Share the post "The Perils of the Safe Income Illusion" Here’s Josh Brown with a good piece on dividends. He asks, “are we too obsessed with dividend income?” Tricky question, but I would tend to answer by saying that, when we substitute equity income for bond income, we’re often searching for “safe income” in all the wrong places. As I noted in a recent piece, corporations don’t have to pay out dividends and we should expect capital appreciation to accurately reflect the true value of...

Read More »Understanding Modern Portfolio Construction [New Research]

Share the post "Understanding Modern Portfolio Construction [New Research]" My newest research paper, Understanding Modern Portfolio Construction, is available on SSRN. This paper is the culmination of years of work and I consider it to be the most important piece of research I’ve published. I wrote this paper in much the same way that I wrote my paper, Understanding the Modern Monetary System, however, since I’m not an academic economist, this paper is more along the lines of my...

Read More »Control What You Can Control

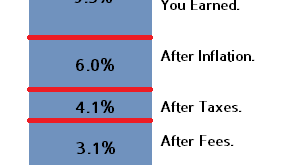

Share the post "Control What You Can Control" Vanguard has a timely reminder for investors – “cost is the new performance”.¹ We’ve entered a new era in the asset management business. The era of low fees. We now know definitively that paying high fees is hugely destructive to long-term performance. You don’t don’t get what you pay for and you don’t get better returns by paying for more expensive money managers. In fact, high costs are correlated with lower returns. As I’ve outlined in...

Read More »Assessing the Utility of Wall Street’s Annual Forecasts

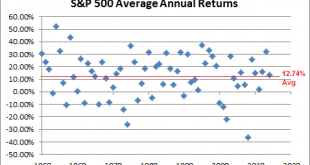

Share the post "Assessing the Utility of Wall Street’s Annual Forecasts" It’s that time of year when everyone starts preparing for the New Year and Wall Street makes its 2016 predictions. I’ll get right to the point here – these annual predictions are largely useless. But it’s still helpful to put these predictions in perspective because it highlights a good deal of behavioral bias and some of the mistakes investors make when analyzing their portfolios. The 2016 annual stock market...

Read More »The Temporal Problem in Market Forecasting

Share the post "The Temporal Problem in Market Forecasting" You can’t talk about money and investing without talking about time. After all, the two are inherently interconnected. There’s the time value of money, the erosion of value due to inflation, the linkage between money and interest rates, etc. The problem is, time is a great unknown for all of us. It is a concept that we apply in a strict sort of theoretical sense to create structure to our lives. But there is nothing certain...

Read More » Heterodox

Heterodox