In-depth analysis on Credit Writedowns Pro. Should FIFAA Be Red-Carded? Absolute Return Letter, November 2015 “When I want your opinion, I will give it to you.” Samuel Goldwyn No, I haven’t gone bonkers – the focus of the Absolute Return Letter has not all of a sudden switched to football. Nor have I lost the ability to spell correctly, although I am sure that there are one or two like-minded readers out there who would also like to see the rear side of Sepp Blatter one final time. FIFAA is an acronym that stands for Flexible Indeterminate Factor-based Asset Allocation and is the brainchild of Harvard Management Company’s President and CEO, Stephen Blyth. Harvard Management Co. (HMC) manages Harvard University’s endowment and related financial assets, a total of almost billion, and has underperformed their chief ‘rivals’ at Yale University pretty much every year since the financial crisis changed everything in 2008. This is obviously not particularly satisfying, and HMC has now taken action, but is it appropriate action? The following is not about Harvard per se but about what I believe to be an appropriate approach to investing in what is rapidly turning into a very different – and very difficult – investment environment. I remain convinced that if you want to succeed as an investment manager post 2008 you must approach portfolio construction very differently.

Topics:

Niels Jensen considers the following as important: asset allocation, demographics, investing, markets, risk, wealth, Weekly

This could be interesting, too:

Nick Falvo writes Subsidized housing for francophone seniors in minority situations

Dean Baker writes Businesses and DEI: Corporations don’t maximize shareholder value

Nick Falvo writes Homelessness among older persons

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Should FIFAA Be Red-Carded?

Absolute Return Letter, November 2015

“When I want your opinion, I will give it to you.”

Samuel Goldwyn

No, I haven’t gone bonkers – the focus of the Absolute Return Letter has not all of a sudden switched to football. Nor have I lost the ability to spell correctly, although I am sure that there are one or two like-minded readers out there who would also like to see the rear side of Sepp Blatter one final time.

FIFAA is an acronym that stands for Flexible Indeterminate Factor-based Asset Allocation and is the brainchild of Harvard Management Company’s President and CEO, Stephen Blyth. Harvard Management Co. (HMC) manages Harvard University’s endowment and related financial assets, a total of almost $40 billion, and has underperformed their chief ‘rivals’ at Yale University pretty much every year since the financial crisis changed everything in 2008. This is obviously not particularly satisfying, and HMC has now taken action, but is it appropriate action?

The following is not about Harvard per se but about what I believe to be an appropriate approach to investing in what is rapidly turning into a very different – and very difficult – investment environment. I remain convinced that if you want to succeed as an investment manager post 2008 you must approach portfolio construction very differently. That is, in short, what this month’s Absolute Return Letter is about.

What is FIFAA?

Let’s begin with FIFAA. The following few paragraphs are essentially a summary of a paper published by HMC back in August, which you can find here. I would encourage you to read the entire paper as it makes many good points.

The starting point is a recognition that the world of investment management is (very broadly) divided into two schools – a quantitative (determinate) one and a qualitative (indeterminate) one. The quants began to gain momentum following Harry Markowitz’s work that peaked in 1952, when he published the now famous paper on Modern Portfolio Theory (MPT). Today, the best known leg of MPT is almost certainly Mean-Variance Optimisation (MVO).

The qualitative school has been around forever but has lost ground to the quants in recent years. The best known qualitative approach is probably the ‘best ideas’ approach which is practiced by many investment managers around the world every single day of the year. What FIFAA brings to the table is a hybrid between the two methodologies. It incorporates features of several frameworks – quantitative as well as qualitative – e.g. MPT and best ideas.

FIFAA focuses on the principal drivers of risk and return (I just wish FIFA did the same) and have established an investment process along the following lines:

- What are the appropriate underlying factors?

- How are different asset classes exposed to these factors?

- What factor exposures are desired?

- What asset class portfolios match the desired factor exposures?

Hence, the choice of the underlying factors becomes key, and the August paper offers a number of options at HMC’s disposal:

a. Global Equities

b. U.S. Treasuries

c. Credit Spreads

d. Inflation Protection

e. Currency Protection

f. Liquidity

g. Volatility

In this context, I should also mention that in the smart beta craze currently unfolding (which is also referred to as factor investing) the factors are entirely non-related to asset classes. Instead the focus is on factors such as growth, value, momentum, size, etc. HMC has made a public comment on this. They say that “it is a perspective, not a portfolio construction methodology.” If MVO is part of the portfolio construction methodology, I would have to agree.

One final note on FIFAA. According to a recent article in the Financial Times, the day one portfolio will be constructed on the basis of only five of the underlying factors – global equities, Treasuries, credit spreads, the U.S. dollar and inflation (which the portfolio will hedge against by going long Treasuries and short TIPS) – see details here. The same five factors are listed in the HMC paper but as an example only, so it is not entirely clear to me if the FT has misunderstood things and interpreted an example portfolio to be the opening portfolio.

