By Eric Tymoigne The following answers a few question in order to illustrate the previous post and to develop certain points. Q1: Can a commodity be a monetary instrument? Or, does money grow on trees? Let us tackle the idea that “gold is money”. Clearly, a gold ingot is not a monetary instrument. There is no issuer, no denomination, no term to maturity or any other financial characteristics. A gold ingot is just a commodity, a real asset not a financial asset. On the other hand, gold coins...

Read More »Money and Banking Part 15: Monetary Systems

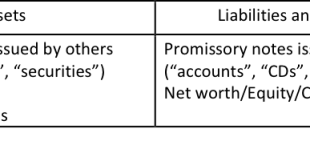

By Eric Tymoigne Throughout this series, posts have used balance sheets extensively to get an understanding of the monetary operations of developed economies, but nothing has been said about what a monetary instrument is. It is time to spend some time on the nature of monetary instruments and the inner workings of monetary systems. A monetary system is composed of two core elements: A unit of account that provides a common method of measurement: the euro (€), the pound sterling (₤), the yen...

Read More »Money and Banking Part 14: Financial Crises

By Eric Tymoigne While visiting the London School of Economics at the end of 2008, the Queen of England wondered “why did nobody notice it?” In doing so, she echoed a narrative that had been promoted among some prominent economists: the Great Recession (“it”) was an accident, a random extreme event and no one so it coming. This narrative is false. Quite of few economists saw it coming and it was not an accident. A previous post showed how different theoretical framework about financial...

Read More »Money and Banking Part 13: Balance Sheet Interrelations and the Macroeconomy

By Eric Tymoigne Past posts have focused on the mechanics of a specific balance sheet, specifically that of the central bank and of private banks. This post looks at the balance-sheet interrelations between the three main macroeconomic sectors of the economy: the domestic private sector, the government sector and the foreign sector. This macro view provides some important insights about issues such as the public debt and deficit, policy goals that are more likely to be achieved, the...

Read More »Money and Banking Part 12: Economic Growth and the Financial System

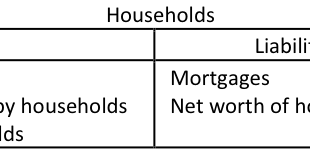

By Eric Tymoigne Money is the blood of capitalist enterprise and finance is about money now for money later. As such a well-developed financial system is essential for economic activity in a capitalist economy. The broader the range of promissory notes that can be issued, the more accommodative the financial system is to the demands of the productive system. Households cannot fund the purchase of a house with a credit card and there is no point in buying groceries with a 30-year mortgage....

Read More »Money and Banking – Part 11: Inflation

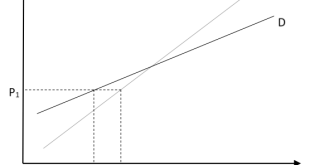

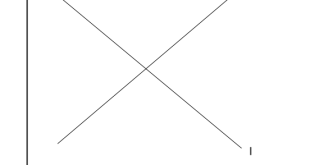

By Eric Tymoigne We are done with the study of banking operations. The next step is to incorporate them into the analysis of macroeconomic issues and this post begins on such topic by focusing on inflation. When inflation is mentioned, it is usually in relation to the cost of buying newly produced goods and services for consumption purpose. Another type of inflation concerns asset-prices, i.e. the price of non-producible commodities and old producible commodities. This post does not study...

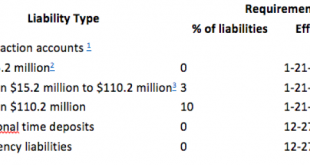

Read More »Money and Banking – Part 9: Banking regulation

By Eric Tymoigne It may surprise you to know that the banking sector is one of the most regulated industries in the United States with a bank having to file regulatory documents with several agencies. These regulations determine how banks should and should not operate their business in terms of many aspects; from disclosure of information to potential customers, to means of determining creditworthiness of a potential client, to the amount of reserves to hold, to management issues, among...

Read More »Money and Banking-Part 8: The Private Banking Business

By Eric Tymoigne The US financial system is extremely complicated and this series shades light only on some corners of that system by focusing on the banking sector. Here is a broad picture of the US financial system (some things have changed since the time I made this). Since the beginning of this M&B series, posts have emphasized the importance of balance sheet to get a solid understanding the mechanics at play in the financial sector. This post continues that trend. The balance...

Read More »Money and Banking Part 7

By Eric Tymoigne Given that the concept of leverage will be used often in the upcoming posts, this post spends some time explaining what leverage is and some of its impacts on the balance sheet of any economic unit. What is Leverage? Leverage is the ability to acquire assets in an amount that is larger than what one’s own capital allows to buy. Say that an economic unit has a net worth of $100, that it has no debt and that the counterparty is $100 in cash. The balance sheet looks like...

Read More »Money and Banking – Part 6

Treasury and Central Bank Interactions This post concludes our study of central banking matters (there would be a lot more to cover…maybe another time). The post studies how the Fed is involved in fiscal operations and how the U.S. Treasury is involved in monetary-policy operations. The extensive interaction between these two branches of the U.S. government is necessary for fiscal and monetary policies to work properly. Once again the balance sheet of the Federal Reserve provides a simple...

Read More » Heterodox

Heterodox