Here is my latest podcast. Enjoy.

Read More »Where on earth is growth in Greece going to come from?

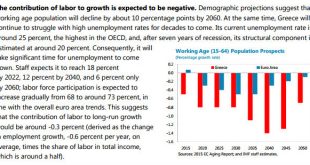

It's not going to come from people working more. Excerpt from the IMF's latest Debt Sustainability Analysis for Greece, just released: Oh dear. Quite apart from the negative contribution to growth, the prospect of unemployment taking 44 years to return to something approaching normality is simply appalling for Greece's population. I've looked in more detail at this here (Forbes).Well, if labour isn't going to drive growth, there's always investment, yes?Er, not really. The outlook for...

Read More »The untimely end of a flamboyant dictator

At Forbes, I have posted the latest episode in the long-running saga of the failure of Hypo Alpe Adria: The story of the failed Austrian bank Hypo Alpe Adria (HAA), and its transformation into the world’s worst “bad bank” – the insolvent HETA – resembles a Hollywood blockbuster. Complete with a cast of thousands, colorful principal characters, an extraordinary range of special (legal) effects and a reach far beyond its national borders, the HETA saga is long, staggeringly expensive,...

Read More »Posts on Russia

I wrote a number of posts on Forbes about Russia at the back end of 2014. At the time, there was a lot going on with the currency, the central bank and the banks. So for ease of reference, I've collected them here, in chronological order.Why the Russian Central Bank can't defend the rubleHas the Russian Central Bank thrown in the towel?The Russian Central Bank is regaining control, but for how long?Oil, sanctions and Russian politicsHow to destroy a currency, Russian styleRussia and the...

Read More »Investment is needed everywhere

And particularly in Europe, as this chart shows: The ratings agency Standard & Poors has called for governments everywhere to increase investment spending. It also says they need to improve the efficiency of the spending they are already doing. Private sector investment spending all over the world fell after the 2008 financial crisis. In Europe, where the crisis started earlier, it started falling in 2007. And it has not recovered. Private sector investors remain risk-averse and...

Read More »“Quantitative Tightening” is a myth

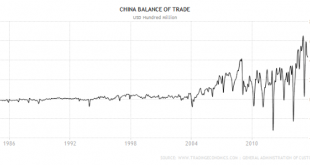

(But that doesn't mean we don't have a problem).Deutsche Bank has frightened everyone by warning that if China sold substantial quantities of US Treasuries (USTs) to support the yuan, this would amount to a substantial tightening of US monetary policy.The reason why China accumulated USTs in the first place was because of its trade surplus: The excess of exports over import sucked dollars into China, where the People’s Bank of China (PBoC) exchanged them for domestic currency (yuan). The...

Read More » Heterodox

Heterodox