Let’s hope we don’t go through the next recession debating in the same way whether fiscal policy can affect GDP, particularly during periods of economic slack and accommodative monetary policy (e.g., Fama, Mulligan, etc.).… If we do, I foresee social unrest.Menzie Chinn lays out an empirical case against neoclassical argument based on non-empirical assumptions like Ricardian equivalence, for example, that also turn out to be contradicted by data-based evidence.EconbrowserPrebuttal: Fiscal...

Read More »Proto-Keynesians in the Last Years of Weimar Republic Germany

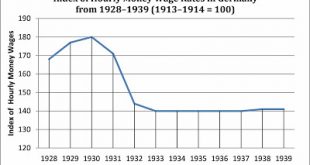

It is well known that the Great Depression hit Weimar Republic Germany particularly hard. There was severe unemployment, and the wage and price deflation was also severe, as can be seen in these graphs (with data from Mitchell 1992): Moreover, the wage and price deflation did not bring about a rapid or effective recovery. Austerity policies clearly failed in the Weimar Republic, and a number of German businessmen, bureaucrats, journalists, and unorthodox economists were driven to advocate...

Read More »Alan Longbon — Good News: U.S. Government Posts A $214 Billion Deficit For August 2018, The U.S. Private Sector Posts A $214 Billion Surplus

Summary The US budget deficit is $214 billion in August 2018; this is a net add of income to the private sector and a bumper month. The good news is that dollars are being added to the economy by the Federal government, allowing the private sector to post a $214 billion surplus. Further, net inflows are expected for the rest of the year from the Federal government and private credit growth. Private credit growth is a big surprise, growing strongly despite Fed rate rises. Seeking...

Read More »Prakash Loungani — Links

From a new paper by Antonio Fatas: “This paper studies the negative loop created by the interaction between pessimistic estimates of potential output and the effects of fiscal policy during the 2008-2014 period in Europe. The crisis of 2008 created an overly pessimistic view on potential output among policy makers that led to a large adjustment in fiscal policy during the years that followed. Contractionary fiscal policy, via hysteresis effects, caused a reduction in potential output that...

Read More »Democrats Should Reject Bernanke’s ‘Wily E. Coyote’ Criticism of Trump’s Deficits

By William K. Black June 11, 2018 Kansas City, MO Ben Bernanke recently gave a speech predicting that President Trump’s deficits will cause the economy to “go off a cliff in 2010.” Many Democratic Party politicians, of course, will rush to embrace the criticism and prove that they are the true party of fiscal responsibility. They can then get back to pushing for increased taxation and cuts to the safety net “to save it” from collapse – and feeling virtuous. These Democrats will...

Read More »Alan Auerbach and Yuriy Gorodnichenko — Fiscal stimulus in downturns is safe even when debt is high

Government spending in a recession can boost a country’s economy without permanently bloating its public debt, even if the debt is already quite large, researchers told an influential group of central bankers in Jackson, Wyoming, on Saturday. “Expansionary fiscal policies adopted when the economy is weak may not only stimulate output but also reduce debt-to-GDP ratios,” University of California, Berkeley, professors Alan Auerbach and Yuriy Gorodnichenko said in a paper presented at the...

Read More »Bill Mitchell — Japan is different, right? Wrong! Fiscal policy works

Japan is different, right? Japan has a different culture, right? Japan has sustained low unemployment, low inflation, low interest rates, high public deficits and high gross public debt for 25 years, but that is cultural, right? Even the mainstream media is starting to see through the Japan is different narrative as we will see. Yesterday (August 14, 2017), the Cabinet Office in Japan published the preliminary – Quarterly Estimates of GDP – which showed that the Japanese economy is growing...

Read More »Zero Hedge — Japan GDP Surges 4%, Most In Two Years, On Jump In Government Stimulus Spending

The unexpectedly strong GDP print was driven by a 9.9% jump in private non-residential investment as well as an striking 21.9% annualized surge in public investment as some of the public works spending included in last year’s economic stimulus package starting to emerge; meanwhile exports declined.... Zero HedgeJapan GDP Surges 4%, Most In Two Years, On Jump In Government Stimulus Spending Tyler Durden

Read More » Heterodox

Heterodox