"Britain nearly went bust in March, says Bank of England", reads a headline in the Guardian. In similar vein, the Telegraph's Business section reports "UK finances were close to collapse, says Governor":Eh, what? The Governor of the Bank of England says the UK nearly turned into Venezuela? Well, that's what the Telegraph seems to think: The Bank of England was forced to save the Government from potential financial collapse as markets seized up at the height of the coronavirus crisis,...

Read More »Britain was not “nearly bust” in March

"Britain nearly went bust in March, says Bank of England", reads a headline in the Guardian. In similar vein, the Telegraph's Business section reports "UK finances were close to collapse, says Governor":Eh, what? The Governor of the Bank of England says the UK nearly turned into Venezuela? Well, that's what the Telegraph seems to think: The Bank of England was forced to save the Government from potential financial collapse as markets seized up at the height of the coronavirus crisis,...

Read More »Shut down the ratings agencies

Remember Friday Night Is Downgrade Night, from the Eurozone crisis? It's back. Last night, Fitch Ratings downgraded the UK to AA-, negative outlook. Here's their rationale: The downgrade reflects a significant weakening of the UK's public finances caused by the impact of the COVID-19 outbreak and a fiscal loosening stance that was instigated before the scale of the crisis became apparent. The downgrade also reflects the deep near-term damage to the UK economy caused by the coronavirus...

Read More »Shut down the ratings agencies

Remember Friday Night Is Downgrade Night, from the Eurozone crisis? It's back. Last night, Fitch Ratings downgraded the UK to AA-, negative outlook. Here's their rationale: The downgrade reflects a significant weakening of the UK's public finances caused by the impact of the COVID-19 outbreak and a fiscal loosening stance that was instigated before the scale of the crisis became apparent. The downgrade also reflects the deep near-term damage to the UK economy caused by the coronavirus...

Read More »The NI Fund’s reserves don’t pay down the National Debt

The NI Fund discussed in this post covers England, Wales and Scotland only. Northern Ireland has a separate NI Fund, which is excluded from the figures given in this post. However, it works in exactly the same way as the Fund discussed here. Sometimes the government is its own worst enemy. HM Treasury's hamfisted response to this Freedom of Information request from Trudy Baddams of the pension rights campaign group "We Paid In, You Paid Out", has caused a very silly storm.Ms Baddams...

Read More »The NI Fund’s reserves don’t pay down the National Debt

The NI Fund discussed in this post covers England, Wales and Scotland only. Northern Ireland has a separate NI Fund, which is excluded from the figures given in this post. However, it works in exactly the same way as the Fund discussed here. Sometimes the government is its own worst enemy. HM Treasury's hamfisted response to this Freedom of Information request from Trudy Baddams of the pension rights campaign group "We Paid In, You Paid Out", has caused a very silly storm.Ms Baddams...

Read More »Raising interest rates is not that simple, Lord Hague

The present period of very low interest rates is widely assumed to be temporary, a consequence of the 2008 financial crisis and subsequent central bank action. Because of this, as the financial crisis fades into the mists of time, there is growing political pressure for "normalisation" of interest rates. Here, for example, is William Hague warning that central banks must start to raise rates or face losing their independence: The only way out is for the US Fed to summon the courage to lead...

Read More »Schroedinger’s assets

In a new paper*, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure.Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of...

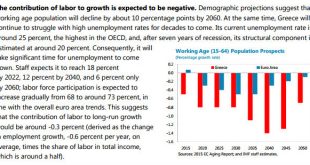

Read More »Where on earth is growth in Greece going to come from?

It's not going to come from people working more. Excerpt from the IMF's latest Debt Sustainability Analysis for Greece, just released: Oh dear. Quite apart from the negative contribution to growth, the prospect of unemployment taking 44 years to return to something approaching normality is simply appalling for Greece's population. I've looked in more detail at this here (Forbes).Well, if labour isn't going to drive growth, there's always investment, yes?Er, not really. The outlook for...

Read More »Keynes and the Quantity Theory of Money

"Best diss of the Quantity Theory of Money comes from Keynes", commented Toby Nangle on Twitter, referring to this paragraph from Keynes's Open Letter to Roosevelt (Toby's emphasis): The other set of fallacies, of which I fear the influence, arises out of a crude economic doctrine commonly known as the Quantity Theory of Money. Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output...

Read More » Heterodox

Heterodox