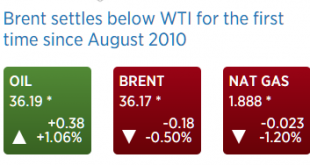

This means ‘the swamp has been drained’ and falling production has eliminated the trapped oil in Cushing that caused WTI to be at a discount to Brent. In fact, Brent should trade at a discount to WTI when the shortage is fully eliminated, reflecting transportation costs to the US. This, however, does not mean there’s any kind of national shortage or that prices will go up as unlimited imports are continuously available at then current prices, and last I saw the Saudis are still discounting...

Read More »Saudi oil pricing, import and export prices, Japan Manufactures’ sentiment

Not a lot of change for January, most ‘discounts’ still at or near the wides, so price action likely to be more of same:Something the Fed takes into consideration: Import and Export PricesHighlightsCross-border price pressures remain negative with import prices down 0.4 percent in November and export prices down 0.6 percent. Petroleum fell 2.5 percent in the month but is not an isolated factor pulling prices down as non-petroleum import prices fell 0.3 percent in the month. Agricultural...

Read More »Consumer Credit, Oil comment

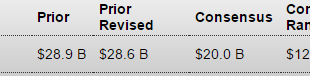

Looks like the last blip up just got reversed so it continues to go nowhere and it’s at levels higher than before the last recession: Consumer CreditHighlightsRevolving credit barely made it into the plus column in October, up $0.2 billion for what is, however, an eighth straight gain. Non-revolving credit, which in contrast to revolving credit hasn’t posted a decline since April 2010, rose an intrend $15.8 billion, once again boosted by vehicle financing and also by student loans which are...

Read More »Payrolls, Trade

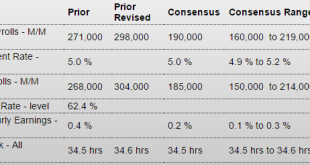

The growth rate continues to decelerate (see chart): NFP HighlightsPayroll growth is solid and, though wages aren’t building steam, today’s employment report fully cements expectations for December liftoff. Nonfarm payrolls rose a very solid 211,000 in November which is safely above expectations for 190,000. And there’s 35,000 in upward revisions to the two prior months with October now standing at a very impressive 298,000. The unemployment rate is steady and low at 5.0 percent with the...

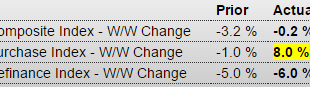

Read More »Business Roundtable, Mtg apps, ADP, Productivity, 1 year charts

More evidence the capital spending contraction is not over: CEO Confidence Goes From Bad to Worse Dec 1 (Fox Business) — CEO confidence in the U.S. economy is dwindling. The Business Roundtable CEO Economic Outlook Index for the 4Q, which looks out six months, fell to the lowest level in three years For third consecutive quarter, U.S. CEOs cautious on economy Dec 1 (Reuters) — The Business Roundtable CEO Economic Outlook Index fell 6.6 points to 67.5 in the fourth quarter. The long-term...

Read More »Saudi output, Redbook sales, PMI, ISM

While demand for Saudi crude is up a bit, seems it’s still far below their presumed 12 million or so bpd capacity, and their strategy has been to lower their prices to the point where they are selling their full capacity: Nice bounce here, as the year over year comparisons get ‘easier’: RedbookHighlightsStore sales surged in the November 28 week, the week that includes Black Friday. Redbook’s same-store year-on-year sales tally jumped to plus 3.9 percent, more than doubling the pace of...

Read More »Saudi production, Restaurant index

Just came out. Saudis still producing and selling far below their stated ‘cap’: OPEC November Crude Output Down 33,000 Bbl/Day to 32.121 Mln2015-11-30 17:55:55.463 GMTNew York, Nov. 30 (Bloomberg) — Crude-oil production from the 12 OPEC members in November declined 33,000 barrels a day from October, the latest Bloomberg survey of producers, oil companies and industry analysts shows. Figures are in the thousands of barrels a day.Nov. Oct. Monthly 1/1/2012 Nov. vs Est.OPEC Country Est. Output...

Read More »Chicago index, PMI manufacturing index, Existing home sales, Saudi pricing

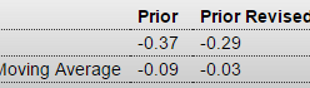

Still negative. This is just a composite of other indexes that have been released: Chicago Fed National Activity IndexHighlightsOctober was a soft month for the economy but solidly improved from September, based on the national activity index which is at minus 0.04 vs September’s revised minus 0.29. October’s improvement is centered in the key component of employment, at plus 0.11 vs September’s minus 0.06. The gain reflects the month’s very strong 271,000 rise in nonfarm payrolls and the 1...

Read More »Mtg Purchase Apps, Saudi Pricing History, China

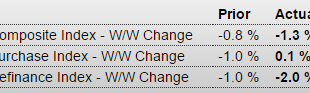

So much for housing leading the way up- looks to have gone from flat to down: MBA Mortgage Applications For the most part Saudis have been lowering premiums and increasing discounts which causes prices to fall to get their sales up to their pumping capacity: Not without a bit of pain, which they may have come to believe inevitable due to long term supply/demand dynamics: Saudi Arabia risks destroying Opec and feeding the Isil monster (Telegraph) — The rumblings of revolt against...

Read More »Saudi statement, NFIB detail

This means they continue with their discount policy until their entire output capacity is being sold, and then continue to sell their full output capacity at ‘market prices’. That is, they no longer want the high priced producers to benefit from their willingness to to be swing producer and support prices by not selling their full output: Moving ahead, Opec — led by Saudi Arabia — plans to pump as much as it can towards meeting global oil demand, leaving higher-cost producers to make up the...

Read More » Heterodox

Heterodox