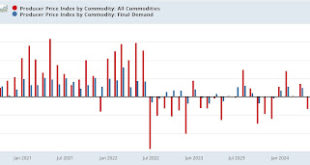

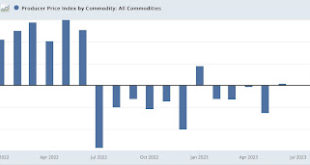

– by New Deal democrat Sometimes producer prices lead consumer prices; sometimes they don’t – but in the sense that sometimes there is no lag at all before increases show up in consumer prices. In any event, overall the message from the producer price index this morning was benign, with very little pressure “in the pipeline” for consumer inflation.To begin with, raw commodity prices (red) declined -1.2% in September, continuing their 2+ year...

Read More »September producer prices confirm economic tailwind has ended

September producer prices confirm economic tailwind has ended – by New Deal democrat My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. For the last several months, my focus has been whether that decline is over. This morning’s producer price...

Read More »A note on producer prices and (possibly) cooling inflation

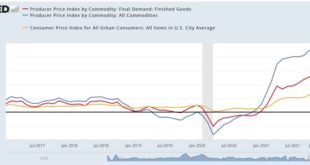

A note on producer prices and (possibly) cooling inflation One point I make from time to time is that, with seasonally adjusted data, YoY comparisons can miss, or at least lag, turning points. We *may* have such a situation developing with producer prices as evidenced by this morning’s report (Feb. 15). On a YoY basis, producer prices for finished goods (red in the graph below) are up 12.5%, while commodity prices are up 19.3%. Consumer...

Read More » Heterodox

Heterodox