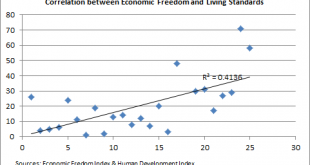

I am going to spend some time trying to put the debate about Capitalism and Socialism into perspective here. But before we can do that I need to properly define the terms because they’re used in a rather lazy manner in the mainstream media. So, let’s establish some understandings: Capitalism – a system in which the means of production are privately owned and the economic benefits of that production are distributed by the owners and regulated by the government. Socialism – a system in which...

Read More »Let’s Talk About Sectoral Balances

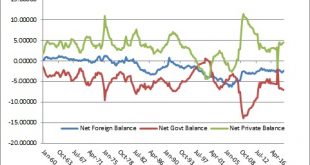

I am a big fan of looking at things through the lens of the sectoral balances. For instance, I sometimes post this chart on this website which depicts the government’s balance vs the non-government. (This is a stupid chart without a lot more context) It’s a decent (though incomplete) depiction of the private sector’s balance versus the government’s position and it’s helpful to understand because, mainly, if you believe the private sector is too heavily indebted, then the government’s...

Read More »EVERYONE Funds Their Spending

One of the most confused (and confusing) elements of endogenous money is the idea of “funding”. Endogenous money is not a new theory, but it is not well understood even to this day. Even many supposed endogenous money theorists, like the MMT people, misunderstand it and as MMT has gained some popularity I am seeing increasing misinterpretations. So let’s dive in and see if I can’t explain this more succinctly and clearly. Endogenous money is the fact that anyone can expand their balance...

Read More »Let’s Stop Talking About “Paying Off the National Debt”

When we talk about personal finance we often talk about paying off our debts to become financially free. But this is a fallacy of composition. While some households can pay off their debts, the economy actually relies on expanding debt (and assets) to have liquidity and growth. After all, debt isn’t necessarily bad. Yes, there are bad types of debt (like credit card debt which almost always have a negative long-term return), but there are also good types of debt (for instance, when someone...

Read More »My View On: Minsky’s Financial Instability Hypothesis

Hyman Minsky’s Financial Instability Hypothesis (FIH) has been an influential component of how I think of the financial markets and the economy. The FIH, in a nutshell, says that capitalist economies will, at times, deviate from an equilibrium into substantial inflations and deflations. In other words, booms can beget booms which can beget busts which beget busts. This view, that booms lead to busts, has garnered renewed interest in the wake of the GFC where a housing boom clearly led to a...

Read More »Is Government Debt “Equity”?

I’ve noticed a trend in some economic circles that seems to stem from the Positive Money and MMT people – this idea that government “debt” is “equity”. While the taxonomy in mainstream macroeconomics can sometimes be messy I don’t think this is a case where we need to be trying to reinvent well established terms. Let me explain. First off, I understand the desire to create a more coherent taxonomy for terms that seem to have no meaning (for instance, the term “money” in mainstream macro),...

Read More »The Monetary Duration Dilemma

I’ve been careful in my research on money not to call money a “store of value”. There’s a good reason for this which I will try to explain in this piece. In traditional definitions of money three criteria are generally applied: Unit of account Medium of exchange Store of value The first two are uncontroversial. Money needs to be denominated in a unit of account (the USD, Yen, Euro, etc) and it needs to be a medium of exchange. As a store of value, however, the best money cannot serve this...

Read More »How Bond Vigilantes Really Think

Discussions on interest rates tend to fall into two camps – the state based view and the market based view. The state based view says that the government can always control the cost of its interest while the market based view argues that the market (typically “bond vigilantes”) can control the rate of interest. I find both of these views confused or at least misleading. One of the nice things about being an actual bond portfolio manager is that I see how prices are set every day. I’ve...

Read More »Funding in an Endogenous Money System (Nerdy)

(I come across this topic quite a bit and I think it’s hard for some people to understand so I am going to get a little nerdy here and see if I can clarify how financial instruments are created and used in the process of “funding” the economy’s needs). Endogenous money is an essential understanding for anyone who wants to better comprehend how the monetary system works. Okay, okay. Let me step back a second. First, what is endogenous money? Endogenous money refers to money that grows from...

Read More »5 Questions and Answers on “Passive” Investing, Part Deux

Here’s part two of the Q&A on passive investing. If you haven’t read part 1 it will be helpful to do that first since I laid out the necessary definitions and foundation for a clear discussion. I answered Marks’ first question about passive investing in the first post, but as it was running a little long I didn’t get to the next four. So let’s bang those out: Question 2: “What are the implications of passive investing for active investing?” Marks goes on to specifically ask: “what...

Read More » Heterodox

Heterodox