A critique of FIFAA

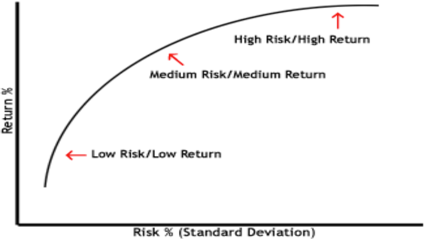

Any incorporation of MPT immediately tunes you into the underlying key variables in MVO, which are expected returns, standard deviations (volatility) and correlations. Assuming you have 10 asset classes at your disposal when building the portfolio, you need 65 input data – 10 returns, 10 standard deviations (SDs) and 45 correlations. Then you can create the efficient frontier (chart 1)[1].

The efficient frontier is basically a collection of all theoretically possible optimal portfolios, given the underlying data you have entered, and this is my key problem with FIFAA (and with MVO in general). Before I established Absolute Return Partners I ran the European private client business of Lehman Brothers. This was back 15-20 years ago, years before Lehman got into serious trouble. MVO was an integral part of what we did back then, so I know one or two things about the pros and cons of it.

In fact, you don’t need to have worked with MVO before to be aware that correlations are not stable; in fact, they are anything but. SDs do also vary considerably over time but, in my experience, the single biggest problem with MVO is the return estimates you use in the model, where even modest changes can have a massive impact on the portfolio composition. At Lehman Brothers we addressed that by using ultra long term averages. If European equities had returned (say) 10% over the previous 30-40 years, the chances are that they will do roughly the same over the next 30-40 years, or so we concluded 15-20 years ago.

Chart 1: Creation of the efficient frontier in MVO

Source: Investopedia

The problem with such an approach is that it requires an element of stability of the underlying key variables to work. If GDP growth over the next 30-40 years is going to be much lower than that of the last 30-40 years, as we now expect, so will corporate earnings be and possibly also equity returns, unless P/E multiples rise substantially. This was not even on my radar screen back then but certainly is now.

At the most basic level, only two factors are responsible for economic growth – the number of hours worked and productivity improvements. Algebraically, it can be expressed as follows:

rGDP = rHours Worked + rProductivity

The total number of hours worked is almost impossible to measure but, assuming that people on average work pretty much the same number of hours from one year to the next, the size of the workforce is a good proxy for the number of hours worked, and that is much easier to track. By taking advantage of that, the formula above can be expressed as follows:

rGDP ≈ rWorkforce + rProductivity

Now, if I tell you that the European workforce will fall approximately 0.5% per annum through 2050 (which is about right unless we open the doors to millions of immigrants), it becomes obvious that, short of any massive productivity enhancements, average annual GDP growth in Europe will be close to 0% through 2050. Why? Because European productivity growth averages 0.5-1.0% per annum (+/-).

Let’s stay with that thought for a second. Is it conceivable that productivity suddenly takes off and ‘saves’ economic growth? Since World War II, we have only experienced two major spikes in productivity. The first came around in the late 1950s / early 1960s, when it became the norm to own your own car. The U.S. highway system, followed by the European motorway system, was established and had a very significant effect on overall productivity.

The second spike occurred in the late 1990s / early 2000s when the dot.com boom changed the way many of us work. The big question is: What comes next? I have no idea (driverless cars anyone?), but another boost in overall productivity would certainly have a very positive, and much needed, effect on GDP growth.

All this is relevant as far as FIFAA is concerned because MVO is a vital part of FIFAA. If you haven’t worked with MVO before, you would be surprised to learn how big an impact it would have on the portfolio composition, if you were to alter your return estimates only modestly. It is therefore fair to say that the MVO output could be way off, unless you are either very good or very lucky with your estimates. MVO is a superb tool if used appropriately, i.e. as a rough guideline only, but it is not a be all and end all tool for investment managers. It will be interesting to see how HMC deals with that challenge.

I have one additional issue with FIFAA. Many of the underlying factors in HMC’s model are asset classes (HMC has obviously adapted their thinking to something that would work in MVO), but asset classes are not underlying factors. Rather they are the result of underlying factors. Take demographics. I consider demographics a factor, but demographics are likely to impact equites in about half a million different ways, so one would need to drill further down, if the aim is to get a true picture of how demographics are likely to affect equities.

At Absolute Return Partners we do this the following way. We begin by identifying a number of so-called structural mega-trends (we have identified six such trends at the moment). The beauty is that they will happen regardless of what happens elsewhere. How the economic cycle unfolds matters not one iota. Changing demographics is one such structural mega-trend; we have named it The Retiring Baby Boomers.

