I joined The Investor’s Podcast for a special Masterclass in Inflation. In this episode we covered the following topics: 00:00:00 – Intro 00:00:45 – What is inflation, and what is it not 00:05:51 – How much of inflation is due to base effects 00:09:53 – How can expected inflation drive inflation 00:14:21 – If the current inflation is temporary 00:21:37 – How is inflation reflected in the real estate prices 00:28:27 – Why do we have regional differences in inflation 00:36:40 – If...

Read More »How Does the Fed “Manipulate” Interest Rates?

Warning – hard money types are going to lose their minds over this article. I apologize in advance. It’s impossible to talk about interest rates without running into people who think the Fed has “manipulated” interest rates lower than they otherwise would be. As if the bond market has become nothing more than one huge completely manipulated Federal Reserve market. This is a really intuitively appealing argument and it’s not even completely wrong, but I want to add some important...

Read More »What is “Fractional Reserve Banking”?

The term “fractional reserve banking” is commonly used in a confusing manner in both mainstream economics and within lay conversations about economics. I hope this article with clear up some of the common confusions. Fractional reserve banking is the idea that banks take their reserves and lend them into some fraction based on the quantity of reserves they hold. This idea has been largely debunked since the financial crisis. In reality, banks do not lend their reserves, except to one...

Read More »Everything Wrong with the “Money Printer Go Brrrr” Meme

You’ve probably seen some version of the following meme in the last few years. In case you haven’t it’s generally used to infer that Jerome Powell is printing money and hyperinflation is coming. I love a good meme and few things make me happier than hilarious nonsense on the internet. So I feel bad debunking this meme because it’s kind of funny and memes are mostly harmless, but this is one of those memes used by people who want you to believe something that isn’t right. Anyhow let’s get...

Read More »The Scarcity of Money Myth

I’m here to ruin some long running narratives. I apologize in advance. Money is not scarce. It never has been and it never will be. More importantly, scarcity of money is not a strength.¹ It is a weakness. Sound weird? Yeah, I bet. Let me explain. Back in college I was kind of obsessed with commodities and commodity money. I’d been reading a lot of Austrian econ and all that stuff. But then I came across the endogenous money theories and I learned over time that money is not a physical...

Read More »Understanding Government Liabilities

I keep running into a strange issue in macroeconomic discussions – no one seems to agree on how we should account for government liabilities. For instance, Gold standard economists believe government issued cash is not a liability (even though the Federal Reserve specifically shows it as a liability on their balance sheet). MMT economists say government “debt” is an IOU, but not borrowed debt. They also, at times, refer to government debt as equity.¹ Other people think the government’s...

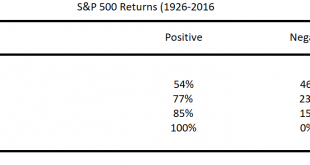

Read More »Why Stocks and Bonds are the Core of any Portfolio

“Stocks are overvalued and risky. Bonds yield nothing and expose you to interest rate risk. So you need to invest in alternative assets.” – Pretty Much Everyone I am a big advocate of a core and satellite approach to asset allocation. For instance, in my book I talked about the Total Portfolio approach. That is, everyone should own a diverse group of assets and consider how their Total Portfolio relates to what we typically think of as our “investment portfolio”. This might include real...

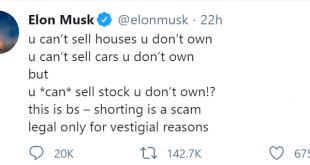

Read More »My View On: Short Selling

The recent craziness in Gamestop has resulted in a lot of hot takes on short selling. I have the hottest takes, of course, so let’s dive into this a bit deeper and put this debate to rest. Here’s a piping hot take from the richest man in the world: Wow. That kinda makes sense. But wait, does it really? No, Cullen, stop. Back up. Let’s explain how this works first. Just so we’re all on the same page. Short Selling Basics. This whole convo kinda reminds me of the buyback debates or the...

Read More »Government Bond Markets Aren’t “Free” Markets

This is one of those posts that is operational in nature, but will sound political to some people. Before you send me a mean email please try not to politicize the issue.¹ I hope this is helpful. Here’s a question I got from Twitter: “Cullen, why not let government bond markets be free and not manipulated?” I see this one a lot and it’s based on a misunderstanding of “free markets” and how they relate to the government. So let’s dive in. First, currencies are essentially imposed on us. So...

Read More »Why is Shorting Stocks so Difficult?

Did you hear about Tesla? Yeah, it’s up a lot. A lot. A lot. Like, hundreds of percent a lot. Or, 400% from its recent lows. Now, that might not matter much except that that rally now makes Tesla an extraordinarily large business by market cap. At 160B market cap they’re now the 44th largest firm in the world. That’s roughly the same size as McDonalds and larger than Nike. It’s FOUR times the size of Ford and GM. TWO times as large as Ford and GM COMBINED. Whoa. Much of this growth seems...

Read More » Heterodox

Heterodox