Recently NPR had a story about the criminalization of poverty in the US, and the fact that now poor people that get a parking ticket and the fees that go with that for processing, for court expenses, and what not, may end up in jail. At least now a series of lawsuits are challenging this kind of abuse.

Read More »Branko Milanovic on Global Inequality

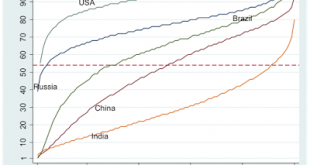

You can hear the podcast of this interview at Bloomberg's Taking Stock here. You can also read this interview from last year. Graph below is from the latter. As he explains: The graph (for year 2008) shows on the horizontal axis a person’s position in their own country’s income distribution, and on the vertical axis, a person’s position in global income distribution. Thus, the poorest Americans (points 1 or 2 on the horizontal axis have incomes that put them above the 50th percentile...

Read More »Wealth Concentration, Income Distribution, and Alternatives for the USA

New paper by Lance Taylor, Özlem Ömer and Armon Rezai. From the abstract: US household wealth concentration is not likely to decline in response to fiscal interventions alone. Creation of an independent public wealth fund could lead to greater equality. Similarly, once-off tax/transfer packages or wage increases will not reduce income inequality significantly; on-going wage increases in excess of productivity growth would be needed. These results come from the accounting in a simulation...

Read More »All QE is “”people’s QE” – just not the right people

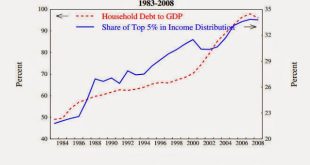

Inequality, the Financial Crisis and Stagnation

By Thomas PalleyThis paper examines several mainstream explanations of the financial crisis and stagnation and the role they attribute to income inequality. Those explanations are contrasted with a structural Keynesian explanation. The role of income inequality differs substantially, giving rise to different policy recommendations. That highlights the critical importance of economic theory. Theory shapes the way we understand the world, thereby shaping how we respond to it. The theoretical...

Read More »Property, inequality and financial crises

At the end of my previous post, I posed the question: why did Latvia experience the deepest recession in the world in 2008-9?The first puzzle is that Latvia's banks were in no worse shape than anyone else's and better than some. Among small countries, Iceland, Ireland and (in 2013) Cyprus all experienced bigger banking collapses relative to the size of their economies than Latvia. Larger countries did too, notably Germany and the UK, both of which suffered widespread damage across their large...

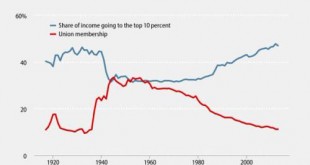

Read More »On Trade Unions & Inequality

This chart is pretty wow: Florence Jaumotte and Carolina Osorio Buitron of the International Monetary Fund have some ideas about how the correlation may have been caused: The main channels through which labor market institutions affect income inequality are the following: Wage dispersion: Unionization and minimum wages are usually thought to reduce inequality by helping equalize the distribution of wages, and economic research confirms this. Unemployment: Some economists argue that while...

Read More » Heterodox

Heterodox