One of the enduring myths that mainstream macroeconomists and the politicians that rely on their lies to depoliticise their own unpopular actions continue to propagate is that of ‘central bank independence’. This is the claim that macroeconomic policy making improved in the ‘neoliberal’ era following the emergence of Monetarism because monetary policy was firmly in the hands of technocratic bankers who were not part of the political cycle. As such, they could make decisions based on...

Read More »The Monetarist fantasy is over — Robert Skidelsky

Quite a good piece that pushes the MMT view without naming it.Progressive Economy ForumThe Monetarist fantasy is overRobert Skidelsky | Crossbench peer and Emeritus Professor of Political Economy at Warwick University

Read More »Central Bank Objective Functions — Brian Romanchuk

One topic of research that keeps popping up is the question of what the central bank objective function should be. In simpler terms, what is the target of the central bank? (At present, most central banks have an inflation target, possibly with secondary objectives.) This is a preoccupation of many "conventional" economists -- those in the neoclassical tradition, as well as those that are somewhat out of the mainstream (e.g., Market Monetarists are pushing for a Nominal Gross Domestic...

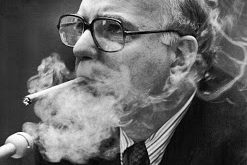

Read More »Paul Volcker’s legacy

Paul Adolph Volcker (1927-2019) Paul Volcker has passed away, and many obits (NYTimes here) and blog posts will be published in the next couple of days. Most likely, the majority will suggest how Carter appointed him to bring down inflation, a courageous decision, that might have costed him the election, and how Volcker went on to stabilize the so-called Great Inflation. Volcker was the head of the New York Fed from 1975 to 1979, before he was appointed chairman of the Fed in that...

Read More »Bill Mitchell — We are approaching a period of fiscal dominance

The dissonance in mainstream economics and the political debate about policy settings is getting deeper and more public. We now have examples of central bankers ‘throwing their hands up in the air’ and nearly begging governments to abandon their obsession with fiscal surpluses, and, instead, use fiscal policy to stimulate waning economic growth. What I think is happening is that we are entering a period of fiscal dominance, which will represent a categorical rejection of the mainstream...

Read More »Modern Monetary Theory from a Monetarist Angle — William Heartspring

Abstract This paper presents an alternative presentation of Modern Monetary Theory (MMT). The main thesis of this paper is that when a nation has monetary sovereignty and fiat currency, government is quite flexible its methods in controlling price level through market mechanisms, as Warren Mosler - one of the founders of MMT - often states. The reason given, however, differs from typical MMT or chartalist accounts and comes more from a traditional monetarist origin. This somewhat...

Read More »Stephanie Kelton — Modern Monetary Theory Is Not a Recipe for Doom

In this post, Stephanie Kelton takes on Paul Krugman. She appears to agree with Paul Krugman's assumption that monetary policy that is built on raising interest rates to address inflation is not backwards. Actually, central bank interest rate setting is a form of price setting, the policy rate being a variable that sets the cost of borrowing (price of money). Higher interest rates are also inflationary to the degree that increase the income of holders of securities, as Warren Mosler has...

Read More »Lars P. Syll’s Blog Krugman vs Kelton on the fiscal-monetary tradeoff

The battle of the titans. Or maybe better, David and Goliath. We have to free ourselves from the loanable funds theory — and scholastic gibbering about ZLB — and start using good old Keynesian fiscal policies. Keynes — as did Lerner, Kaldor, Kalecki, and Robinson — showed that it was possible to promote economic growth with an “appropriate size of the budget deficit.” The stimulus a well-functioning fiscal policy aimed at full employment may have on investment and productivity does not...

Read More »Michael Roberts — The monetary dilemma

According to the minutes of the last meeting of the monetary policy committee of the US Federal Reserve Bank, the most powerful monetary authority in the world, the committee members are split and unclear on what to do. “Some participants who counselled patience expressed “concern about the recent decline in inflation” and said the Fed “could afford to be patient under current circumstances.” They “argued against additional adjustments” until the central bank was sure that inflation was on...

Read More » Heterodox

Heterodox