from Dean Baker CEOs and other top management in the U.S. are far more highly paid than their counterparts in Europe and Asia. NYT columnist Jeff Sommer had an entertaining piece on how many of the business leaders who eagerly embraced DEI a few years back are now being very quick to abandon it. This is not terribly surprising to those of us who never took the commitment to DEI very seriously, but there is an important aspect to his discussion that he leaves out. Sommer spends much of the...

Read More »Monetary developments in the Euro Area, september 2024. Quiet.

Like John Stuart Mill, I´m more interested in credit than in money. Developments in the amount of credit provided are much more instructive to the economist than data on money. Look at the graph below (no. 2 in the ECB press release) , a highly Post-Keynesian graph that originated from the pre-Euro Bundesbank and is now published by the European Central Bank. It shows that money growth in the EU is relatively moderate and, more interesting, caused by a combination of 1) lather large...

Read More »More Thoughts about Japan and US Treasuries

By Marc Chandler (originally published at Marc to Market) The US Treasury International Capital report for the month of November 2017 was released yesterday. It showed that the two largest foreign holders of US Treasuries, China and Japan, were net sellers. China sold about $12.6 bln and Japan sold about $9 bln of US Treasuries. Foreign investors sold $6.4 bln of Treasuries, meaning that...

Read More »Italian Election–Two Months and Counting

By Marc Chandler (originally published at Marc to Market) Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority government. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press Visegrad group of central European countries to conform to the values of...

Read More »Doubling Down: Leveraged ETFs offer promise – and danger

Every once in a while, I get contacted to answer questions and/or provide quotes for articles, news programs, etc. (Nothing will ever be as neat as the feature in Grazia though.) The latest was an inquiry from a very nice fellow named Chris Taylor, who is the money guy for Reuters. The article is linked above, and here is the larger context: Okay, what actually happened was basically this: Chris: Can I ask you some questions about leveraged ETFs?Me: Oh hell no.Chris: Oh sorry to disturb...

Read More »IPA’s weekly links

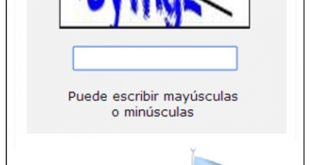

Guest post by Jeff Mosenkis of Innovations for Poverty Action. In a clever online nudging experiment, 627,000 online taxpayers in Guatemala were given one of five different kinds of honesty messages, reminders about public goods, or legal warnings in a captcha. But none of the messages had any effect on taxes paid. Some unexpected side effects of antimalarial insecticide-treated bednets (ITNs): We show that ITNs reduced all-cause child mortality, but surprisingly increased total fertility...

Read More »Why Is Connecticut Giving Its Employees’ Money to the Asset Management Industry?

By James Kwak In general, the State of Connecticut offers pretty good defined contribution retirement plans to its employees. Most importantly, it offers several low-cost index funds in institutional share classes. For example, you can invest in the Vanguard Institutional Index Fund Institutional Plus Shares, which tracks the S&P 500 for just 2 basis points, or the TIAA-CREF Small-Cap Blend Index Institutional Class, which tracks the Russell 2000 for just 7 basis points....

Read More »Why Is Connecticut Giving Its Employees’ Money to the Asset Management Industry?

By James Kwak In general, the State of Connecticut offers pretty good defined contribution retirement plans to its employees. Most importantly, it offers several low-cost index funds in institutional share classes. For example, you can invest in the Vanguard Institutional Index Fund Institutional Plus Shares, which tracks the S&P 500 for just 2 basis points, or the TIAA-CREF Small-Cap Blend Index Institutional Class, which tracks the Russell 2000 for just 7 basis points....

Read More »Asset allocation in a period of wealth mean reversion

In-depth analysis on Credit Writedowns Pro. Should FIFAA Be Red-Carded? Absolute Return Letter, November 2015 “When I want your opinion, I will give it to you.” Samuel Goldwyn No, I haven’t gone bonkers – the focus of the Absolute Return Letter has not all of a sudden switched to football. Nor have I lost the ability to spell correctly, although I am sure that there are one or two like-minded readers out there who would also like to see the rear side of Sepp Blatter one final time....

Read More »Jensen: How long bonds could actually outperform equities

In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a...

Read More » Heterodox

Heterodox