Given the severity of recent events I want to start writing more broadly and providing more in-depth research pieces. I’ll be starting to publish long form letters on topics of interest. The series will be called “Pragmatic Thinking On…” This will hopefully provide more detail than the blog posts and provide readers with more in-depth understandings of the topics I write about. You can find the new letters on the front of the Orcam website under “Letters From Our Founder.” I hope you...

Read More »3 Reasons to Hold Long Bonds as Short Rates Rise

As short rates rise the tendency for novice bond investors is to believe that the short end of the curve suddenly makes it irrational to hold any long-term bonds. While it’s true that the risk/reward of short-term bonds improves in this environment it doesn’t mean that long bonds serve no purpose in diversifying a portfolio. Here’s a very good video from Cathy Jones, Schwab’s Chief Fixed Income Strategist outlining three reasons why you shouldn’t abandon long-term bonds as short rates...

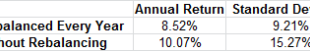

Read More »Why Does the Rebalancing Bonus Work?

One of the best parts about Twitter is that you can follow super smart people and just read their interactions. For instance, yesterday I was creeping on Jeremiah Lowin, Jake from Econompic and Corey Hoffstein. These are three super smart finance guys who were going back and forth about the rebalancing bonus which was made famous by William Bernstein. I will let you assess their comments as you wish, but I have a A LOT to say about rebalancing because it’s so central to everything I...

Read More »The Best Investment Strategy: DISCIPLINE

I was reading this article in the NY Times about a wide ranging diet study. They performed a meticulously controlled test to study what type of diet works best. Their conclusion: “The bottom line is that the best diet for you is still the one you will stick to. No one knows better than you what that diet might be. You’ll most likely have to figure it out for yourself.” One of my favorite things about investing is its similarities with dieting and health. Mainly, investing is really...

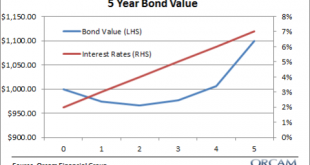

Read More »How to Overcome Your Fear of Bonds

I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to go through another 2008, but also want to generate a decent return above the rate of inflation. This means I end up managing a lot of fixed income because being a long only equity manager would expose investors to too much 2008 risk and owning cash guarantees a negative inflation adjusted return....

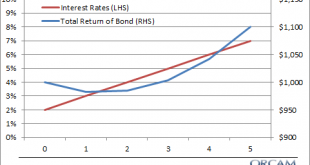

Read More »Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”

Share the post "Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”"If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as...

Read More »Understanding the Art of Doing Nothing

Share the post "Understanding the Art of Doing Nothing"Most of what we end up doing in our lives is determined not by what we decide to do, but by what we decide NOT to do. In the course of any given day we decide not to do millions of things. Eliminating all of these actions results in a direction that determines how we end up acting out our day. For instance, at lunch you might think you’re choosing to eat a baloney sandwich. But you didn’t really choose to eat the baloney sandwich. You...

Read More »How Do Indexers Do Better Than Average?

Share the post "How Do Indexers Do Better Than Average?"One of the more common investing myths is the idea that indexing is necessarily “average”.¹ It makes sense at first. If you bought all of the stocks in the market then you’d generate the average return. It would be like playing fantasy football and picking all of the players in the NFL. You would lose more often than not because there is no way you’re going to beat the team that has Tom Brady, Adrian Peterson, Antonio Brown or, well,...

Read More »The Alpha Paradox

Share the post "The Alpha Paradox"Here are a few things we know about the financial markets:Beating the market or obtaining “alpha” (excess return) is extremely difficult as evidenced by the annual SPIVA Scorecards.Alpha doesn’t exist in the aggregate because we all hold what sums to one portfolio wherein we earn the after tax and after fee return of the global financial asset portfolio (GFAP).In order to be properly diversified to reduce single entity risk we must hold a portfolio that...

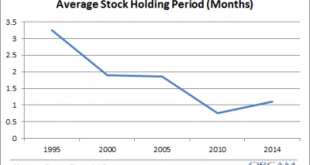

Read More »How to Avoid the Problem of Short-Termism

Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this...

Read More » Heterodox

Heterodox