The last week has been extraordinary, even by the standards of these extraordinary times. A flurry of Executive Orders from the new President of the United States has thrown the global order into chaos and sparked outrage throughout the world. But he has only done exactly what he said he would do. There is nothing in the Executive Orders signed so far that was not announced during the Presidential campaign, repeatedly and to loud cheers from his many supporters. The President was...

Read More »The untold story of the UK’s productivity slump

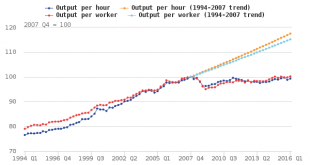

The ONS has produced a fascinating discussion of the UK's productivity puzzle, with some great charts. This one shows just how much the UK's productivity has slumped: Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems...

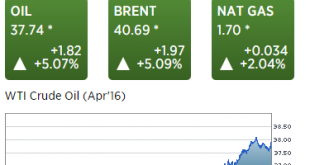

Read More »Mexico car production, oil prices

Not a good sign for US sales: Mexico Car ProductionMexico’s auto production decreased by 4.1 percent on the year in February of 2016 following a 0.4 percent rise in January and exports dropped 1.2 percent. Automakers produced about 271 thousand units during the month, while exports totaled 220 thousand. Car Production in Mexico averaged 179.92 Thousand Units from 1999 until 2016, reaching an all time high of 330.16 Thousand Units in October of 2014 and a record low of 81.53 Thousand Units...

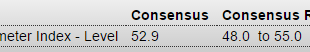

Read More »Chicago PMI, Pending home sales, EU inflation, G20 statement, Virginia jobless claims

As previously suspected, last month’s higher print was just a bit of volatility on the way down, as per the chart: Chicago PMIHighlightsAnother month and another month of wild volatility for the Chicago PMI which lurched from solid expansion in January to noticeable contraction in February. At a headline 47.6, Chicago’s PMI has fallen outside Econoday’s consensus range for a third month in a row! Still, this report is closely watched and confirms other early indications of February...

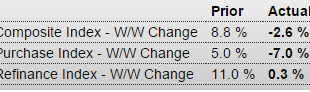

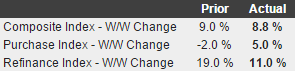

Read More »Mtg purchase apps, Car sales comments, ADP, ISM services, Exxon capex, BOJ comment

Up last week now back down as this sector remains in prolonged depression: MBA Mortgage ApplicationsHighlightsThe purchase index has been posting outsized gains this year but not in the January 29 week, falling 7.0 percent. The refinance index, however, did post a gain in the week, up 0.3 percent. Low interest rates have triggered strong demand for mortgage applications. The average 30-year fixed loan for conforming mortgages ($417,000 or less) fell 5 basis points and is back under 4.00...

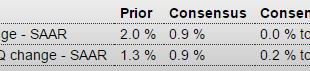

Read More »GDP, Saudi oil production, KC Fed, Chicago PMI, Shale Italy and Japan comments

As expected, the deceleration continues, and over the next couple of years it wouldn’t surprise me if the entire year gets revised down substantially: GDPHighlightsConsumer spending is the central driver of the economy but is slowing, at least it was during the fourth quarter when GDP rose only at a 0.7 percent annualized rate. Final demand rose 1.2 percent, which is the weakest since first quarter last year but is still 5 tenths above GDP.Spending on services, adding 0.9 percentage points,...

Read More »Mtg purchase apps, Vehicle sales, Oil capex, Business equipment borrowing, Equipment sales, New home sales

Inching up a bit but still seriously depressed: MBA Mortgage ApplicationsHighlightsWeekly mortgage applications have been very volatile so far this year but mostly to the upside. Purchase applications jumped 5.0 percent in the January 22 week with refinancing applications up 11.0 percent. Low mortgage rates are driving the activity, down 4 basis points in the week to an average 4.02 percent for 30-year conforming loans ($417,000 or less). Looks like Wards is forecasting no improvement in...

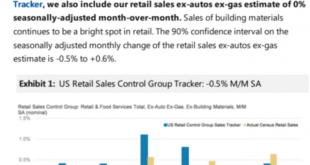

Read More »ECB comment, Retail Sales, Fed Atlanta, Oil comment

Seems there’s no wisdom on the topic of ‘money’ anywhere of consequence: No ‘plan B’ for ECB despite still low inflation: Praet Jan 6 (Reuters) — Executive Board member Peter Praet said various factors, notably low oil prices and less buoyant emerging economies, meant it was taking longer to reach the goal of inflation of close to but below 2 percent. “We need to be attentive that this shifting horizon does not damage the credibility of the ECB,” he added. “There is no plan B, there is just...

Read More »Saudi pricing, Mtg purchase apps, ADP, Trade, Factory orders, ISM non manufacturing

Saudi discounts for February. Some reduced, some increased, so probably more same- prices fall until Saudi output hits its capacity:Zig zagging a lot recently, now back down to where they’ve been for a while: MBA Mortgage ApplicationsHighlightsMortgage application activity fell sharply in the two weeks ended January 1, down 15 percent for home purchases and down 37 percent for refinancing. Rates were steady in the period with the average 30-year mortgage for conforming balances ($417,000 or...

Read More »Trade, Capex, Japan tax hike, Redbook retail sales, Saudi spending cuts

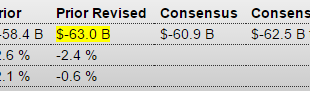

Not good for Q4 GDP. Remember, lower oil prices were supposed to reduce our trade deficit…;) International Trade in GoodsHighlightsNovember’s international trade goods deficit narrowed to $60.5 billion from the revised $63.0 billion in October. October’s estimate previously was minus $58.4 billion. Expectations were for a deficit of $60.9 billion. Both exports and imports continued to decline on the month. Goods exports were down 2.0 percent while imports were 1.8 percent lower. Weak...

Read More » Heterodox

Heterodox