If you have read my 2012 essay on “The Myth of Passive Investing” then you probably don’t need or want to read what’s below. If there’s a consistent theme on this website it’s that I am trying to establish a consistent taxonomy and set of understandings of financial concepts so that people can better navigate the monetary world we live in. Sadly, finance and economics is filled with words that are used in such a general manner that they have virtually no meaning. For instance, the word...

Read More »The Difference Between Asset Price Inflation & Consumer Price Inflation

One of the more common responses to the fact that inflation is low is the idea that the inflation is all in asset prices. So, for instance, if someone were to say that all the Fed’s post-crisis stimulus didn’t result in inflation you might look at stock prices and argue that the price increases all flowed into stocks. That’s not necessarily wrong, but I think it needs to be well understood because asset price inflation is generally good for the economy while consumer price inflation could...

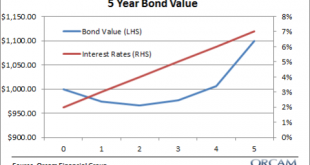

Read More »Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”

Share the post "Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”"If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as...

Read More »The Alpha Paradox

Share the post "The Alpha Paradox"Here are a few things we know about the financial markets:Beating the market or obtaining “alpha” (excess return) is extremely difficult as evidenced by the annual SPIVA Scorecards.Alpha doesn’t exist in the aggregate because we all hold what sums to one portfolio wherein we earn the after tax and after fee return of the global financial asset portfolio (GFAP).In order to be properly diversified to reduce single entity risk we must hold a portfolio that...

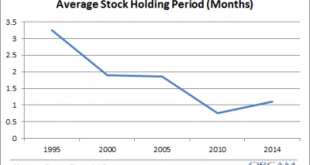

Read More »How to Avoid the Problem of Short-Termism

Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this...

Read More »Why Equity Outperforms Credit

Share the post "Why Equity Outperforms Credit" In my new paper on asset allocation I go into quite a bit of detail about why certain asset classes generate the returns they do. Understanding this is useful when thinking in a macro sense and trying to gauge why financial assets perform in certain ways in both the short-term and the long-term. It’s important to understand the fundamental drivers of these returns in order to avoid falling into the trap that these assets generate returns due...

Read More »Understanding Modern Portfolio Construction [New Research]

Share the post "Understanding Modern Portfolio Construction [New Research]" My newest research paper, Understanding Modern Portfolio Construction, is available on SSRN. This paper is the culmination of years of work and I consider it to be the most important piece of research I’ve published. I wrote this paper in much the same way that I wrote my paper, Understanding the Modern Monetary System, however, since I’m not an academic economist, this paper is more along the lines of my...

Read More »Why Stock Market Declines are Good

Share the post "Why Stock Market Declines are Good" James Bullard, the St Louis Fed President, gave an interview today discussing how the stock correction has been good because it has helped to prevent a bubble. He’s inferring that lower prices are bad in the short-term and good in the long-term. And he’s totally right. I’ll show you why. What happens when the stock market booms is that future returns get pulled into the present. Stock bubbles are dangerous because they pull so much of...

Read More »Why Would Anyone Buy a Negative Interest Bearing Bond?

Share the post "Why Would Anyone Buy a Negative Interest Bearing Bond?" Good question here from the Q&A section about negative yielding bonds: Hi Cullen. The Economist had a good article explaining why people buy negative yielding bonds. http://www.economist.com/blogs/economist-explains/2016/02/economist-explains-6 Do you agree with their explanation? The Economist’s explanation is a bit odd as it leaves out the main reason that someone might want to buy a negative yielding bond –...

Read More »Central Banks Didn’t Eat Your Lunch

Share the post "Central Banks Didn’t Eat Your Lunch" One of the consistent trends you’ll find in my econ and finance work is that I don’t think much about Central Banks. In other words, I think mainstream macro puts far too much emphasis on the efficacy of things that Central Bankers do. This is why I said QE wouldn’t do much back in 2009 and it’s also why I’ve consistently argued that the Federal Reserve wasn’t the primary cause of the stock bull market of recent years. Of course, none...

Read More » Heterodox

Heterodox