Apologies, but the page you requested could not be found. Perhaps searching will help. Search for:

Read More »Rethinking government debt

There is a huge amount of hysteria about government debt and deficits, not just in the UK but throughout much of the world. As I write, Brazil has been downgraded by Standard & Poors because of concerns about rising government debt and weakening commitment to primary fiscal surpluses in a context of political uncertainty and deepening recession. It is the latest in a long line of downgrades and investor flight over the last few years. The global economy is a very stormy place.The UK,...

Read More »“Quantitative Tightening” is a myth

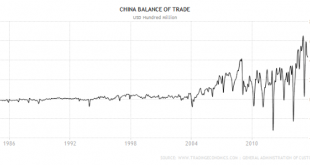

(But that doesn't mean we don't have a problem).Deutsche Bank has frightened everyone by warning that if China sold substantial quantities of US Treasuries (USTs) to support the yuan, this would amount to a substantial tightening of US monetary policy.The reason why China accumulated USTs in the first place was because of its trade surplus: The excess of exports over import sucked dollars into China, where the People’s Bank of China (PBoC) exchanged them for domestic currency (yuan). The...

Read More »This is the Framework of a Potential Greek Compromise Taking Shape

In-depth analysis on Credit Writedowns Pro. By Marc Chandler Through the venomous comments and erosion of trust, the broad framework of what couple prove to be a workable compromise over Greece’s financial crisis may be emerging. This is not to suggest that the eurozone finance ministers meeting will reach any important decision. Indeed, the Greek Prime Minister has already reduced his finance minister’s role in the negotiations, and it appears Merkel has done something vaguely...

Read More » Heterodox

Heterodox