Share the post "Understanding the Art of Doing Nothing"Most of what we end up doing in our lives is determined not by what we decide to do, but by what we decide NOT to do. In the course of any given day we decide not to do millions of things. Eliminating all of these actions results in a direction that determines how we end up acting out our day. For instance, at lunch you might think you’re choosing to eat a baloney sandwich. But you didn’t really choose to eat the baloney sandwich. You...

Read More »The Alpha Paradox

Share the post "The Alpha Paradox"Here are a few things we know about the financial markets:Beating the market or obtaining “alpha” (excess return) is extremely difficult as evidenced by the annual SPIVA Scorecards.Alpha doesn’t exist in the aggregate because we all hold what sums to one portfolio wherein we earn the after tax and after fee return of the global financial asset portfolio (GFAP).In order to be properly diversified to reduce single entity risk we must hold a portfolio that...

Read More »Investing is not the Same as Gambling

Share the post "Investing is not the Same as Gambling" It’s the Monday following the second leg of the Triple Crown and a whole bunch of people lost money betting on the Preakness. Like the stock market, the allure of gambling is strong because many people think that having more money will solve most of their problems. And while there are some similarities between investing and gambling we should be clear that they are not nearly as similar as some people might believe. First, some...

Read More »How to Avoid the Problem of Short-Termism

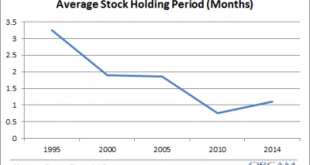

Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this...

Read More »Why Equity Outperforms Credit

Share the post "Why Equity Outperforms Credit" In my new paper on asset allocation I go into quite a bit of detail about why certain asset classes generate the returns they do. Understanding this is useful when thinking in a macro sense and trying to gauge why financial assets perform in certain ways in both the short-term and the long-term. It’s important to understand the fundamental drivers of these returns in order to avoid falling into the trap that these assets generate returns due...

Read More »The Perils of the Safe Income Illusion

Share the post "The Perils of the Safe Income Illusion" Here’s Josh Brown with a good piece on dividends. He asks, “are we too obsessed with dividend income?” Tricky question, but I would tend to answer by saying that, when we substitute equity income for bond income, we’re often searching for “safe income” in all the wrong places. As I noted in a recent piece, corporations don’t have to pay out dividends and we should expect capital appreciation to accurately reflect the true value of...

Read More »Understanding Modern Portfolio Construction [New Research]

Share the post "Understanding Modern Portfolio Construction [New Research]" My newest research paper, Understanding Modern Portfolio Construction, is available on SSRN. This paper is the culmination of years of work and I consider it to be the most important piece of research I’ve published. I wrote this paper in much the same way that I wrote my paper, Understanding the Modern Monetary System, however, since I’m not an academic economist, this paper is more along the lines of my...

Read More »Control What You Can Control

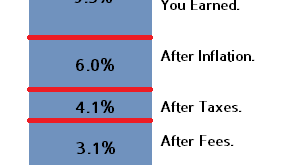

Share the post "Control What You Can Control" Vanguard has a timely reminder for investors – “cost is the new performance”.¹ We’ve entered a new era in the asset management business. The era of low fees. We now know definitively that paying high fees is hugely destructive to long-term performance. You don’t don’t get what you pay for and you don’t get better returns by paying for more expensive money managers. In fact, high costs are correlated with lower returns. As I’ve outlined in...

Read More »Assessing the Utility of Wall Street’s Annual Forecasts

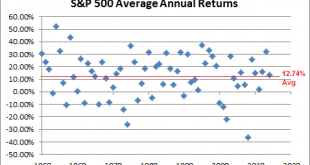

Share the post "Assessing the Utility of Wall Street’s Annual Forecasts" It’s that time of year when everyone starts preparing for the New Year and Wall Street makes its 2016 predictions. I’ll get right to the point here – these annual predictions are largely useless. But it’s still helpful to put these predictions in perspective because it highlights a good deal of behavioral bias and some of the mistakes investors make when analyzing their portfolios. The 2016 annual stock market...

Read More »What is Portfolio “Risk”?

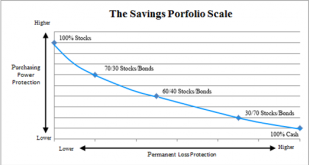

The idea of risk is a rather confusing and nebulous concept in modern finance. The traditional textbook definition of “risk” is standard deviation or volatility. This is convenient for academic purposes because it allows us to quantify risk in a portfolio. But this is a flawed concept for several reasons: Volatility isn’t always a bad thing. In fact, volatility with a positive skew is a good thing. No one complains about a portfolio allocation that rises 20% per year and falls 5% every once...

Read More » Heterodox

Heterodox