Share the post "Control What You Can Control" Vanguard has a timely reminder for investors – “cost is the new performance”.¹ We’ve entered a new era in the asset management business. The era of low fees. We now know definitively that paying high fees is hugely destructive to long-term performance. You don’t don’t get what you pay for and you don’t get better returns by paying for more expensive money managers. In fact, high costs are correlated with lower returns. As I’ve outlined in the past, investors should be spending more time on what they can control (taxes and fees) and less time on what they can’t control (market returns).² The math behind real, real returns is ugly.³ For instance, take the 60/40 stock/bond portfolio with an average historical annual return of 9.5%. Then back out average inflation of 3.5%. Then back a conservative tax hit of 20%. Then back out the average management expense of 1%. Your 9.5% return is suddenly a small 3.1% return: If you’re a diversified investor you probably can’t do much to control your top line returns aside from having an appropriate asset allocation plan that you’ll stick with. While you can’t control the returns in the portfolio you can control that tax and fee hit. Unfortunately, advisors and asset managers these days still charge way too much. My general rule is this.

Topics:

Cullen Roche considers the following as important: Investing Basics, Investment Strategy, Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Vanguard has a timely reminder for investors – “cost is the new performance”.¹ We’ve entered a new era in the asset management business. The era of low fees. We now know definitively that paying high fees is hugely destructive to long-term performance. You don’t don’t get what you pay for and you don’t get better returns by paying for more expensive money managers. In fact, high costs are correlated with lower returns.

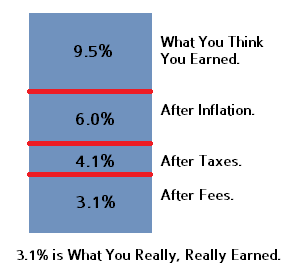

As I’ve outlined in the past, investors should be spending more time on what they can control (taxes and fees) and less time on what they can’t control (market returns).² The math behind real, real returns is ugly.³ For instance, take the 60/40 stock/bond portfolio with an average historical annual return of 9.5%. Then back out average inflation of 3.5%. Then back a conservative tax hit of 20%. Then back out the average management expense of 1%. Your 9.5% return is suddenly a small 3.1% return:

If you’re a diversified investor you probably can’t do much to control your top line returns aside from having an appropriate asset allocation plan that you’ll stick with. While you can’t control the returns in the portfolio you can control that tax and fee hit. Unfortunately, advisors and asset managers these days still charge way too much.

My general rule is this. If your asset manager or advisor charges more then 0.5% then you’re paying too much. The investment world has made incredible leaps forward on the cost side. There is simply no reason to be paying that much for asset management services. So, as we head into the new year take control of what you can control and reduce that tax and fee burden as much as you can.

Sources:

¹ – Cost is the new performance. Vanguard.

² – Understanding Your Real, Real Returns

³ – Understanding Your Real, Real Returns, Fee Edition