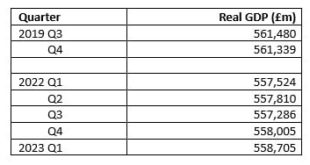

Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in...

Read More »The UK economy – stalled and unhealthy

Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean. [The Rime of the Ancient Mariner, Samuel Taylor Coleridge] The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than...

Read More »The UK economy – stalled and unhealthy

Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in...

Read More »UK – bottom of the international economic league table

Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »UK – bottom of the international economic league table

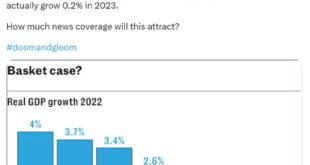

There are still a lot of arguments on Twitter as to whether the UK is doing ‘better’ or ‘worse’ in terms of GDP than, in particular, our EU neighbours, and the G7 in general. (Yes we know GDP is a wholly inadequate measure, but it’s still the common currency in our political debate, and we don’t want to leave the field to the false claims of others). Today, dear old Liam Halligan, now to be found wandering the arid deserts of GB News and the Daily Torygraph, has valiantly tried to lift...

Read More »UK – bottom of the international economic league table

Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »The UK’s public spending led recovery – before the cost-of-living deluge strikes

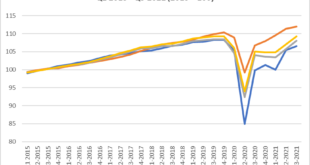

In this article I look mainly at the UK’s GDP position. While the ONS first estimate for Q1 2022 shows that it is now 0.6% higher than the pre-pandemic peak in Q3 of 2019, this is entirely down to increased government consumption and investment, mainly health-related. But for this real-terms increase, the economy (measured in GDP) would be some 2% smaller now, even before the cost-of-living crisis hits us fully, and before government and Bank of England tighten fiscal and monetary policy...

Read More »The UK’s public spending led recovery – before the cost-of-living deluge strikes

In this article I look mainly at the UK’s GDP position. While the ONS first estimate for Q1 2022 shows that it is now 0.6% higher than the pre-pandemic peak in Q3 of 2019, this is entirely down to increased government consumption and investment, mainly health-related. But for this real-terms increase, the economy (measured in GDP) would be some 2% smaller now, even before the cost-of-living crisis hits us fully, and before government and Bank of England tighten fiscal and monetary policy...

Read More »The UK’s public spending led recovery – before the cost-of-living deluge strikes

In this article I look mainly at the UK’s GDP position. While the ONS first estimate for Q1 2022 shows that it is now 0.6% higher than the pre-pandemic peak in Q3 of 2019, this is entirely down to increased government consumption and investment, mainly health-related. But for this real-terms increase, the economy (measured in GDP) would be some 2% smaller now, even before the cost-of-living crisis hits us fully, and before government and Bank of England tighten fiscal and monetary policy...

Read More »(How far) has Brexit affected UK GDP?

It looks as if the UK’s GDP will have risen by a little over 7% in 2021, after a fall now estimated at 9.4% in 2020. (We await the Q4 data). It seems that – despite stronger November data – GDP in 2021 will come in below that of 2019, and maybe a tad less than 2018. Clearly COVID has played a major part, but is there also evidence of Brexit-induced slowdown in the mix? The “Conservative Home” website (among so many other right-wing propaganda outlets) tries hard to keep spirits up and the...

Read More » Heterodox

Heterodox