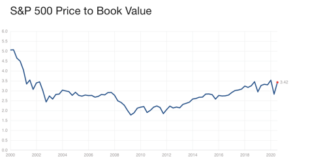

“Financial Assets = Liabilities.” It’s one of the great accounting-identity truisms of economic understanding — both among traditional, mainstream economists, and even (especially) among many heterodox, “accounting based” practitioners. It seems obvious: When a company issues and sells bonds, it posts a liability to its balance sheet; the bond buyers hold financial assets on theirs.[1] The problem is, that truism isn’t even close to true. The most obvious example is corporate...

Read More »Put Fairness at the Heart of Finance

This article appeared in the UK-based Church Times on 26 June, 2020 The coronavirus pandemic is a moment of reckoning for globalisation and our international financial system. The pandemic has shown how unjust the international system is towards low income countries; given us the opportunity to imagine another economy; and served as a warning. If we do not fix the system to prepare for the coming, graver crisis of earth systems breakdown, the survival of humanity is at risk. Just as it was...

Read More »Put Fairness at the Heart of Finance

This article appeared in the UK-based Church Times on 26 June, 2020 The coronavirus pandemic is a moment of reckoning for globalisation and our international financial system. The pandemic has shown how unjust the international system is towards low income countries; given us the opportunity to imagine another economy; and served as a warning. If we do not fix the system to prepare for the coming, graver crisis of earth systems breakdown, the survival of humanity...

Read More »Rebuild the ramshackle global financial system

The following appeared in Nature magazine on 17 June, 2020 Economic researchers neglect the role of financialization in global existential crises. Riddled with comorbidities, the current global monetary and financial set-up precipitates crises with increasing frequency. At first, these were on the fringes of the global economy; in 2007–09 they moved to its very core. Since 1971, national economies, and all our lives, have been shaped by this ‘system’, which can be described only as...

Read More »Rebuild the ramshackle global financial system

The following appeared in Nature magazine on 17 June, 2020 Economic researchers neglect the role of financialization in global existential crises. Riddled with comorbidities, the current global monetary and financial set-up precipitates crises with increasing frequency. At first, these were on the fringes of the global economy; in 2007–09 they moved to its very core. Since 1971, national economies, and all our lives, have been shaped by this ‘system’,...

Read More »Vultures are Circling our Fragile Economy. We Must Not Let Them Feast.

This article appeared on the Open Democracy site on 16 June 2020 On the weekend of 30 May Elon Musk – a billionaire with a net worth of $38billion – launched a rocket into space. This private venture was in contrast to President Kennedy’s ‘moonshot’ ambition of 1961-69 – one of the greatest mobilizations of public resources and manpower in U.S. history. Musk’s ostensible aim is to colonise Mars; but his ultimate purpose is to extract future rents from billionaires ferried...

Read More » Heterodox

Heterodox