Next, we drill down. A number of sub-trends will materialise as a result of the structural mega-trends we have identified. Example: Assuming interest rates remain relatively low, ageing investors hungry for income will – implicitly or explicitly – penalise companies that allocate their surplus cash towards buy-backs and reward companies that pay attractive dividends (and can afford to do so). The drive towards more attractive dividends we consider a structural sub-trend.

The challenge facing HMC is that such structural trends are much more difficult to adapt to something that can be utilized in MVO, so I can see why they are going about it the way they are, but suddenly guesswork becomes a fairly prominent factor, which I am not comfortable with. Only time can tell if they have figured it out or not.

How you can easily go wrong in MVO

Following on from the above, I cannot resist the temptation to share with you an example why the return, SD and correlation estimates that you enter into MVO could quite easily be horribly wrong, with rather dramatic consequences for the overall portfolio composition to follow.

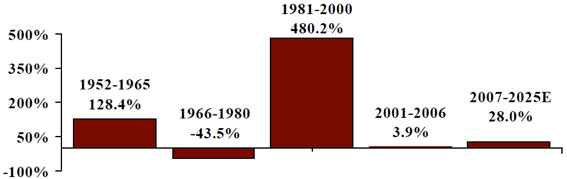

Mean Reversion of Wealth is one of the six structural mega-trends that we have identified. As is pretty obvious when looking at chart 2, wealth creation during the great bull market of 1981-2000 was quite extraordinary and, in our opinion, unlikely to be repeated anytime soon. Wealth simply cannot outgrow GDP indefinitely, as it has done in most years since the early 1980s. It is only a question of time before mean reversion kicks in.

Chart 2: Cumulative real growth of U.S. household financial wealth

Source: Strategic Economic Decisions.

The day will therefore arrive where some of that wealth will have to be given up again. The tricky question is when and how quickly? Nobody has any clue, although some will argue they do. My own guess, and it is very much a guess, is that mean reversion will commence when interest rates begin to rise again in a meaningful way. This could make otherwise reasonable estimates look very silly and totally jeopardise the output of quantitative models such as MVO.

The approach of Absolute Return Partners and Blu

So how do we[2] structure portfolios? To begin with, we differentiate between behaviour and drivers of risk to determine capital allocations. Asset classes and types of products are irrelevant and merely represent execution tools to get exposure to different types of risk, which we label beta, alpha and gamma. Beta risk is market risk – pure and simple. Returns are a function of the strategic allocation to the various global regions, style and costs. We don’t see any value in trying to outperform markets, as this ability would be much better exploited in absolute return strategies (but not necessarily in hedge funds). As such, the most cost efficient way of getting exposure to beta risk is through passive investment vehicles such as ETFs.

Alpha by definition is everything beta isn’t; it is non-market risk. Returns are driven by extracting risk premiums from short term mis-pricings in the listed markets through market neutral latency, mean reversion or event strategies, and there is no correlation to beta. Pure alpha is incredibly difficult to find in today’s market place, and we would estimate that only about 15% of today’s 11,000+ hedge funds actually generate alpha.

Gamma is idiosyncratic risk and often associated with less liquid investment strategies, which usually have a more convex return profile. Many strategies which produce gamma deal with un-listed opportunities; however, gamma can be found in the listed space as well – in strategies such as Macro, CTAs (e.g. trend following) and in volatility/optionality based investment strategies.

The trick in constructing the different investment ‘buckets’ is to make sure they behave differently and have a liquidity profile that allows the efficient allocation between them in changing market conditions. We believe that any combination of the three different buckets (beta, alpha and gamma) greatly reduces risk compared to being exposed to only one type of risk. As we saw in August, the classic model of using bonds to diversify and protect equity risk can no longer be relied upon.

Let’s go back to beta risk for a second or two. Virtually all the structural trends that we have identified will impact the beta element. Many will also affect gamma strategies, and some will even affect alpha. Having said that, alpha tends to be more driven by liquidity, volatility and dispersion.

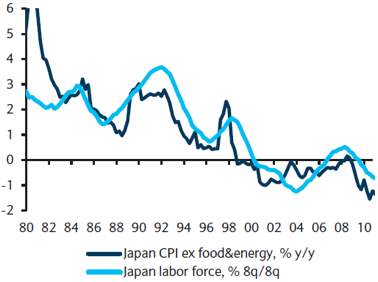

Take demographics again. We know from Japan that consumer prices (CPI) are very closely correlated with the growth in the working age population (chart 3). As I cannot see any reason why you would expect it to be any different here in Europe, there are very strong reasons to believe that inflation, and therefore also interest rates, will stay relatively low for many years to come. That is just one example of how a structural trend is likely to affect beta risk in a major way.

