September producer prices confirm economic tailwind has ended – by New Deal democrat My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. For the last several months, my focus has been whether that decline is over. This morning’s producer price report added more evidence that indeed producer prices have bottomed. Commodity prices increased 0.5% in September: They are up 1.9% since June: The Final demand prices for goods (blue) increased 0.2%, and final demand services prices (gray) increased 0.3% for the month: Final demand goods

Topics:

NewDealdemocrat considers the following as important: Economic Tailwind, Hot Topics, New Deal Democrat, October 2023, politics, producer prices, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

September producer prices confirm economic tailwind has ended

– by New Deal democrat

My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. For the last several months, my focus has been whether that decline is over.

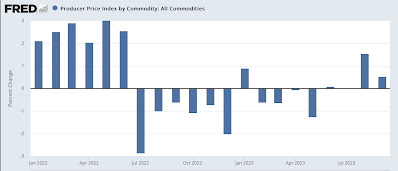

This morning’s producer price report added more evidence that indeed producer prices have bottomed.

Commodity prices increased 0.5% in September:

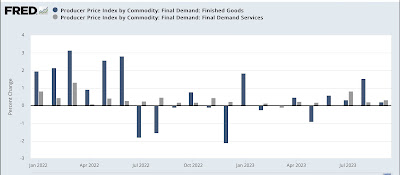

They are up 1.9% since June:

The Final demand prices for goods (blue) increased 0.2%, and final demand services prices (gray) increased 0.3% for the month:

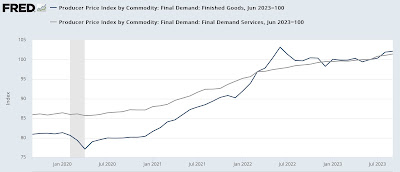

Final demand goods prices are up 2.1% since June. Final demand prices for services are up 1.4%:

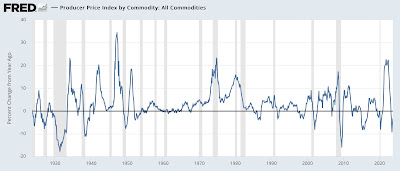

This returns to the more normal situation with producer and commodity prices. Historically, as seen in this 100-year graph of commodity prices YoY, typically there are big declines during recessions. This reflects a decline in demand:

But if you focus on more recent declines since the 1980s, you can see a number of incidents – 1986, 1997-98, and 2014-15 – where the big declines in commodity prices were dominated by declining gas prices, which put more money in consumers’ pockets to spend on other things. In all of these cases, there was no recession.

The nearly 10% decline in commodity prices between June 2022 and June 2023 was the biggest 12 month decline yet driven by lower gas prices, as well as the un-kinking of pandemic-related supply chains. Except for the very unlikely scenario that current geopolitical events drive a further decline in gas prices, that is almost certainly over.

This is probably going to be reflected in tomorrow’s report on consumer prices as well. Remember, if consumer inflation simply stops decelerating, it will lessen the gap between prices and aggregate consumer income, meaning slower economic growth at least.

Economic tailwind from falling commodity prices has likely ended, Angry Bear, New Deal democrat.