This is Part 2 of a three-part response to an iNET article (September 6, 2018) – Mainstream Macroeconomics and Modern Monetary Theory: What Really Divides Them?. In Part 1, I considered what we might take to the core body of mainstream macroeconomics and used the best-selling textbook from Gregory Mankiw as the representation. The material in that textbook is presented to students around the world as the current state of mainstream economic theory. While professional papers and policy...

Read More »Bob Bryan — Bob Woodward book: Gary Cohn was ‘astounded at Trump’s lack of basic understanding’ about the federal debt

Funny. Trump gets some of the basics of MMT, which the article mentions. Gary Cohn, not so much.Business InsiderBob Woodward book: Gary Cohn was 'astounded at Trump's lack of basic understanding' about the federal debt Bob Bryan

Read More »Bill Mitchell — The divide between mainstream macro and MMT is irreconcilable – Part 1

My office was subject to a random power failure for most of today because some greedy developer broke power lines in our area. So I am way behind and what was to be a two-part blog series will now have to extend into Wednesday (as a three-part series). That allows me more time today to catch up on other writing commitments. The three-part series will consider a recent intervention that was posted on the iNET site (September 6, 2018) – Mainstream Macroeconomics and Modern Monetary Theory:...

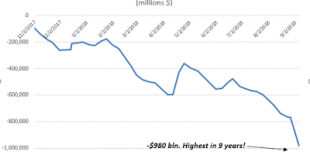

Read More »Deficit balloons to $980 bln. Where are all the MMT gods cheering this??

A giant end-of-month spending spree in August has ballooned the Federal defiicit to $980 bln and 4.8% of GDP.This is the largest nominal deficit since 2009 and the largest as a percentage of GDP since 2012.The MMT gods should be cheering this. They're not. Weird.

Read More »Brian Romanchuk — Jayadev/Mason Article On MMT

I just want to comment briefly on a few points that I saw some disagreements. Bond Economics Jayadev/Mason Article On MMTBrian Romanchuk

Read More »Charles Adams — The single most important piece of economics that everyone should know [sectoral balances]

Sectoral balances may not sound like something you need to know, but if you will give me a moment I will try to convince you. It might change what you do.... Progressive PulseThe single most important piece of economics that everyone should knowCharles Adams | Professor of Physics at the University of Durham, where he teaches Optics and Econophysics

Read More »Arjun Jayadev and J. W. Mason — Mainstream Macroeconomics and Modern Monetary Theory: What Really Divides Them?

Abstract An increasingly visible school of heterodox macroeconomics, Modern Monetary Theory (MMT), makes the case for functional finance – the view that governments should set their fiscal position at whatever level is consistent with price stability and full employment, regardless of current debt or deficits. Functional finance is widely understood, by both supporters and opponents, as a departure from orthodox macroeconomics. We argue that this perception is mistaken: While MMT’s policy...

Read More »Bill Mitchell — Exploring the effectiveness of social media

About strategy and tactics for promoting MMT.Bill Mitchell – billy blogExploring the effectiveness of social mediaBill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Read More »Bill Mitchell — Bank of Japan once again shows who calls the shots

On August 1, 2018, the 10-year Japanese government bond yield, shot through the roof (albeit a very low one). Yields shifted from 0.05 per cent on July 31 to 0.129 on August 1, which was the largest one-day rise since July 29, 2016 (when the yield rose 0.101 per cent). The Financial Times article (August 1, 2018) – Japanese bond market jolted as traders test BoJ resolve – wrote that “traders wasted no time in testing the Bank of Japan’s resolve to loosen its target range for the debt...

Read More »Bill Mitchell – Fiscal space has nothing to do with public debt ratios or the size of deficits

The Project Syndicate is held out as an independent, quality source of Op Ed discussion. When you scan through the economists that contribute you see quite a pattern and it is the anathema of ‘independent’. There is really no commentary that is independent, if you consider the term relates to schools of thought that an economist might work within. We are all bound by the ideologies and language of those millieu. So I assess the input from an institution (like Project Syndicate) in terms of...

Read More » Heterodox

Heterodox