Historically, Absolute Return Partners has been most active in the gamma bucket, but the investment in Blu will give us access to beta and alpha tools that we haven’t had many of in the past. We will report back to you how this business develops. Feel free to contact us for further information, and we would welcome any feedback.

Chart 3: Japanese working age population and core CPI

Source: Barclays Equity Gilt Study 2014

Conclusion

HMC has chosen to go down the MVO route (albeit with a caveat), and we wish them good luck. We have chosen a different approach. Unfortunately, it doesn’t have an acronym as nice as that of Mean-Variance Optimisation, but less can also do. We call it the route of permanent capital, unaffected by low returns. We believe that playing the MVO game is an arms race, and we don’t fancy being part of such a race. We are simply not big or powerful enough. Our philosophy is simple. It is to let investment decisions be dictated by risk budgets, not asset classes.

In effect, HMC’s approach is one that asks the question: Which factors do you really want to be exposed to? Subsequently the portfolio is constructed with assets and investment strategies that are explicitly or implicitly exposed to those factors. Our approach, on the other hand, asks the question: What are the factors that will impact us all regardless of economic cycles, and how do we best get exposure to those factors, or avoid them if negative?

The two methodologies are not a million miles apart but, in a low return environment, for a long-term investor (and only for a long-term investor), I think the permanent capital approach makes more sense. I am obviously biased, and it is perhaps not fair to criticise HMC’s approach without knowing more about it than I do today but, as I see it, HMC can quite possibly fall into the trap of becoming too short sighted if they are not careful.

Our approach is very close to a traditional ‘best ideas’ approach but with none of the short-sightedness and focus on cyclical trends that most ‘best ideas’ portfolio managers suffer from. We emphasise the structural factors that we have identified. Precisely where we are in the economic cycle matters less.

Before wrapping up this month’s Absolute Return Letter, I should also point out that, in the years to come, I believe that superior returns are likely to come from taking alpha and gamma risk. Returns from taking beta risk won’t necessarily be negative, but I expect them to be quite modest when compared to the last 30-35 years.

If that turns out to be correct, fees will likely be affected in a major way. The investment management industry is much more efficient than it was when I first joined it some 30 years ago, yet fees are broadly the same (i.e. profit margins are much higher). Expect a lot of fee pressure in the years to come. The show has only just begun.

Finally, I should point out that I decided to write about FIFAA, not just because I think it is a noteworthy approach, but also because Harvard and Yale have a history of setting new industry standards, and I wouldn’t be at all surprised if we are going to hear a lot more about FIFAA as time progresses. This is the first serious attempt of creating a hybrid between the two schools and is quite likely to establish a significant following as a result. Therefore, Harvard doesn’t deserve a red card at all. It is a weak yellow at worst.

Niels C. Jensen

2 November 2015

©Absolute Return Partners LLP 2015. Registered in England No. OC303480. Authorised and Regulated by the Financial Conduct Authority. Registered Office: 16 Water Lane, Richmond, Surrey, TW9 1TJ, UK.

Important Notice

This material has been prepared by Absolute Return Partners LLP (ARP). ARP is authorised and regulated by the Financial Conduct Authority in the United Kingdom. It is provided for information purposes, is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. The information provided is not intended to provide a sufficient basis on which to make an investment decision. Information and opinions presented in this material have been obtained or derived from sources believed by ARP to be reliable, but ARP makes no representation as to their accuracy or completeness. ARP accepts no liability for any loss arising from the use of this material. The results referred to in this document are not a guide to the future performance of ARP. The value of investments can go down as well as up and the implementation of the approach described does not guarantee positive performance. Any reference to potential asset allocation and potential returns do not represent and should not be interpreted as projections.

Absolute Return Partners

Absolute Return Partners LLP is a London based client-driven, alternative investment boutique. We provide independent asset management and investment advisory services globally to institutional investors.

We are a company with a simple mission – delivering superior risk-adjusted returns to our clients. We believe that we can achieve this through a disciplined risk management approach and an investment process based on our open architecture platform.

Our focus is strictly on absolute returns and our thinking, product development, asset allocation and portfolio construction are all driven by a series of long-term macro themes, some of which we express in the Absolute Return Letter.

We have eliminated all conflicts of interest with our transparent business model and we offer flexible solutions, tailored to match specific needs.

We are authorised and regulated by the Financial Conduct Authority in the UK.

Visit www.arpinvestments.comto learn more about us.

Absolute Return Letter contributors:

Niels C. Jensen

Gerard Ifill-Williams

Nick Rees

Tricia Ward

Alison Major Lépine

[1] I apologise if this is too elementary, but I do have readers who have never heard of the efficient frontier before. I will swiftly move on, though.

[2] In this context ‘we’ refer to Absolute Return Partners (ARP) and Blu, a multi-family office that ARP recently acquired an equity stake in. You can read more about Blu here.