“Stocks are overvalued and risky. Bonds yield nothing and expose you to interest rate risk. So you need to invest in alternative assets.” – Pretty Much Everyone I am a big advocate of a core and satellite approach to asset allocation. For instance, in my book I talked about the Total Portfolio approach. That is, everyone should own a diverse group of assets and consider how their Total Portfolio relates to what we typically think of as our “investment portfolio”. This might include real...

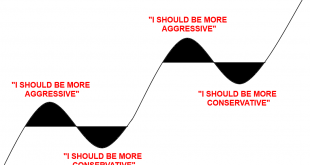

Read More »The Psychology of the Stock Market, in One Image

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom. In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive. Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative. But this is the battle we constantly wage with ourselves. Successful...

Read More »Why is Shorting Stocks so Difficult?

Did you hear about Tesla? Yeah, it’s up a lot. A lot. A lot. Like, hundreds of percent a lot. Or, 400% from its recent lows. Now, that might not matter much except that that rally now makes Tesla an extraordinarily large business by market cap. At 160B market cap they’re now the 44th largest firm in the world. That’s roughly the same size as McDonalds and larger than Nike. It’s FOUR times the size of Ford and GM. TWO times as large as Ford and GM COMBINED. Whoa. Much of this growth seems...

Read More »The Permaeverything Approach

I’m a permaeverything. Not a permabear. Not a permabull. A permaeverything. What the hell does that mean? It means I try to always maintain a relatively balanced exposure across my financial assets. I am never too heavily leveraged to stocks. Never too heavily leveraged to bonds. Never too heavily leveraged to cash. I am balanced. I am permanently bullish AND bearish about everything to some degree. The Permaeverything mentality is essentially a type of Permanent Portfolio or All Weather...

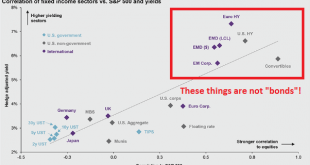

Read More »When “Bonds” Aren’t Bonds

In finance and economics we tend to use oversimplified terms like “money” and “bonds” when the reality is that it’s important to be more nuanced in understanding these terms. That’s why, for instance, I prefer the term “moneyness” when I refer to a money-like instrument. It conveys the proper degree of flexibility about the item. Sometimes cash has more money-like properties than a bank deposit. Sometimes it doesn’t. We can apply the same type of thinking to the financial markets and in...

Read More »3 Reasons to Hold Long Bonds as Short Rates Rise

As short rates rise the tendency for novice bond investors is to believe that the short end of the curve suddenly makes it irrational to hold any long-term bonds. While it’s true that the risk/reward of short-term bonds improves in this environment it doesn’t mean that long bonds serve no purpose in diversifying a portfolio. Here’s a very good video from Cathy Jones, Schwab’s Chief Fixed Income Strategist outlining three reasons why you shouldn’t abandon long-term bonds as short rates...

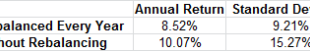

Read More »Why Does the Rebalancing Bonus Work?

One of the best parts about Twitter is that you can follow super smart people and just read their interactions. For instance, yesterday I was creeping on Jeremiah Lowin, Jake from Econompic and Corey Hoffstein. These are three super smart finance guys who were going back and forth about the rebalancing bonus which was made famous by William Bernstein. I will let you assess their comments as you wish, but I have a A LOT to say about rebalancing because it’s so central to everything I...

Read More »The Best Investment Strategy: DISCIPLINE

I was reading this article in the NY Times about a wide ranging diet study. They performed a meticulously controlled test to study what type of diet works best. Their conclusion: “The bottom line is that the best diet for you is still the one you will stick to. No one knows better than you what that diet might be. You’ll most likely have to figure it out for yourself.” One of my favorite things about investing is its similarities with dieting and health. Mainly, investing is really...

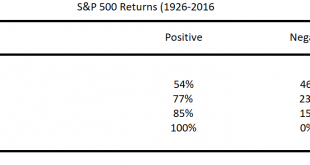

Read More »How to Overcome Your Fear of Bonds

I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to go through another 2008, but also want to generate a decent return above the rate of inflation. This means I end up managing a lot of fixed income because being a long only equity manager would expose investors to too much 2008 risk and owning cash guarantees a negative inflation adjusted return....

Read More »Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”

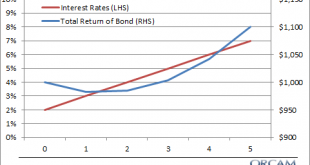

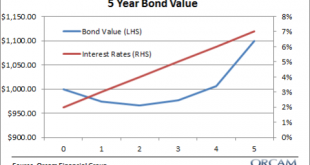

Share the post "Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”"If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as...

Read More » Heterodox

Heterodox